So, Deribit, the crypto exchange that’s basically the prom queen of options trading, just had a year that can only be described as “hold onto your hats, folks!” In 2024, their trading volume skyrocketed to a jaw-dropping $1.185 trillion. That’s almost double the $608 billion from 2023! 🎉 I mean, who knew trading crypto could be more popular than avocado toast?

Options trading was the star of the show, raking in a whopping $743 billion. That’s a 99% increase year-over-year! It’s like Deribit is saying, “Move over, Bitcoin, we’ve got options!” The Chief Commercial Officer, Luuk Strijers, says this surge was thanks to some key market events. You know, like the usual suspects: the US presidential election and a Bitcoin bull run that made everyone feel like they were riding a unicorn. 🦄

Spot Trading: The New Kid on the Block with 810% Growth!

November was like the Super Bowl for Deribit. On November 12, they hit a record daily trading volume of $14.8 billion. That’s more transactions than I’ve made on my dating apps! By November 28, open interest across futures and options reached a staggering $48 billion. All thanks to Bitcoin prices that were soaring higher than my hopes on a Monday morning.

Spot trading is now the fastest-growing segment, exploding by 810% to $7.6 billion. That’s up from a measly $837 million in 2023. It’s like watching a toddler grow into a basketball player overnight. Institutional investors are finally getting serious, using advanced strategies that make my head spin faster than a hamster on a wheel. 🚀

Meanwhile, Deribit is playing nice with regulators, securing a Virtual Assets Regulatory Authority in Dubai and going after licenses in France and Brazil. They’re basically the overachievers of the crypto world. And let’s not forget about the FATF Travel Rule, which they implemented to make things more secure and transparent. KYC processes? More like KYC, please let’s make this easier!

Bitcoin Rules, USD is the Bouncer

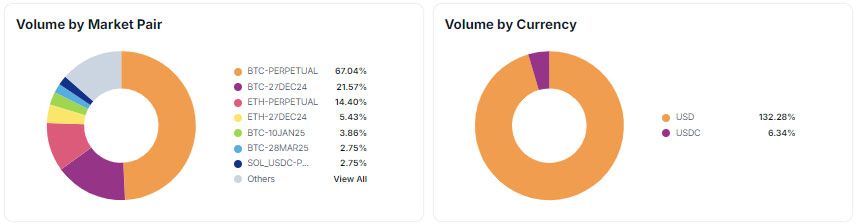

Bitcoin is still the big boss on Deribit, holding 67.04% of market pair volume. It’s like the cool kid in school that everyone wants to hang out with. ETH-perpetual is trailing behind at 14.4%, but let’s be real, it’s just happy to be invited to the party. Options like BTC-27DEC24 are showing traders are hedging their bets like they’re in Vegas. 🎲

And guess who’s dominating the currency volume? USD, with a solid 132.28%. USDC is trailing behind like the kid who forgot their lunch at home, sitting at 6.34%. This preference for USD shows that traders are clinging to it like it’s a life raft in a sea of regulatory uncertainty. Because let’s face it, in the world of crypto, it’s always good to have a safety net! 💰

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2025-01-22 14:03