The digital phoenix, Bitcoin, finds itself not soaring but sulking, entwined in a rather morbid waltz with the staid and jittery S&P 500. Investors, in their solemn conclaves of coffee-stained spreadsheets and jittering nerves, mutter gravely as this unholy coupling evokes memories of financial spirals past. Yet, whisper it—data (that beguiling, stately dancer) hints at a future pyrotechnic pirouette from the crypto demigod.

Through the prism of present politics, the nation swirls in a surreal spectacle, with President Donald Trump—Act II, Scene II—presiding over a 10% nosedive in the stock market. The blame, elusive and slippery as a bar of soap in a prison shower, falls on inflationary fumblings and fiscal fog. We’re reminded of the sour symphonies of 2009. Nostalgia, anyone?

“How fares the empire under Trump Redux?” The S&P, poor bugger, tumbles 9% down the rabbit hole.

In ’09, recession played the villain; today, blurry intentions take center stage. Bravo! 🎭

Leap into the numbers below to savor the tragicomedy.

— CryptoQuant.com (@cryptoquant_com) March 12, 2025

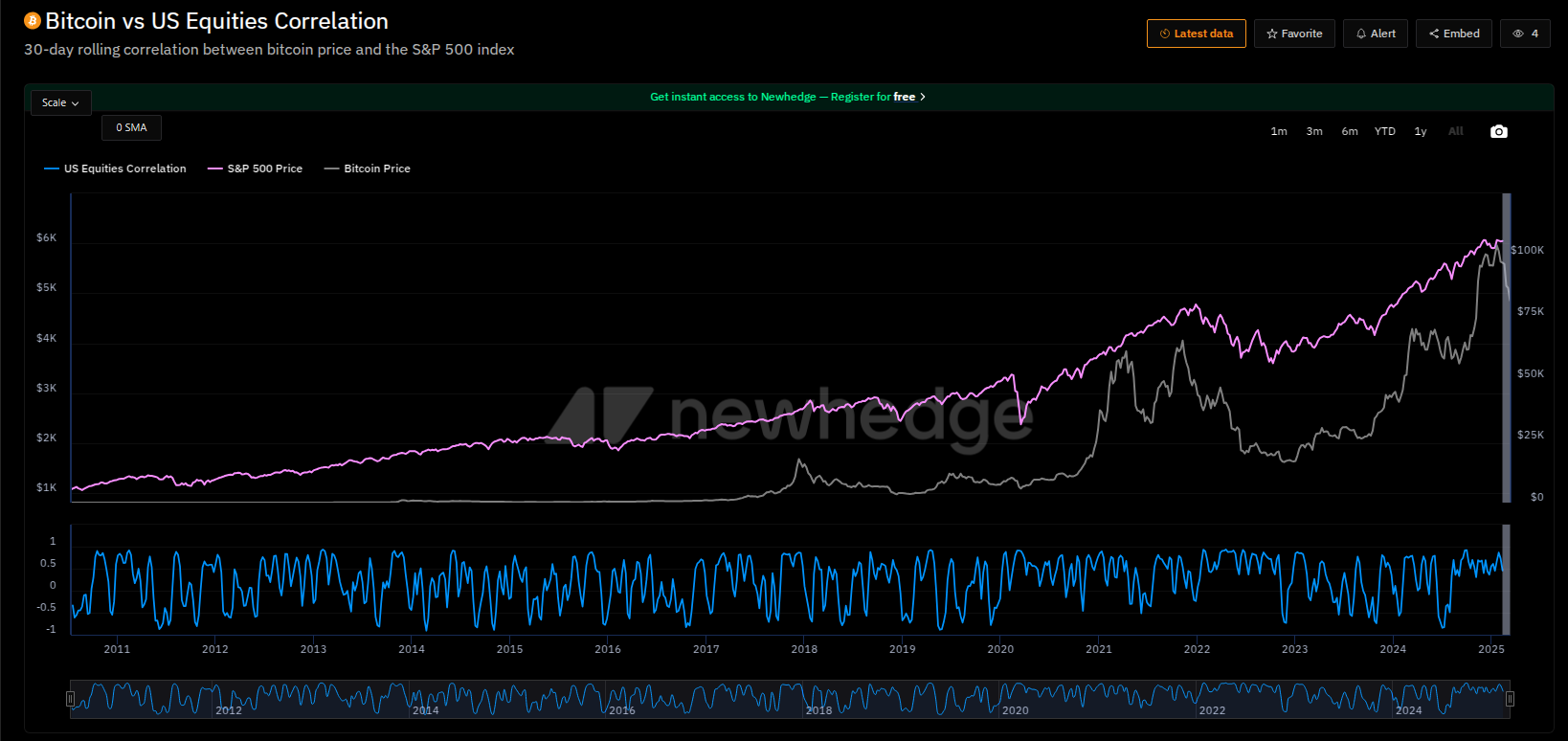

Stocks and Bitcoin: Dance Partners in a Bitter Reel

Bitcoin—frequent recipient of rather grandiose monikers like “digital gold”—is currently masquerading as a clumsier cousin to tech stocks. CryptoQuant’s soothsayers believe the flagship crypto is mimicking traditional market theatrics yet again. Recall, dear reader, the pandemic of 2020 when Bitcoin and stocks slipped on the fiscal banana peel together before staging their respective comebacks. Ah, the drama never wanes.

But hold your monocles! Analysts at IntoTheBlock claim that Bitcoin’s tango with the S&P has fizzled to “near-zero correlation,” as mysterious as a magician’s disappearing act. Could Bitcoin be plotting independence? A touch of revolt over its entanglement with those dreary stocks? Let’s hope so—for our entertainment, if nothing else.

Anecdotes of Resurrection: Cryptocurrency’s Melodrama Unfolds

CryptoQuant’s historical archives tell tales of Bitcoin’s uncanny Lazarus-like comebacks. Picture it: 2018, when the currency lost 80% on sheer melodrama, only to flex its muscles again in 2019. Or 2020, when Bitcoin fell flat on its proverbial face, then stood up, dusted itself off, and waltzed to new peaks in 2021. Consistently capricious, I grant you, but thoroughly thrilling. 🎢

Consider, too, the Coinbase Premium Index: that curious oracle tracking Bitcoin’s value divergences between exchanges. Whenever this floozy of a statistic dips into the negative and resurfaces, sharp-eyed nerds spot a looming price rally. It’s almost poetic, isn’t it? A love letter to volatility, signed and sealed by chaos. 💌

Wagging Fingers & Nervous Optimism

Ah, the analysts—those omniscient oracles. Some clutch pearls, warning that Bitcoin’s belly flop signals impending doom for an artificially inflated stock market. Tyler Richey, ever the dramatic, muses that this crypto ennui might hint at fragility in traditional equities. Could it spell the end of bull-market ballet? Or simply the beginning of another madcap act in the Spectacle of Speculation?

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2025-03-14 08:12