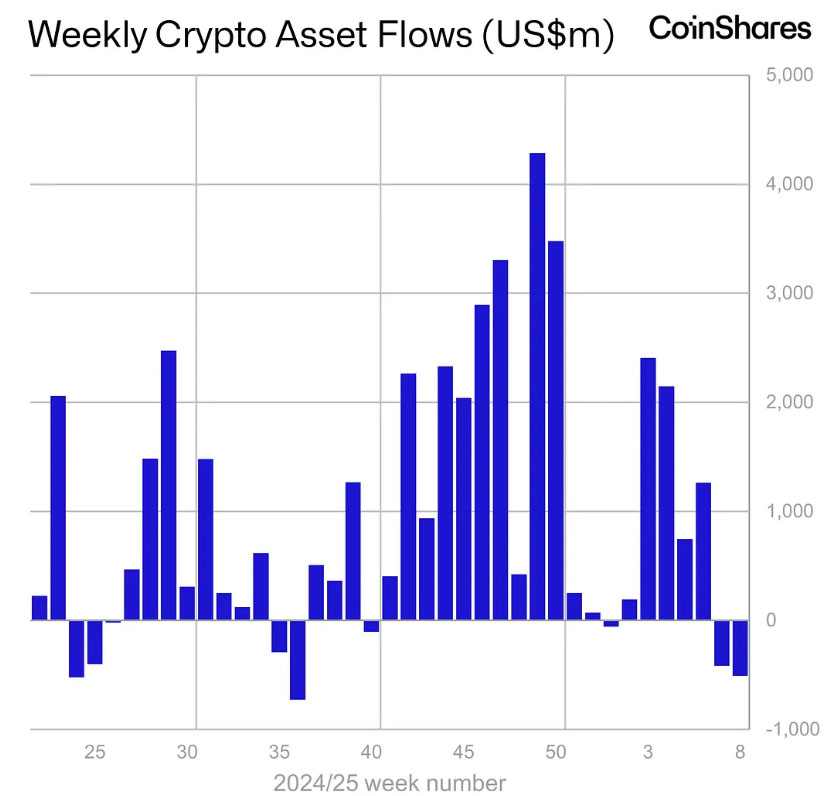

In a week that could only be described as a financial farce, cryptocurrency investment products were unceremoniously dumped by investors to the tune of $508 million. This marked the second consecutive week of such melodrama, with the previous week’s outflows of $415 million bringing the grand total to a jaw-dropping $924 million. CoinShares, the ever-watchful digital asset investment firm, delivered this grim news on February 24, as if reporting on a particularly disastrous garden party.

Source: CoinShares

The market’s instability, much like a poorly timed joke, coincided with the growing uncertainty over US economic policies following the presidential inauguration. Investors, already on edge due to concerns about trade tariffs, inflation, and shifting monetary policies, decided to reassess their holdings in crypto exchange-traded products (ETPs). One might say they were as skittish as a cat in a room full of rocking chairs.

James Butterfill, head of research at CoinShares, offered his two cents on the matter, stating with the gravitas of a man who has seen too much:

“Digital asset investment products saw outflows totalling $508M as investors exercise caution following the US Presidential inauguration and the consequent uncertainty around trade tariffs, inflation and monetary policy.”

Bitcoin Takes the Hardest Hit

Bitcoin, the once-mighty king of cryptocurrencies, faced a brutal sell-off, with outflows reaching $571 million. Some investors, perhaps feeling particularly masochistic, even bet against Bitcoin, pouring $2.8 million into short positions. This shift in sentiment suggests that many believe Bitcoin’s future is as bright as a candle in a hurricane.

//www.coinspeaker.com/wp-content/uploads/2025/02/crypto-assets-saw-508m-outflow-market-reacts-us-policy-uncertainty-coinshares-1.jpg”/>

Source: CoinShares

Trading turnover has also taken a sharp hit. Two weeks ago, market turnover stood at $22 billion, but that figure plunged to $13 billion last week, a sign that many traders are moving to the sidelines. The drop in liquidity further exacerbates volatility, making the market more susceptible to sudden price swings. It’s as if the market is a drunkard stumbling through a minefield, with no one quite sure where the next explosion will come from.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Best Japanese BL Dramas to Watch

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2025-02-24 16:15