As a seasoned crypto investor with a knack for navigating through market turbulences, I must admit that Robinhood’s Q3 performance has left me quite impressed. After the rollercoaster ride we all witnessed last year, it’s refreshing to see this American financial giant back on its feet and showing impressive growth.

After a challenging period, it appears that Robinhood, a well-known U.S. financial services provider, has made significant progress. In their third-quarter report ending on September 30th, 2024, the company revealed an impressive 165% increase in revenues and a substantial boost in year-to-date (YTD) net deposits to $34 million.

As a crypto investor, I’m quite intrigued by the recent progress Robinhood Markets has made this quarter, given the hurdles they’ve encountered previously. The blow from the early 2021 decision to restrict trading in GameStop and other meme stocks during the market madness was certainly felt. However, in a positive turn of events, Robinhood has been moving towards a resolution with their investors and traders, as they recently announced.

Q3 Filing Is Company’s Second-Best Revenue

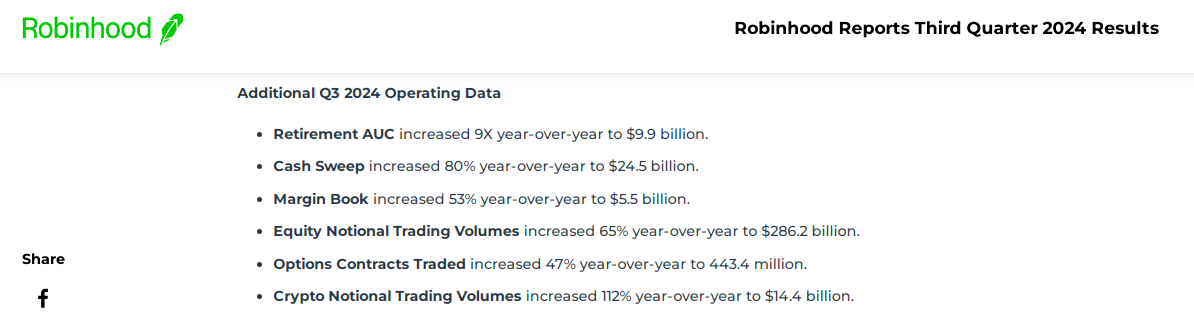

Regardless of its difficult past and regulatory hurdles posed by the SEC, Robinhood Markets managed to find a steady beat, delivering a robust third-quarter performance. The company reported that its net deposits swelled to $34 billion, and revenue climbed 36% annually to reach $367 million. Notably, its cryptocurrency sector spearheaded the growth spurt.

According to its report, Robinhood indicated a significant jump in its cryptocurrency earnings, reaching approximately $61 million during the quarter – an impressive surge of nearly 165% compared to the previous period. This spike in revenue was anticipated by market analysts following Robinhood’s acquisition of Bitstamp, which boosted its trading activity volume.

Robinhood Surprises With Impressive Growth

As an analyst, I’ve been closely following Robinhood’s trajectory, a story that has caught the attention of many market observers. Despite facing challenges such as FTX’s impact, the ‘meme frenzy,’ and regulatory hurdles with the SEC, the company continues to impress. Notably, last year, Robinhood made a strategic move by purchasing back its shares from Alameda Research, amounting to $605 million.

Initially, it was thought that during the deal, Robinhood would steer clear of cryptocurrency investments. But analysts were taken aback when the company decided to heavily invest in crypto via its Robinhood Crypto division instead. This move significantly boosted Robinhood’s holdings, with Assets Under Custody (AUC) jumping by 76% year-on-year, reaching over $152 billion for their Q3 report.

The firm reported that its holdings increased due to higher equity, better crypto valuation, and sustained deposits. The company has a portfolio heavy on Bitcoin, and the recent rise in the top crypto bodes well for the firm, which will continue to earn as long as the trend remains bullish for BTC.

Robinhood Finally Moving Ahead After Regulatory Pressures

Robinhood Markets is now stepping away from the turmoil and complications that it faced earlier, including the trading controversy surrounding GameStop and meme stocks in early 2021. In May, the Securities and Exchange Commission (SEC) sent the company a warning letter known as a Wells Notice.

The argument made by the agency is that certain Robinhood crypto offerings potentially break securities regulations, yet as of now, the Securities and Exchange Commission (SEC) has refrained from bringing legal action against the firm.

For now, Robinhood Markets continues with its regular operations. According to recent updates, Robinhood has added several tokens such as SOL and facilitated asset transfer services. It’s important to note that these services are currently available only to customers residing in the European Union.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-10-31 21:04