As an experienced analyst, I have closely observed the price trends of various cryptocurrencies over the years. Based on my analysis and the historical patterns indicated by the Cardano (ADA) chart shared by Ali Martinez, I believe that ADA may be setting up for a significant parabolic bull run.

As a researcher studying cryptocurrency trends, I’ve observed that the historical price pattern of Cardano (ADA) bears similarities to past parabolic bull runs in other digital assets. If this pattern holds true, we may soon witness an explosive growth phase for Cardano’s price.

Cardano May Be Set For A Bull Run Based On Historical Trends

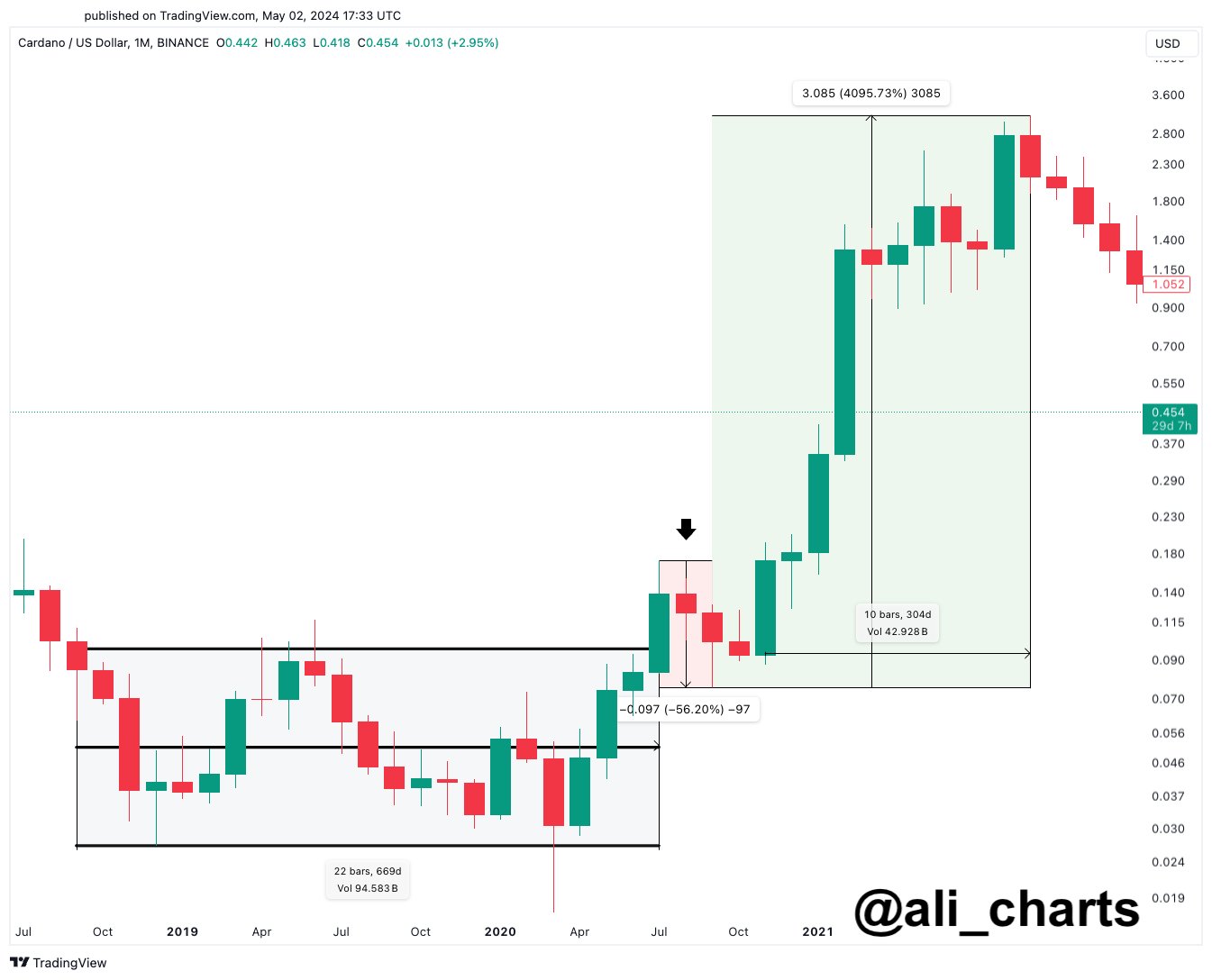

As a researcher studying the latest developments in the cryptocurrency market, I’d like to draw your attention to a recent post by analyst Ali Martinez on platform X. In this post, Martinez delves into the potential clues history may offer regarding the future price direction of ADA. To begin with, let me share an intriguing chart that Martinez has provided, which depicts ADA’s historical trend all the way back to 2019: [Chart inserted here]

In the given graph, the asset appeared to have stabilized between two parallel trendlines, indicating a consolidation phase during that time frame in the context of technical analysis.

In simpler terms, the top line of the chart links the highest prices, whereas the bottom line corresponds to the lowest prices. During periods of market stability within this channel, traders may encounter resistance when attempting to push the price higher towards the upper line, while finding support when the price falls close to the lower line.

A break out of either of these lines can imply a continuation of the trend in that direction. As is visible in the chart, ADA managed to break out of this past parallel channel with a 75% surge. The asset then followed this rally up with a correction of around 56% before finally lifting off into a massive 4,095% bull run.

Intriguingly, Cardano’s price action in 2023 bears a striking resemblance to its behavior in 2019, as depicted in the following chart.

In my analysis of the graph, I’ve observed that Cardano surpassed the boundaries of its recent parallel channel with a significant surge of approximately 72% not too long ago. However, more recently, the asset has experienced a decline of roughly 50%. Despite this setback, the analyst posits that this correction could potentially pave the way for another bullish trend.

The historical patterns in the price movements of Cardano’s ADA may not exactly repeat, but they could share similarities, or as Mark Twain famously put it, “History doesn’t repeat itself, but it often rhymes.” Consequently, with this perspective, we should prepare ourselves for potential future developments and recognize that the recent price decrease might be among the last chances to acquire ADA at relatively lower costs before another potential price surge.

It’s yet to be determined if ADA will follow the same trajectory as during the previous bull market. From a long-term perspective, however, let’s consider potential short-term movements. An insight into this might be provided by a signal given by an analyst in another post.

As Martinez explains:

The TD Sequential indicator, which accurately called the peak of Cardano, now signals a purchasing opportunity on the ADA daily graph. This prediction indicates a possible rebound of one to four consecutive daily candlesticks, potentially marking the conclusion of the ADA correction period.

ADA Price

At the time of writing, Cardano is trading around $0.464, down 3% over the past week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-05-03 22:16