As a seasoned researcher with years of experience tracking digital asset trends, I must say that last week’s inflow into crypto asset investment products was a breath of fresh air. The $2.2 billion net inflows we witnessed are reminiscent of the optimism seen earlier this year when Bitcoin reached its all-time high.

As an analyst, I’ve recently observed some intriguing trends in the digital asset market. According to the latest weekly report from CoinShares, global crypto asset investment products experienced a significant surge last week, attracting approximately $2.2 billion. This represents the highest net inflow since July, underscoring a renewed interest in these digital assets.

The increase in investments is happening as leading cryptocurrencies are gradually recovering, many having regained significant peaks from last week and showing almost ten percent growth over the last seven days.

Who Led the Charge?

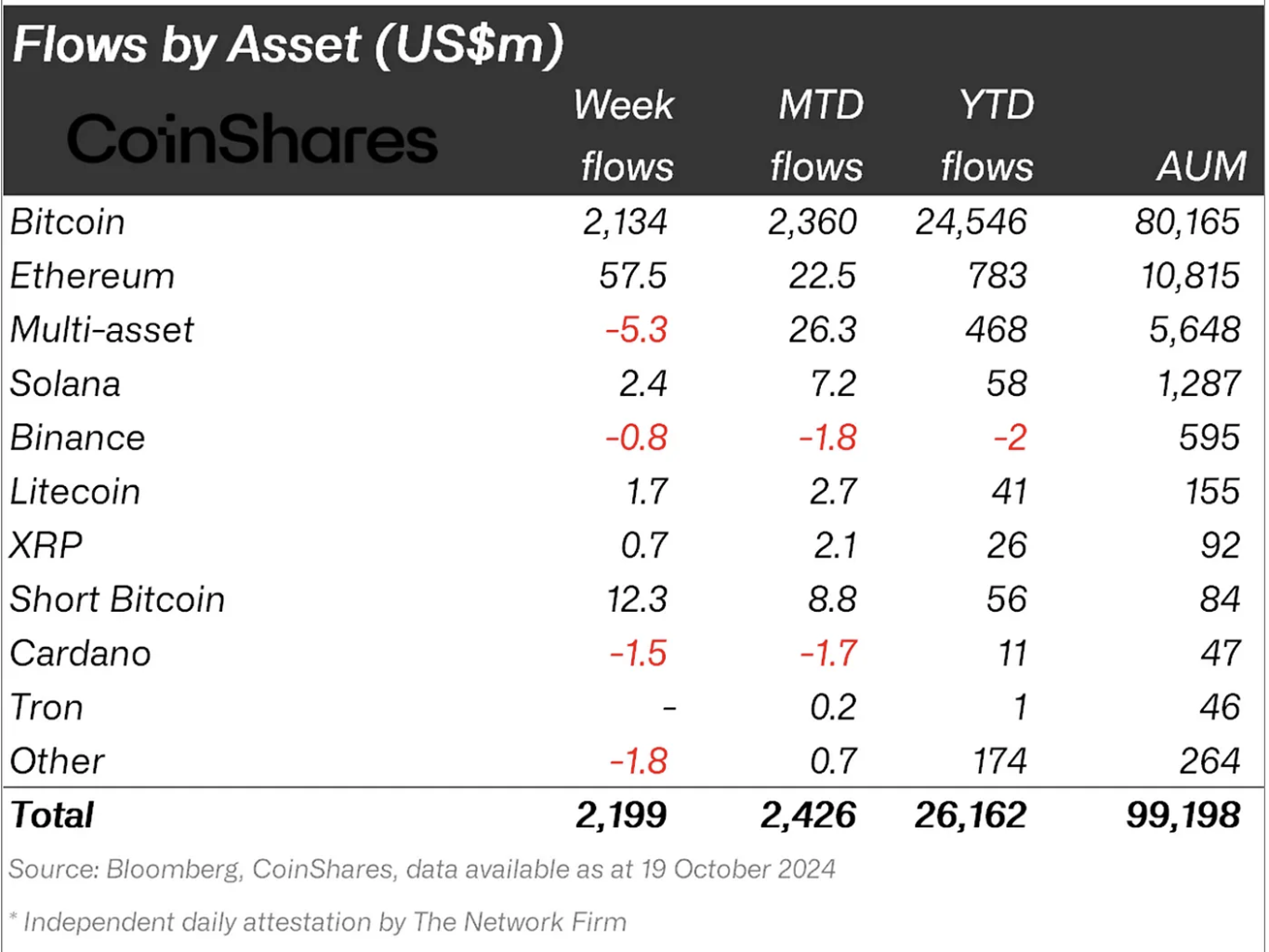

Last week saw a significant boost in investments for products tied to Bitcoin. Specifically, U.S. Bitcoin exchange-traded funds (ETFs) attracted approximately $2.1 billion, with BlackRock’s IBIT ETF accounting for more than $1.1 billion of that amount.

As a crypto investor, I’ve noticed that the combined investments into these Bitcoin ETFs, which made their debut in January, have now reached an impressive $21 billion. These funds have experienced remarkable growth and are now managing an astounding $66 billion in assets under management. This underscores their substantial impact on the market.

remarkably, the resurgence of trust in Bitcoin-related items echoes the optimistic attitude towards it earlier this year. Last week’s investments were the biggest since March, when US spot Bitcoin ETFs received a massive influx of $2.6 billion as Bitcoin surpassed its record high of $73,000.

The high level of interest indicates that investors continue to be optimistic about Bitcoin’s future potential, even amidst temporary changes in the market. Meanwhile, Bitcoin wasn’t the only cryptocurrency that saw an increase in investment last week; other digital currencies also received some inflows, albeit significantly less than Bitcoin.

Inflows to Ethereum-related investments totaled approximately $58 million, whereas funds based on Solana, Litecoin, and XRP recorded comparatively smaller inflows of around $2.4 million, $1.7 million, and $700,000 respectively.

Conversely, the trend for multi-asset investment products saw a reversal, with a total withdrawal of approximately $5.3 million, marking the end of a 17-week run where these products consistently attracted more funds.

What Prompted The Surge In Crypto Inflow?

Based on CoinShares’ findings, this rise in investments appears to be connected to increasing optimism regarding the forthcoming U.S. elections. If the Republicans win, it seems to be influencing investors’ overall attitude positively.

Many think a Republican-led government might be more supportive towards the digital assets market, potentially boosting investor trust and triggering a surge in market prices. Notably, James Butterfill, the Head of Research at CoinShares, emphasized this point.

There’s a sense of renewed hope that’s emerging, and it seems to be fueled by increasing anticipation for a Republican win in the approaching U.S. elections. This optimism is rooted in the perception that Republicans tend to be more favorable towards digital assets.

Significantly, Butterfill echoed this perspective, mentioning that trading activity for these investment products jumped by 30% within the past week. The combined value of cryptocurrency funds worldwide is quickly approaching $100 billion, underscoring the significant attention being paid to digital assets.

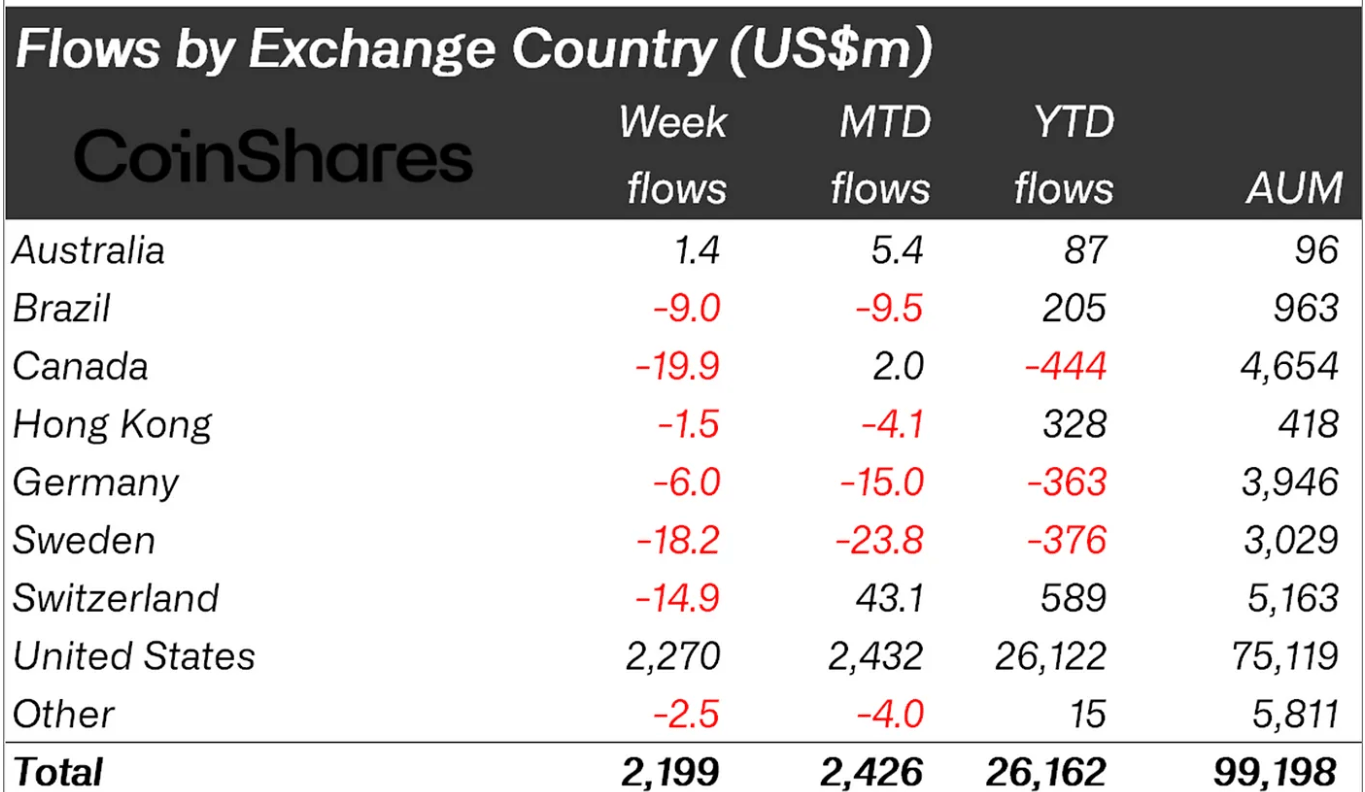

Despite the success of investment funds based in the United States, it’s worth noting that investments in other nations like Canada, Sweden, and Switzerland saw overall withdrawals, suggesting a market landscape with growing disparities worldwide.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-22 04:34