As a seasoned crypto investor with more than a decade of experience navigating the digital asset landscape, I find the recent forecast by 10x Research concerning but not entirely surprising. The decline in active Bitcoin addresses and outflows from Spot Bitcoin ETFs are indicators that the market may be heading for a correction. However, I have learned to take such predictions with a grain of salt, as they often prove to be just one possible outcome among many.

10x Research, a digital asset research platform catering to traders and financial institutions, has issued a grim prediction about Bitcoin‘s (BTC) future value. Analyzing current market trends and Bitcoin’s recent price movements, the research firm anticipates a significant plunge in value, potentially down to $45,000 in the near future.

Bitcoin $45,000 Price Crash Incoming

10x Research recently published a report detailing various aspects of the market that collectively suggest a possible drop in Bitcoin prices to record lows. As the broader cryptocurrency market experiences a phase of adjustment and fluctuation, 10x Research predicts that Bitcoin might dip as far down as $45,000 during this cycle.

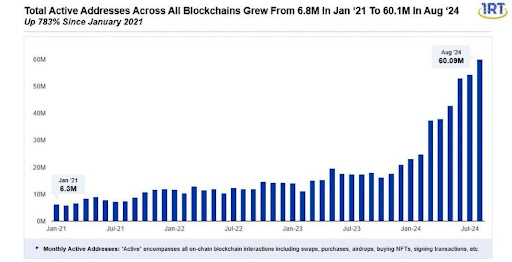

The explanation behind this forecast links back to the decrease in active Bitcoin addresses observed recently. Markus Thielen, who leads research at 10x Research, has articulated reasons for his bearish BTC prediction. He notes that after Bitcoin addresses reached their maximum in November 2023, they experienced a significant drop during the first quarter (Q1) of 2024.

As per Messari’s reports, on November 20, 2023, the number of active Bitcoin accounts surged past 983,000 and peaked at around 1.2 million. This trend continued until April, but since September 2, 2024, there has been a significant drop in active addresses down to 596,940.

The decrease in Bitcoin addresses suggests less network usage and potentially lower investor enthusiasm and interest. Moreover, it was revealed that short-term investors started offloading their BTC in April, while long-term ones cashed out their gains, hinting that the market might have hit its peak for this cycle.

Moreover, since its peak at over $73,000 in March, as reported by CoinMarketCap, the value of a Bitcoin has dropped to $55,246. This price drop coincides with a reduction in active wallet usage and increased market turbulence.

10 times Research found that sell-offs in Spot Bitcoin Exchange-Traded Funds (ETFs) have been putting pressure on Bitcoin’s price and causing their bearish forecast. In the past eight days, these Spot Bitcoin ETFs have experienced a staggering $1.2 billion in sell-offs across the 11 U.S.-listed Bitcoin ETFs. This continuous liquidation is the longest streak of sell-offs since the launch of Bitcoin ETFs on January 10, 2024.

To add to this, the current economic situation in the United States (US) might indicate a bearish trend for Bitcoin as well. Factors such as a struggling US economy and ongoing Bitcoin futures liquidations are thought by 10x Research to potentially drive the price of Bitcoin down to approximately $45,000.

BTC Faces Toughest Month In September

On a recent post from what was once Twitter, Dan Tapiero – the head honcho at 10T Holdings – spoke about the hurdles faced in the crypto market currently. He pointed out that traditionally, the month of September has been tricky for Bitcoin, with either weak returns or heightened selling stresses.

He disclosed that Bitcoin and Ethereum (ETH) have been stuck in a “painful consolidation” period since March. Despite Bitcoin’s underperformance this September, Tapiero remains confident that the market is gearing up for a major bullish trend, advising investors to HODL their assets.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-09-10 02:46