In the stillness of the modern marketplace, where numbers flicker in the pale glow of countless screens and voices are measured in bytes per second, a peculiar change has swept over the landscape as unexpected as the flight of a heron over a sleepy Russian pond. Who could have foretold it? Not even Ki Young Ju, the brooding chieftain of CryptoQuant, perched restlessly atop his mountain of data—certainly not him. Once a prophet of doom, he has now found himself entangled, almost comically, in Bitcoin‘s most recent ballet above $100,000.

The entire market—a gallery of anxious figures—stood breathless, hats in hand, bracing for a further decline, eyes expectant and wallets twitching. Alas, they were rewarded with the splendid surprise of Bitcoin’s upward leap, faster than a provincial gossip spreading through a sleepy village.

What Cycles? Time Is a Flat Circle. Maybe a Möbius Strip?

Recently, in the digital agora known as X (neither roman numeral nor unknown treasure), Ki Young Ju confessed with the humility of a landowner caught at his own card table: this market, much like a Russian estate under new management, is not what it once was. Gone, he says, are the days when a few weathered whales, canny retail traders, or miners with pickaxes—real or metaphorical—could tilt the tides. The ancient matriarchs of crypto, with their secret hoards, can sell off their fortunes, but the market, unbothered, strolls on as if meeting a distant cousin at tea.

The culprit? A heaping, gurgling influx of new coin, poured onto the scene like vodka at a rural wedding. Young points an amused finger at the rise of Spot Bitcoin ETFs, sanctioned with all the sternness of His Imperial Majesty, the SEC, in 2024. Here now are new actors, mysterious and deep-pocketed, institutional aristocrats gliding into the ballroom, glancing dismissively at the local merchants and their worn boots.

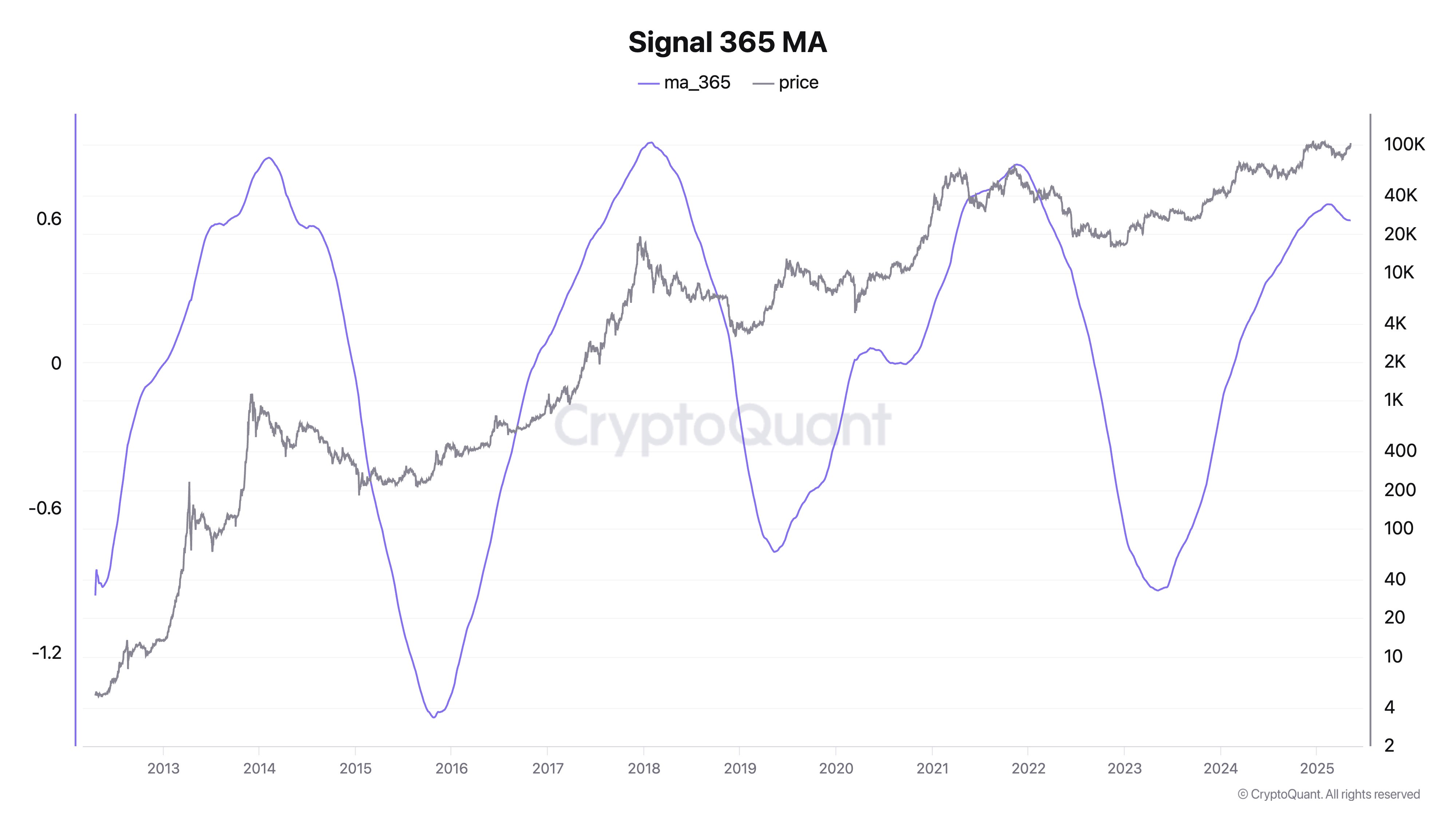

The result? Whales may blubber and flail, but their waves scarcely ripple this ocean. The CEO, dusting off his metaphysical overcoat, suggests it is perhaps the hour to bid farewell to the “cycle theory”—a concept already so battered and weary, it begs for a vacation from all these booms and busts.

Liquidity, now a wayward spirit, hails from unfamiliar sources. “Do not, gentle traders, bother yourselves so much with old whales,” Young muses, stroking his data. “Instead, keep your watchful eyes fixed on the new-fangled institutions and ETFs. Their pockets are deep enough to hide a czar.”

Yet, in spite of his sudden optimism—one could almost mistake it for joy—the CEO remains vexed, caught in philosophical reverie. Is the market truly bullish or bearish? He shrugs, noting with dry irony that indicators are “hanging around the borderline,” like bored students loitering at the edge of a field during harvest.

Meanwhile, Bitcoin, like a patient hunter, does not pause for these existential musings. It stalks new peaks, lining investors’ pockets with profit. Nearly every Bitcoin holder, 99% they say, is flushed with gain. The last time so many Russians were so rich, the novels had twice as much ennui.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Ford Recalls 2025: Which Models Are Affected by the Recall?

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

2025-05-10 12:04