In simpler terms, Bybit – one of the top two cryptocurrency exchanges globally in terms of trading volumes – recently released a report suggesting that broader economic factors are having a greater impact than market turbulence on the price of Bitcoin, which has been repeatedly rejected at $100K. The potential presidency of Donald Trump in the crypto world could be pivotal for predicting future trends and encouraging investor confidence.

Over the last seven days, there’s been a noticeable increase in apprehension within the cryptocurrency derivatives market as investors eagerly anticipate a major political change with the inauguration of Donald Trump. The digital currency sector is optimistic about Trump, who expressed intentions to turn the United States into a global leader in cryptocurrencies during his election campaign.

On the other hand, the Bybit study indicates a significant decrease in liquidity within the perpetual swap market over the holiday period. With trading volumes plummeting throughout the last month, overall volatility across the cryptocurrency market has decreased as well.

Bitcoin and Ethereum Options Markets Show Diverging Trends

In December 2024, the ongoing open interest stayed steady, similar to levels seen prior to the significant options expiration. This suggests a conservative stance and reduced hedging actions within the continuous swap market.

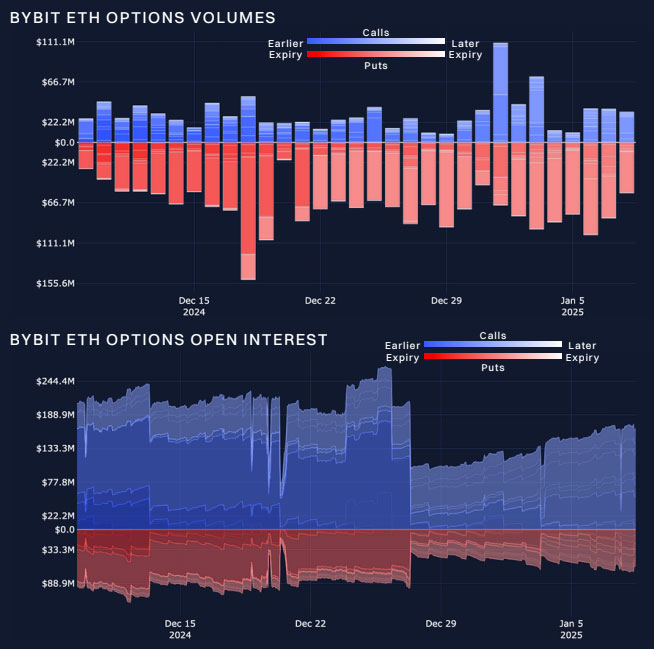

The markets for Ethereum (ETH) and Bitcoin (BTC), as displayed below, indicate significant shifts approaching the new year. Notably, there’s a stark contrast between the implied and realized volatility in these markets. After December’s expiration, Bitcoin’s open interest is readjusting following the conclusion of options contracts.

ETH:

– ETH: $3,298

– 24h volatility: 0.1%

– Market cap: $397.34 B

– 24h volume: $28.88 B

BTC:

– BTC: $94,778

– 24h volatility: 1.5%

– Market cap: $1.88 T

– 24h volume: $61.93 B

From my perspective as a crypto investor, it’s worth noting that the ETH options market is favoring call options significantly. The difference between the 30-day implied volatility and the 7-day realized volatility for both cryptocurrencies has grown to its widest gap since the US elections. This suggests a potential increase in market uncertainty or anticipation, which could impact ETH’s price movement in the near future. Keep a close eye on this trend!

It indicates that options traders perceive a significant amount of risk and turbulence ahead, even though the market appears tranquil on the surface.

ETH Call Options on the Rise

According to the Bybit Research report, there’s been a significant shift in Ethereum (ETH) open interest. Since December, call options have seen an increase in popularity, but put options continue to lead in total volume.

In contrast, the actual volatility of ETH in 2025 has dampened the excitement about ETH options, leading option traders to reconsider their strategies. The structure of volatility has become steeper, as short-term volatility (calculated over a 30-day period) remains over 15 points higher than its long-term counterpart. This difference is the most significant since the election period in 2024, during which geopolitical uncertainties increased volatility premiums.

As the market experiences a period of stability, investors are adopting a careful approach, which mirrors an underlying apprehension that could potentially impact the crypto market over the next few months.

Read More

- POPCAT/USD

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- DYM/USD

- Coachella 2025 Lineup: Which Artists Are Performing?

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Kingdom Come Deliverance 2: How To Clean Your Horse

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

2025-01-10 15:45