As a seasoned crypto investor with over a decade of market navigation under my belt, I find the recent analysis by QCP Capital both insightful and reassuring. The “shallow sell-off” in the crypto market following the Iran-Israel conflict underscores the resilience and demand for risk-on assets in this dynamic space.

As a crypto investor, I noticed that despite the recent tensions between Iran and Israel, the temporary dip in crypto market prices, often referred to as a “shallow sell-off,” suggests a strong underlying appetite among investors for high-risk, high-reward assets like cryptocurrencies. This indicates a healthy demand for risk-on assets within the market.

Crypto Market Remains Well Bid For Risk Assets

Despite Iran launching over 180 missiles toward Israel yesterday, the sell-off in traditional financial (TradFi) assets was relatively muted. The S&P 500 closed 1% lower, while U.S. benchmark West Texas Intermediate (WTI) oil prices rose 2%.

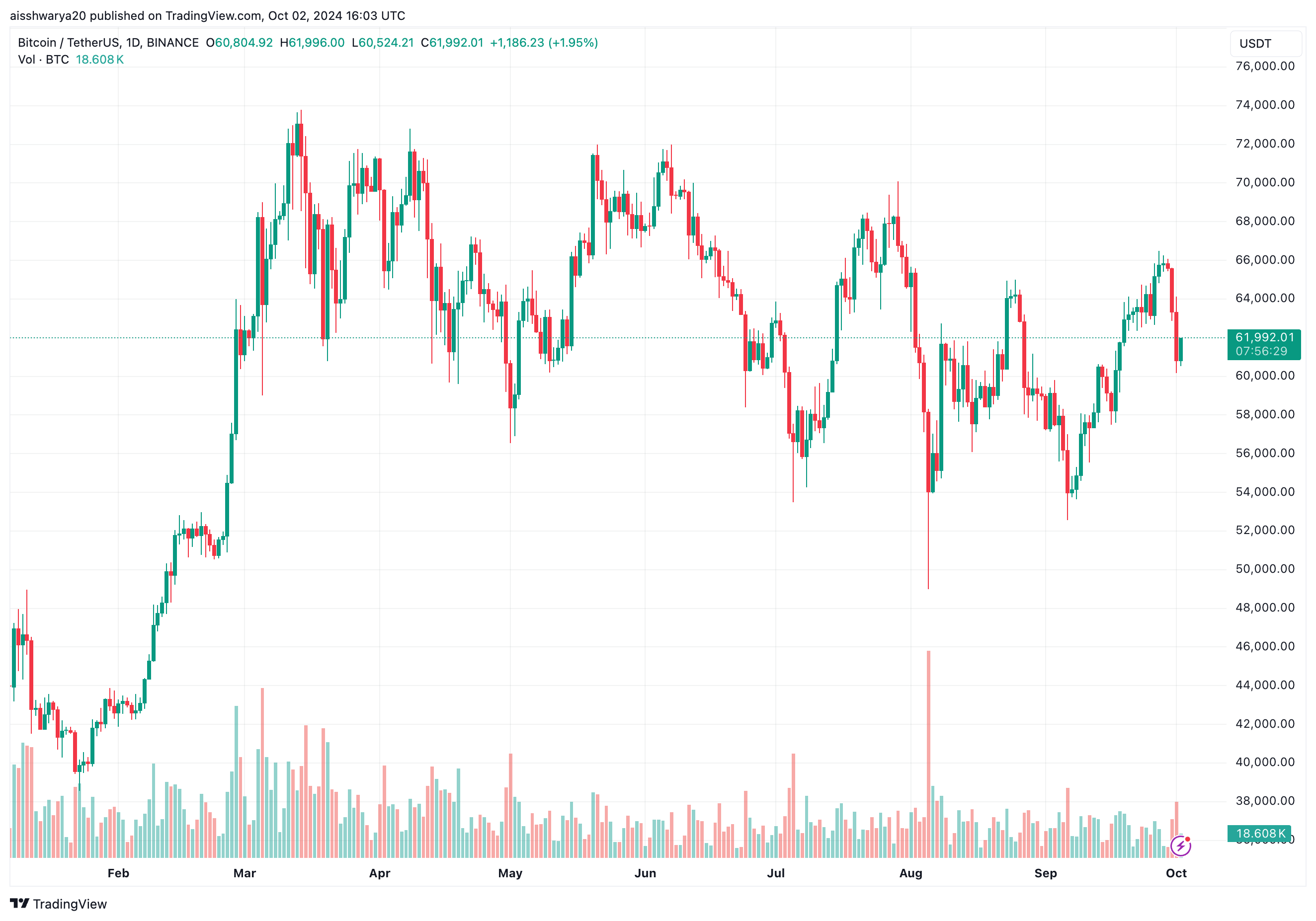

Instead, let me rephrase that statement for you: Unlike other markets, the digital assets sector experienced a significant blow as Bitcoin (BTC) dropped by more than 5% following Iran’s attack. The overall value of the cryptocurrency market fell by over 6%, with liquidations amounting to $550 million in just 24 hours, according to CoinGlass data.

According to a recent report by QCP Capital, it appears that Bitcoin has solid backing at approximately $60,000. Nevertheless, they issue a word of warning: potential intensification in the Middle East could cause Bitcoin’s price to dip down to around $55,000.

Regarding the market sell-off witnessed yesterday, the trading firm stated:

For the moment, political dynamics in the Middle East will be the focus, yet the modest drop in stock prices indicates that investors are still eager to invest in high-risk assets. Let’s not allow this temporary issue to overshadow the larger context.

The analysis in the report further pointed out that China’s current economic policies bear resemblance to those implemented by Japan during the 1990s. Specifically, the Bank of Japan (BoJ) combated deflation through strategies such as lowering interest rates, implementing negative interest rates, and initiating a quantitative easing program. The report also noted:

The release of money by the People’s Bank of China (PBoC) and possible government spending could boost the prices of assets in China. This optimistic outlook might also positively impact high-risk investments worldwide, such as cryptocurrencies.

Moreover, the report highlighted that the Fed Chairman, Jerome Powell, made dovish comments during his speech at the National Association for Business Economics, suggesting potential reductions in interest rates as late as 2024.

Following the Federal Reserve’s decision to lower interest rates for the first time in four years on September 18, there was an uptick in the value of assets considered risky, like stocks and digital currencies, across global financial markets.

According to the findings, it’s anticipated that asset prices will continue to be bolstered as we approach 2025, primarily due to significant reductions in interest rates made by two of the world’s most influential central banks – the Federal Reserve and the People’s Bank of China.

What To Expect From Bitcoin In Q4 2024?

Despite the Iran-Israel conflict causing fluctuations in Bitcoin’s price, crypto experts are still hopeful for a robust fourth quarter of 2024. One expert even proposed that the current drop might mark Bitcoin’s “low point for the quarter.

According to crypto expert Eric Crown, it’s possible that Bitcoin could set a new record high (peak value) by the end of 2024. This prediction is based on Bitcoin’s past performance during the months following September. Currently, Bitcoin is trading at $61,992, representing a decrease of 1.2% over the last day.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-10-03 11:10