As a seasoned researcher with over two decades of experience in the finance industry, I can confidently say that this recent surge in crypto investments is not just a blip on the radar but a clear indication of institutional interest and renewed investor confidence in digital assets. The involvement of giants like BlackRock and Fidelity, coupled with the more cautious approach from the FOMC, has created an environment ripe for growth.

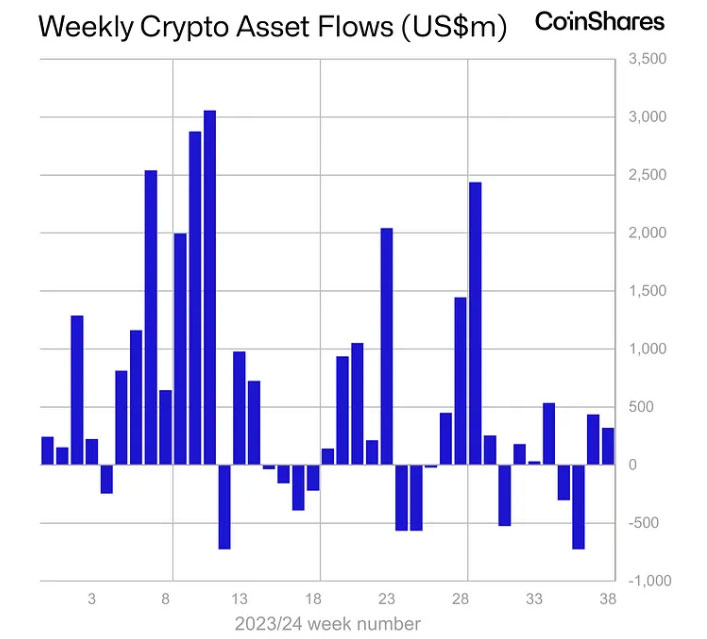

Last week saw a substantial comeback in the international cryptocurrency investment market, as total investments amounted to approximately $321 million across different digital asset categories. This strong resurgence came after two straight weeks of withdrawals, suggesting that investors’ faith in the crypto industry is once again growing.

Leading asset managers like BlackRock, Fidelity, Bitwise, and Grayscale played significant roles in fueling the recent rise. Their participation underscores the increasing institutional appetite for digital assets. Additionally, the recovery can be linked to the Federal Open Market Committee’s (FOMC) latest decisions, which turned out to be more conservative than initially expected.

Based on comments from James Butterfill, Head of Research at CoinShares, the Federal Open Market Committee’s (FOMC) reduction of interest rates by 50 basis points on Wednesday significantly influenced market sentiment, making conditions more favorable for investors, and spurring investment in cryptocurrency products.

Photo: CoinShares

Consequently, the overall value of cryptocurrency funds being managed surged by 9%, amounting to approximately $9.5 billion. Additionally, trading activity experienced a comparable 9% boost over the past week, underscoring the growing vigor within the crypto market.

Bitcoin Dominates the Surge

Products linked to Bitcoin dominated the trend, contributing approximately $284 million to the total inflows. The optimistic trend in Bitcoin drew both long-term investors and an additional $5.1 million into short Bitcoin investments, demonstrating a wide range of opinions within the market.

Bitcoin, represented as BTC and currently valued at approximately $63,366, has been holding its dominant position in the market. Meanwhile, funds based on the Solana platform have also experienced growth, attracting around $3.2 million in investments over the past week. The announcements made during the Solana Breakpoint conference in Singapore have significantly contributed to this increase in investment.

Over the past week, Ether products continued their downward trend, recording a net loss of $29 million for the fifth consecutive week. During this timeframe, Ether funds have experienced total outflows amounting to $187.7 million. Interestingly, Grayscale’s ETHE fund, famous for its high fees, has been a significant factor in these losses. However, US spot Ethereum ETFs, which debuted in July, have managed to attract inflows worth $2.2 billion.

Regional Differences in Fund Flows

Geographically speaking, U.S. funds led the way, accounting for a significant portion of investments with approximately $277 million. Switzerland showed strong potential, reporting its second-largest weekly investment of the year at $63 million. Conversely, investment products in Germany, Sweden, and Canada saw outflows totaling about $9.5 million, $7.8 million, and $2.3 million respectively.

This regional disparity underscores the varying investor sentiment across global markets. While the U.S. and Switzerland saw renewed interest in crypto investments, other regions continued to exhibit caution amid fluctuating market conditions.

In this phase of global cryptocurrency market recovery, I’m curious to see if the current influx can maintain its momentum or if looming macroeconomic factors might dampen investor enthusiasm once more. Yet, the ongoing market rebound is a clear demonstration of the crypto sphere’s resilience and capacity to adapt to changing regulatory and financial environments.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-09-23 16:12