As a seasoned analyst with a decade of experience in the crypto market, I find CryptoCon’s recent analysis strikingly reminiscent of my early days in this space. His comparison of September 2016 to now feels like a deja vu, and if history truly does repeat itself, we could be in for an exciting ride with Bitcoin.

In a recent market analysis, cryptocurrency expert CryptoCon compared the current Bitcoin price movement to that seen in December 2016. He elaborated on his observation and offered predictions for the future of Bitcoin.

“It Is September 2016 All Over Again For Bitcoin”

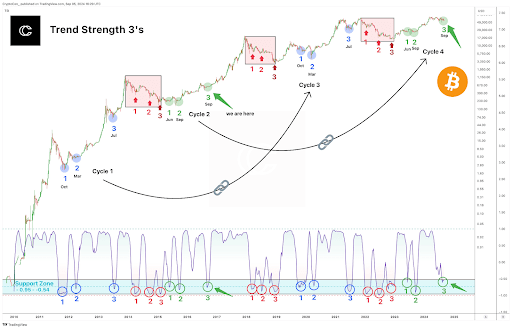

CryptoCon recently posted on X (previously known as Twitter) that it feels like it’s September 2016 all over again for Bitcoin. In line with this sentiment, he noted that the “Bitcoin trend strength prediction” has come true. He elaborated that much like in September 2016, Bitcoin has fallen into its support area after reaching a peak.

To reinforce his belief that the leading cryptocurrency follows historical patterns, he pointed out that every month has shown similar support zones for rotating cycles. He additionally stated that the “pattern of threes” has not faltered yet, whether during mid-cycles or bear markets. His chart indicated that Bitcoin is nearing the end of its accumulation phase, which typically precedes a cycle peak, as was the case in the 2016 market cycle.

After conducting his examination, CryptoCon confidently declared that the upward trend has not yet concluded, instilling faith that Bitcoin could attain unprecedented heights beyond its current all-time high ($73,000) reached in March this year. Earlier, the crypto expert expressed optimism that temporary price fluctuations are insignificant and that the value of Bitcoin will soar up to a potential peak of $160,000 during this bull market surge.

CryptoCon observed that Bitcoin has gone through periods of volatility and sluggishness, often referred to as “dull” periods, during past halving events before hitting new all-time highs (ATHs) the following year. The analyst anticipates that the peak of this cycle might occur around November 2025, a prediction supported by Bitcoin’s historical behavior during halving cycles.

More Hope For BTC Investors

crypto expert Mikybull Crypto recently offered optimism to Bitcoin investors, suggesting that a significant rise in Bitcoin’s value (a “parabolic rally”) could be imminent. In a post on X, he explained that this is because the DXY (Dollar Index), which measures the value of the US dollar against other major currencies, appears ready to collapse from its current macro bear flag pattern. The analyst added that this same situation unfolded in 2017 and 2020.

In another post, Mikybull Crypto predicted that the price of Bitcoin could reach $95,000 in its next growth phase. He noted that Bitcoin appears to be forming a bull flag on a large-scale chart, while the DXY is showing a bear flag. Despite this, the crypto analyst remains optimistic, stating that as macro skepticism and fear dissipate, Bitcoin could embark on another parabolic surge.

Currently, as I’m typing this, Bitcoin is being exchanged for approximately $56,300. However, it has experienced a decrease over the past 24 hours, based on information from CoinMarketCap.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-09-06 23:46