The entire cryptocurrency sector is under significant stress, with Bitcoin (BTC) currently valued at $91,010 and exhibiting a daily volatility of 3.5%. Its market capitalization stands at approximately $1.80 trillion, while the total volume in the last 24 hours amounts to $37.83 billion. The downward trend is also affecting altcoins, which have lost more than 1-5% in the past day. This severe selloff has been ongoing as inflows into the crypto market have decreased by over 56% during the last month.

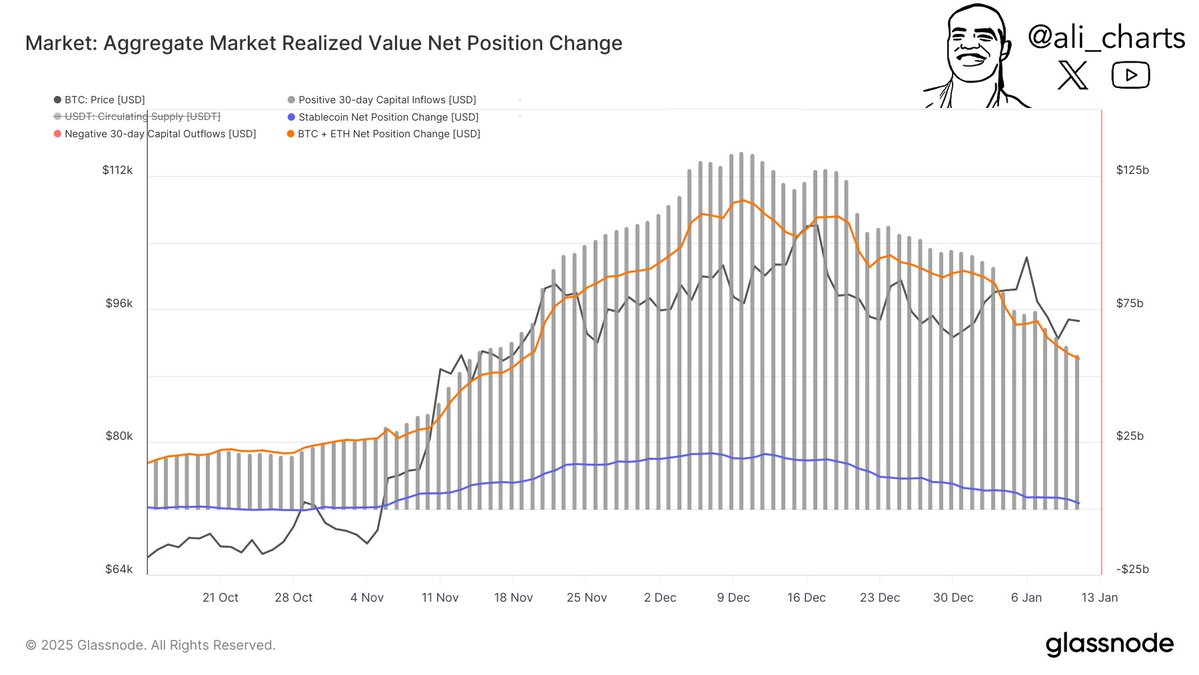

According to figures from blockchain analysis platform Glassnode, well-known crypto analyst Ali Martinez indicates a significant decrease in cryptocurrency investment activity – down approximately 56.7% – over the last month, with inflows plunging from around $134 billion to merely $58 billion.

Source: Ali Charts

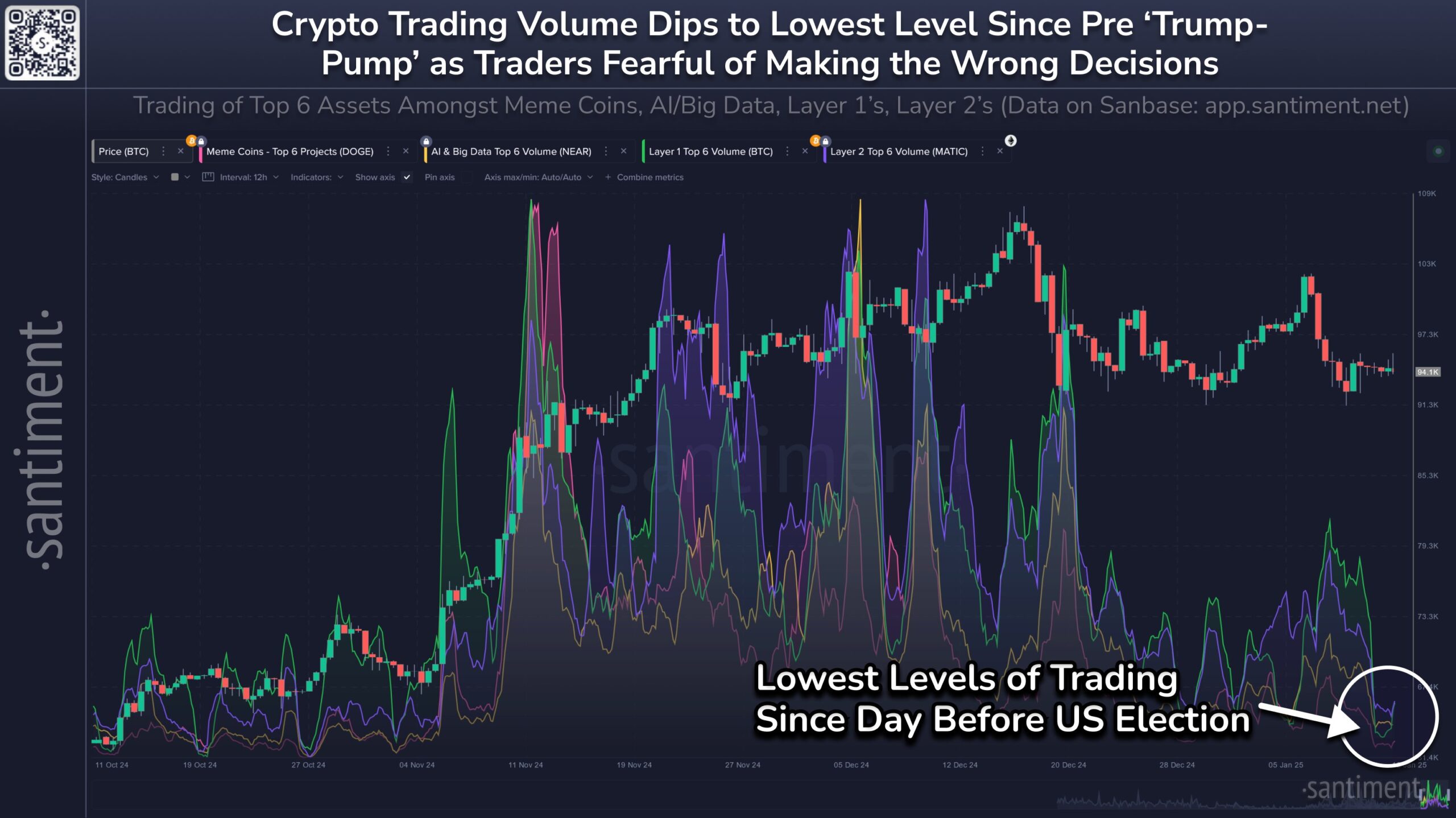

Based on data from Santiment, a blockchain analytics platform, I’ve observed a significant decrease in cryptocurrency trading volumes across multiple sectors. This includes Layer 1 and Layer 2 networks, meme coins, and artificial intelligence (AI) tokens.

Currently, trading activity has decreased to levels similar to those observed on November 4. This could indicate a “freezing” of trades in the market, which typically occurs when investors feel increasingly anxious, uncertain, and worried (FUD). Nevertheless, Santiment’s analysis indicates that these market conditions often precede possible market rebound, as diminished enthusiasm can pave the way for recovery.

Source: Santiment

The price of Bitcoin is experiencing significant selling pressure again, dropping approximately 1.2% and falling below the $93,000 threshold. Data from Glassnode suggests that the short-term holder (STH) cost-basis model for Bitcoin plays a crucial role in gauging the sentiment among newer investors. In the past, this metric has proven useful in pinpointing market bottoms during bull runs and distinguishing between bullish and bearish markets.

Source: Glassnode

At present, the value of Bitcoin is hovering around 7% higher than its short-term holders’ average purchase price ($88,135). Financial analysts warn that if Bitcoin’s price stays below this level, it might signal a decrease in optimism among short-term investors.

Will Donald Trump’s Inauguration Help the Crypto Market Revive?

At present, many people are hoping that the “Trump factor” will spark a new wave of growth in the cryptocurrency market. Given Trump’s pledge to support cryptocurrencies and anticipation of regulatory changes, financial experts believe significant profits could be on the horizon.

Nevertheless, the New York Digital Investment Group (NYDIG) cautioned that Donald Trump’s crypto-related promises might not occur immediately after his inauguration on January 20th. According to Greg Cipolaro, NYDIG’s global head of research, it would be unrealistic to anticipate swift changes in cryptocurrency policy due to Trump’s administration.

According to a research note penned on January 10th, Cipolaro expressed that the incoming administration has instilled a sense of optimism about fulfilling its election pledges. Yet, he underscored the possibility that while certain alterations may happen promptly, others might require time before they become apparent. Additionally, he noted:

Still pending are the appointments of crucial figures. Those who have already been designated will undergo a confirmation process. After successful confirmation, they’ll proceed to gather their team members.

Other crucial pieces of cryptocurrency legislation like regulations on stablecoins and the bill defining the Securities and Exchange Commission’s (SEC) oversight function might require a certain amount of time to be finalized.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2025-01-13 14:48