As a seasoned crypto investor with over five years of experience in the market, I have witnessed the transformative impact of regulatory approvals on crypto prices, particularly when it comes to Exchange-Traded Funds (ETFs). Based on my analysis and observation of the current market trends, I firmly believe that Ethereum (ETH) could potentially reach $4,000 in the coming months.

Expert Analysis:

Why Ethereum Could Reach $4,000

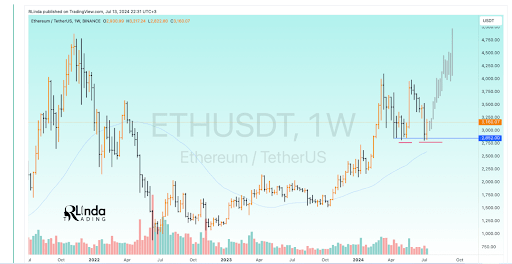

In a recent post on TradingView, Linda pointed out that the anticipated approval of Spot Ethereum ETFs by the SEC could be a significant catalyst propelling Ethereum’s price to reach $4,000. The trading community expresses optimism regarding these funds, eagerly anticipating the SEC’s decision.

According to predictions from market experts, such as James Seyffart of Bloomberg and Michael van de Poppe, it is anticipated that Spot Ethereum Exchange-Traded Funds (ETFs) could be approved imminently. Analogous to these forecasts, various crypto pundits have speculated that the approval of these ETFs would ignite a significant surge in Ethereum’s value.

As a crypto investor, I’ve been closely monitoring Ethereum’s technical developments, and I’m optimistic about its future price movement. Based on my analysis, the bullish trend for Ethereum looks set to continue, potentially pushing the token’s price up to $4,000 or even beyond that to $4,800. The key support level for buyers is around $3,200, and once Ethereum manages to hold above its 200-day moving average and breaks out above this point, the token’s strength should significantly improve.

According to Linda’s assessment on smaller time scales, there are indicators of an optimistic market sentiment, most notably on the daily chart where she identified a potential bounce from a robust support level. Based on this analysis, Linda is confident that Ethereum’s trend will continue upward towards $4,000.

Ethereum’s Chart Identical To Bitcoin’s Before ETF Launch

According to cryptocurrency expert Crypto Rover’s analysis, Ethereum’s price chart bears a striking resemblance to Bitcoin’s prior to the launch of Spot Bitcoin Exchange-Traded Funds (ETFs). This observation implies that Ethereum could potentially experience a price surge similar to Bitcoin following the approval of its own ETF.

In a previous post on X, an analyst expressed confidence that Spot Ethereum ETFs would be authorized, which could signal the beginning of Ethereum’s price increase. The anticipated surge in ETH‘s value is attributed to the significant inflows these ETFs are projected to receive. According to crypto research firm K33, the first five months of trading for these funds may attract up to $4.8 billion.

Expert: Crypto analyst Leon Waidmann pointed out that the introduction of Spot Ethereum ETFs could trigger a significant surge in Ethereum’s price. He explained that large institutional investors are expected to buy substantial amounts of Ethereum as these funds become available for trading, potentially reducing its current supply.

Currently, Ethereum is priced at approximately $3,300 during this report’s compilation, representing a nearly 5% increase within the past 24 hours based on figures from CoinMarketCap.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-07-16 00:04