After enduring a massive hack that cost $235 million last July 2024, WazirX – an Indian cryptocurrency exchange – has outlined a recovery strategy designed to reimburse affected users. According to recent updates, this plan was developed under the watchful eye of Singapore’s legal framework.

In August 2024, Zettai, the parent company of WazirX, sought protection from creditors at the Singapore High Court through a moratorium. Additionally, they proposed a debt restructuring plan using the Singapore Scheme of Arrangement. The Singapore Scheme of Arrangement is a court-approved legal process that helps companies manage their debts and obligations more efficiently. This procedure will also enable WazirX to create a binding agreement with its creditors, leading to a resolution and potentially preventing liquidation.

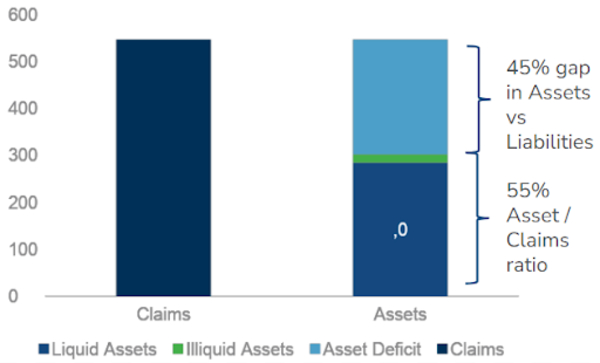

The hacked cryptocurrency platform WazirX has disclosed that they possess liquid assets valued at approximately $566.4 million USD in Tether (USDT), surpassing the $546.5 million USD worth of user claims filed in July 2024. To tackle these remaining claims, the company has additionally introduced recovery tokens.

This arrangement enables creditors to gain from the future earnings produced by the platform’s operations as well as seized assets. Nichal Shetty, the creator of WazirX, mentioned that this reorganization process is a move aimed at regaining the confidence of their clients. He expressed this idea by saying:

“This restructuring effort is a step towards restoring the trust our customers have in us.

Taking a prompt action, we filed for a moratorium and requested the court to initiate a Scheme process. This move was primarily to expedite distributions for our users. Token distributions will follow swiftly once the Scheme receives creditor approval and court sanction. My top priority remains to deliver more value than what was lost.

WazirX Plan for Returning User Funds?

The excess funds that WazirX currently holds over user withdrawal requests is largely attributed to the robust increase in cryptocurrency values observed across the market throughout 2024. Previously, WazirX had experienced a significant 45% deficit of assets relative to its obligations prior to this bullish trend.

Source: WazirX

WazirX, a cryptocurrency trading platform, has declared that they will redistribute user funds by distributing tokens. They anticipate that this distribution will cover between 75% and 80% of the account balances at the moment of the cybersecurity incident. The initial token distributions are expected to be made within ten business days following the approval and implementation of the plan.

Besides handling more creditor claims, the platform also intends to use recovery tokens for this purpose. WazirX will occasionally buy back these tokens using earnings from its operations and the launch of a proposed Decentralized Exchange (DEX). Additionally, the crypto exchange aims to utilize the DEX not only for extra income but also to settle existing debts.

Competitors Are Capitalizing on the Hack

With WazirX mapping out their own road to recovery, competitors such as CoinSwitch are strategically attempting to draw in WazirX’s existing users. To aid those affected by WazirX, CoinSwitch has declared a substantial recovery program.

On the 7th of January, CoinSwitch unveiled through X their new initiative called “CoinSwitch Cares,” a recovery fund worth approximately 600 crore Indian rupees ($69.9 million). The goal of this fund is to aid in restoring funds that were stolen during the WazirX hack.

Furthermore, CoinSwitch has chosen to take legal steps in an attempt to retrieve approximately 12.4 crore Indian rupees (equivalent to $1.44 million) that are currently frozen on the WazirX platform, representing around 2% of their funds.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2025-01-10 18:12