As an experienced analyst in the crypto space, I find the current market trends and developments intriguing. Based on the information provided, there are indeed reasons to be optimistic about a potential relief rally in the crypto markets, especially Bitcoin (BTC), as we enter July.

As the month of July commences, there are indications that the cryptocurrency market is on the mend after a volatile June. Based on data from Santiment, a leading crypto intelligence firm, there’s an increasing sense of hope for a “bounce back” due to reduced selling pressure observed on digital exchanges.

Based on the analysis of July’s forecast, Santiment expressed optimism on July 2, pointing out that the extensive pessimism among small traders could signal an upcoming market turnaround.

Based on the data from July, there are compelling reasons for optimism despite previous capitulation among small traders. The prevalent pessimism and significant losses among average traders could indicate the start of a relief rally. For more information on June’s market trends, please refer to our monthly recap.

To read our…

— Santiment (@santimentfeed) July 2, 2024

As a crypto investor, I’ve experienced a tough June with Bitcoin (BTC) dipping nearly 7%, reaching a low of around $59,500. This downward trend aligned with the broader market, causing a significant decrease in total crypto market capitalization, which dropped approximately $400 billion from its previous peak.

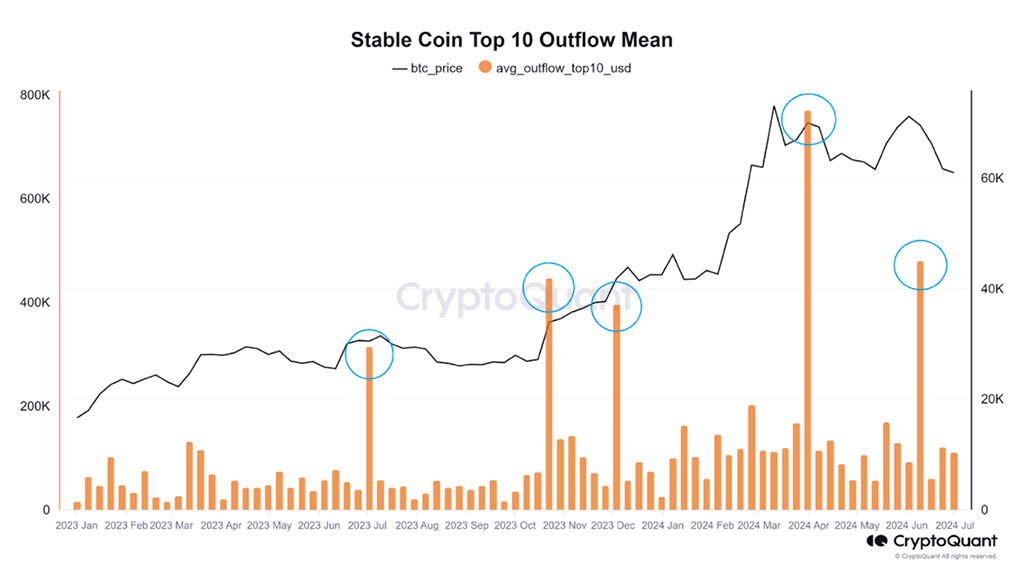

Reduced Stablecoin Outflows Points to Exhaustion among Sellers

In the midst of cryptocurrency markets’ current instability, analyst Minkyu Woo from CryptoQuant has pointed out an intriguing trend indicative of sellers potentially running out of steam. This observation, made public on July 1st, centers around the withdrawal of Tether (USDT) from significant crypto exchanges.

Recently, there’s been a noticeable decrease in the outflow of crypto assets, hinting that intense selling from large-investors is subsiding. This trend implies that more investors are choosing to keep their cryptocurrencies instead of disposing of them, suggesting a possible improvement in market stability.

“Woo pointed out that sellers are displaying signs of fatigue based on the decreasing USDT outflows, which he considers a promising sign reflecting improving market sentiment. The data reveals a persistent pattern of diminishing selling efforts from investors since 2023, suggesting a possible upcoming phase of market stabilization and potential rebound.”

Photo: QryptoQuant

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin (BTC) is currently trading near the $62,900 mark, with only minor price changes over the past day. Based on data from Coincodex, the Bitcoin Fear and Greed Index stands at 51, suggesting a neutral sentiment among investors in the BTC market.

Investors are keeping a keen eye on whether the current decrease in selling activity and the neutrally balanced market mood, according to the Fear and Greed Index, will result in lasting market strength over the next few weeks.

Mt. Gox Bitcoin Distribution Could Impact Market

Mt. Gox, formerly the foremost cryptocurrency exchange globally, intends to initiate the dissemination of approximately 140,000 Bitcoins, which were taken during a hack in 2014, commencing July 2024. This development comes after numerous postponements and may result in substantial selling pressure within the Bitcoin marketplace.

Approximately $9 billion worth of assets transferred from cold storage to unidentified destinations by the exchange in recent times hints at impending repayments, potentially stirring up market instability and influencing investor attitudes. Creditors looking to recoup funds that have been frozen for over a decade might choose to sell, adding fuel to any volatility.

A large sum of money at play could significantly influence Bitcoin’s value, possibly causing a domino effect throughout the cryptocurrency sector. The crypto world closely monitors these events, bracing for potential far-reaching consequences on market trends.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

2024-07-02 15:39