As a seasoned crypto investor with over two decades of experience in the tech industry, Haseeb Qureshi’s crypto predictions for 2025 strike me as both insightful and thought-provoking. His foresight into the blurring lines between L1s and L2s, the revolution in token launches, and the accelerated adoption of stablecoins by small and medium-sized businesses align with my observations of the market’s evolving dynamics.

His prediction that AI agents will move beyond their current state as chatbots linked to cryptocurrencies and become essential for autonomous blockchain operations resonates with me, given my background in artificial intelligence. I am particularly intrigued by his vision of AI facilitating crypto transactions and managing economies on blockchain networks, which could pave the way for a new era of decentralized and autonomous digital ecosystems.

However, I find it interesting that Qureshi predicts Fortune 100 companies to become more willing to offer crypto under the Trump administration. As someone who lived through the Trump era and saw its impact on tech regulations, I can’t help but wonder if we might see a “Trump Rally 2.0” in the crypto space.

Lastly, his prediction that AI will evolve beyond hype reminds me of the dot-com bubble of the late ’90s, where the hype around AI far outpaced its actual capabilities. But if history repeats itself, we’ll see a correction followed by a surge in innovation and growth, making 2025 an exciting time for crypto and AI enthusiasts alike.

On a lighter note, I can’t help but think that memecoins will continue to be the “canary in the coal mine” for market trends – a bellwether of investor sentiment and irrational exuberance. As always, it pays to stay nimble in this ever-changing world of crypto!

As a seasoned investor and managing partner at Dragonfly Capital with over a decade of experience in the crypto world, I’ve seen the industry evolve from a niche corner of the financial market to a global phenomenon. Looking ahead to 2025, my predictions for the crypto landscape are shaped by my personal insights and observations.

First, I see decentralized finance (DeFi) taking center stage. With its potential to democratize access to financial services and products, DeFi has the power to reshape the entire financial system. By 2025, I predict that DeFi will have matured significantly and become a mainstream force, offering a viable alternative to traditional financial institutions for millions of people worldwide.

Next, the regulatory landscape will undergo a major shift as governments begin to understand the potential benefits and risks posed by cryptocurrencies. While there may still be some resistance from certain quarters, I expect that by 2025, we’ll see more clarity on regulations and guidelines for the crypto industry, which will foster greater investor confidence and drive further growth.

I also foresee a surge in the adoption of central bank digital currencies (CBDCs) as more countries seek to capitalize on the benefits of blockchain technology. As CBDCs become more widespread, they could potentially disrupt traditional payment systems and bring about greater financial inclusion.

Lastly, I anticipate that blockchain technology will continue to be a key driver of innovation in various industries, from supply chain management to healthcare. By 2025, we may see the integration of blockchain solutions in sectors like logistics, real estate, and energy, leading to increased efficiency, transparency, and security.

Overall, I believe that the next few years will be transformative for the crypto landscape as decentralized finance matures, regulations become more favorable, central bank digital currencies gain traction, and blockchain technology is adopted across multiple industries. As an investor, I’m excited to see how these trends unfold and the opportunities they create for both traditional financial institutions and innovative startups alike.

Crypto Predictions 2025 By Haseeb Qureshi

#1 Merging Boundaries Between Tier 1 and Tier 2 Networks: In his 2025 cryptocurrency predictions, Qureshi suggests that the differences between Layer 1 (Tier 1) and Layer 2 (Tier 2) networks will become increasingly blurred. He anticipates a significant consolidation within the blockchain sector as a result. “The time for separating Tier 1 from Tier 2 based on technical abilities is past. Now, it’s about finding unique positions and improving user retention,” he states.

This change suggests that in the future, it’s not just about technological advancement, but also about having a strong market position and providing excellent user experiences. Qureshi believes that EVM (Ethereum Virtual Machine) will continue to be prominent and grow, supported by platforms such as Base, Monad, and Berachain. He attributes this growth to the extensive Solidity training data available, which will allow language models to create sophisticated application code using AI in 2025, signifying a major move towards AI-driven development within blockchain environments.

In 2025, according to Qureshi’s crypto predictions, there will be a transformation in the way tokens are launched. Instead of relying on massive airdrops that frequently prioritize quantity over quality of interaction, the industry is expected to adopt a more tactical approach. This approach will ensure that token distribution aligns with long-term user engagement and the feasibility of the project, as noted by Qureshi.

As a researcher, I propose employing tokens as valuable assets for enhancing user engagement and motivating meaningful interactions within our projects that have distinct objectives and measurable key performance indicators (KPIs). Conversely, for those projects where metrics are not yet clearly defined, we may opt to prioritize structured crowdsales to establish and sustain a committed user community.

In addition, he anticipates that “meme coins will gradually lose their market dominance to coins backed by AI agents.” This shift, in my view, represents a transition from financial skepticism to excessive optimism about finance. (And yes, I’m coming up with the term for it.)

#3 Rapid Growth in Stablecoin Usage Among Businesses: It is anticipated that stablecoins will become a vital component of financial transactions for small and medium-sized businesses (SMBs) who require swift and secure monetary exchanges. As stated by Qureshi, we are approaching a time when the widespread adoption of stablecoins among SMBs will be propelled not only by their efficiency but also by growing institutional trust and participation.

1) He expects major shifts from banks, such as the introduction of new stablecoins, as financial institutions aim to tap into this rapidly expanding market. Additionally, he notes that with Howard Lutnick appointed as Secretary of Commerce, institutional reluctance will likely diminish, thereby strengthening Tether’s leading position amidst increasing competition.

He notes, “Ethena is likely to absorb more funds in the upcoming year, particularly with decreasing treasury yields. As the cost of capital drops, it further enhances the appeal of basis trade yields.

#4 Cautious Progress in Regulation: In Qureshi’s crypto forecast for 2025, there appears a blend of progress and challenges in the regulatory landscape. He anticipates that the year will bring about evolutionary changes, with it being probable that the US will pass legislation focused on stablecoins.

Although it appears that the Financial Innovation Technology of the 21st Century Act (FIT21) could encounter some delays, it’s anticipated that there will be progress in strengthening the regulatory framework for stablecoins. However, broader financial technology reforms may not keep pace, leading to a fragmented or piecemeal regulatory landscape instead.

Furthermore, Qureshi anticipates that Fortune 100 companies may grow more inclined to provide cryptocurrencies to consumers under the Trump administration. He suggests that Trump’s inauguration could lead to a perceived period of regulatory leniency before definitive rules and enforcement priorities are established. During this interim, he predicts a surge in the aggressive adoption of cryptocurrency within existing Web2 platforms.

5 Ways AI Agents Could Surpass Expectations: Qureshi’s 2025 crypto predictions highlight the impact of AI agents on the crypto world, yet he expresses concerns about their current capabilities. He states, “AI agents currently in use are essentially advanced chatbots tied to cryptocurrencies. They lack real autonomy and are primarily built for interactions rather than self-governing activities.

In spite of these constraints, he is convinced that AI’s impact on cryptocurrency will expand substantially, transitioning from a novelty to an essential component. He predicts that AI’s ability to automate and improve blockchain functions will spark a new era in software development, significantly reducing the hurdles for creating blockchain applications.

#6 Crypto and AI: By the year 2025 and beyond, Qureshi predicts a more seamless blend of crypto and AI technologies. He believes that as AI becomes more sophisticated and regulatory standards are established, cryptocurrencies will play a crucial role in powering AI operations. This could lead to self-governing agents executing transactions and managing their own economies within blockchain networks. This interaction is expected to significantly enhance user experiences and operational efficiency, heralding the advent of a novel era characterized by decentralized and autonomous digital environments.

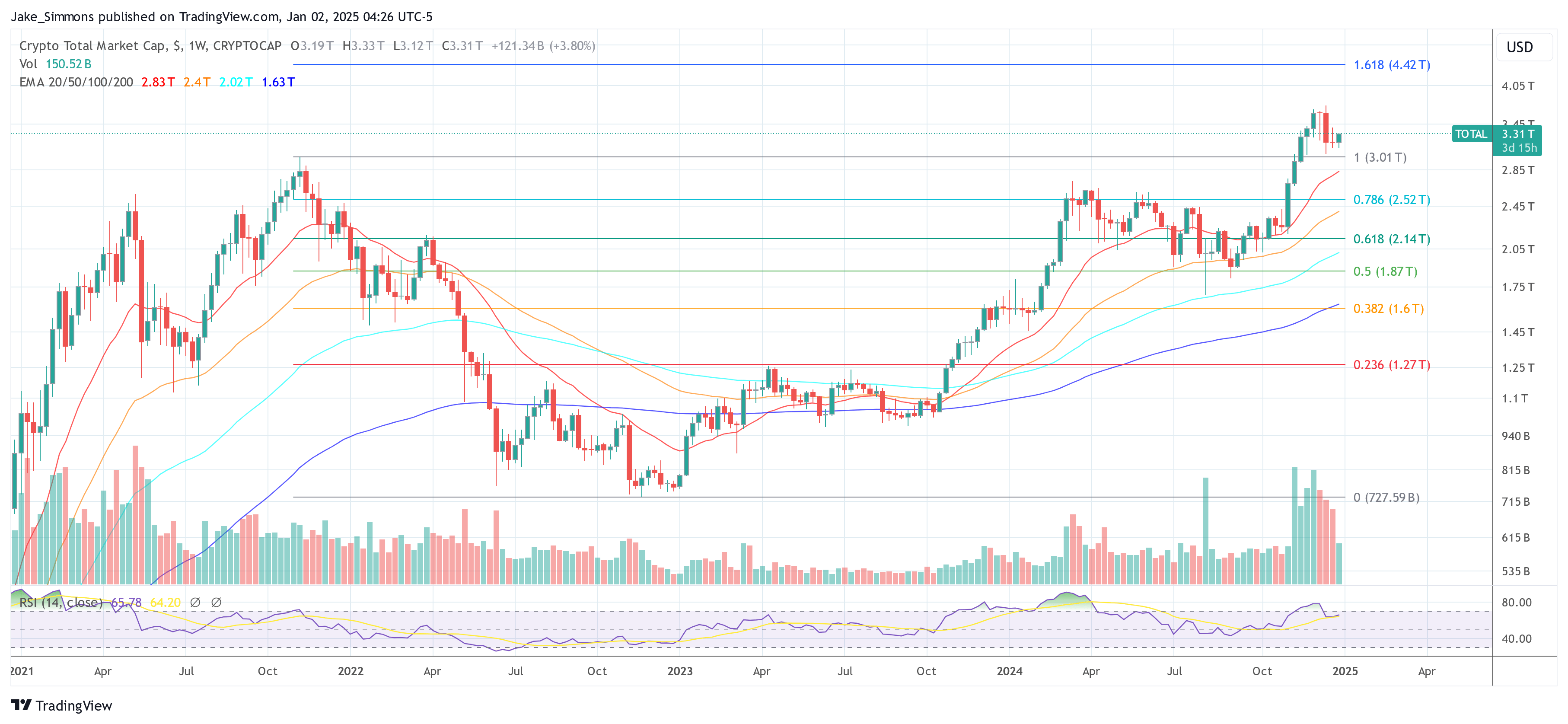

At press time, the total crypto market cap stood at $3.31 trillion.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-01-02 14:47