The cost of a single Bitcoin has surpassed $100,000 again following three consecutive days of price rises. This latest surge above $100,000 is significant because it happened after Bitcoin saw a rise of 12.5% on Monday, January 13, when it rebounded from the $90,000 support level.

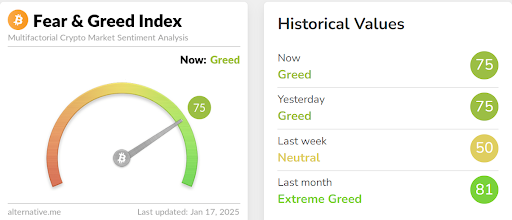

Just as anticipated, the optimistic trend with Bitcoin has influenced other digital currencies. Notably, prominent altcoins have mirrored Bitcoin’s growth spurt, leading to a significant expansion in the total market capitalization of cryptocurrencies (denoted as ‘A’). This surge in crypto market cap has also triggered a corresponding shift in the Crypto Fear and Greed Index, which is edging towards the Extreme Greed level.

Fear And Greed Index Moves To Extreme Greed

The Crypto Fear and Greed Index is a commonly used tool that gauges investors’ emotions towards the cryptocurrency market, ranging from 0 to 100. This scale categorizes feelings from extreme fear at the lower end, through neutral sentiments in the middle, up to extreme greed at the higher end. When the index indicates extreme fear, it typically means the market is oversold, and investors are pessimistic, creating potential buying opportunities.

From my perspective as a crypto investor, when I find myself overwhelmed by greed, it’s usually a sign that the market may be overheated. This situation could potentially lead to a correction or even a crash, particularly if the sentiment swiftly shifts from cautious optimism to an extreme level of greed.

Over the course of this week, there’s been a consistent increase in value across the entire crypto market. As of now, the total cryptocurrency market capitalization stands at approximately $3.57 trillion, which is a rise from around $3.14 trillion at the start of the week. This growth represents an influx of about $430 billion over the past five days, signifying a 13.5% increase. This significant spike suggests that investors are becoming more optimistic, with Bitcoin and some major altcoins aiming to reach new peak values again.

Over the past few days, there’s been a surge in investments into the cryptocurrency market, causing the overall market sentiment to rapidly shift from neutral at the start of the week to extreme greed as we speak. This rapid change indicates that we might be approaching an area where the market is overheated or overvalued.

Where Does The Bitcoin Price Go From Here?

The stability and optimistic outlook of the market depends on Bitcoin keeping its price above $100,000 due to its leading role in the market. If the bulls can manage to guard the $100,000 level and make it a reliable support, this could help prevent excessive greed causing the market to become overbought, which might lead to a possible correction going downwards.

If the crypto market surpasses $100,000, it will essentially trigger a reset of the Crypto Fear and Greed Index at this level. However, if it can’t maintain above $100,000, it could confirm that the pattern seen in history is accurate: extreme greed often precedes a market crash.

At the time of writing, Bitcoin is trading at $101,420 and is up by 1.6% in the past 24 hours.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2025-01-17 14:11