As a researcher with a background in financial analysis and experience working with on-chain data, I find the MVRV pricing model and its application to Bitcoin intriguing. The model’s ability to provide insights into market sentiment based on investors’ realized profits can be quite valuable for understanding potential price movements.

An analyst has shared that Bitcoin is expected to challenge the $79,600 mark based on its current price trend, assuming it manages to stay above this significant threshold in the pricing model.

Next Bitcoin MVRV Pricing Band Is Currently Valued At $79,600

Analyst Ali Martinez discusses potential future directions for Bitcoin’s price in a recent post on X, utilizing an on-chain pricing method. This approach employs the widely-used “Market Value to Realized Value” (MVRV) indicator as its foundation.

As a market analyst, I would explain that this metric provides insight into the current worth of Bitcoin investments in relation to the amount initially invested by its holders. In simpler terms, it shows us the difference between Bitcoin’s current market capitalization and its realized capitalization.

As a crypto investor, when the MVRV (Market Value to Realized Value) ratio surpasses 1, it signifies that on average, we’re all sitting on profits – our collective holdings are now worth more than what we initially paid for them. Conversely, an MVRV less than 1 indicates that collectively, we’re underwater – the market value of our holdings is currently lower than the total amount we’ve spent to acquire them.

In my analysis, I’ve come across various pricing models based on this specific metric. However, during our ongoing conversation, it’s the “MVRV extreme deviation pricing bands” that merit closer attention.

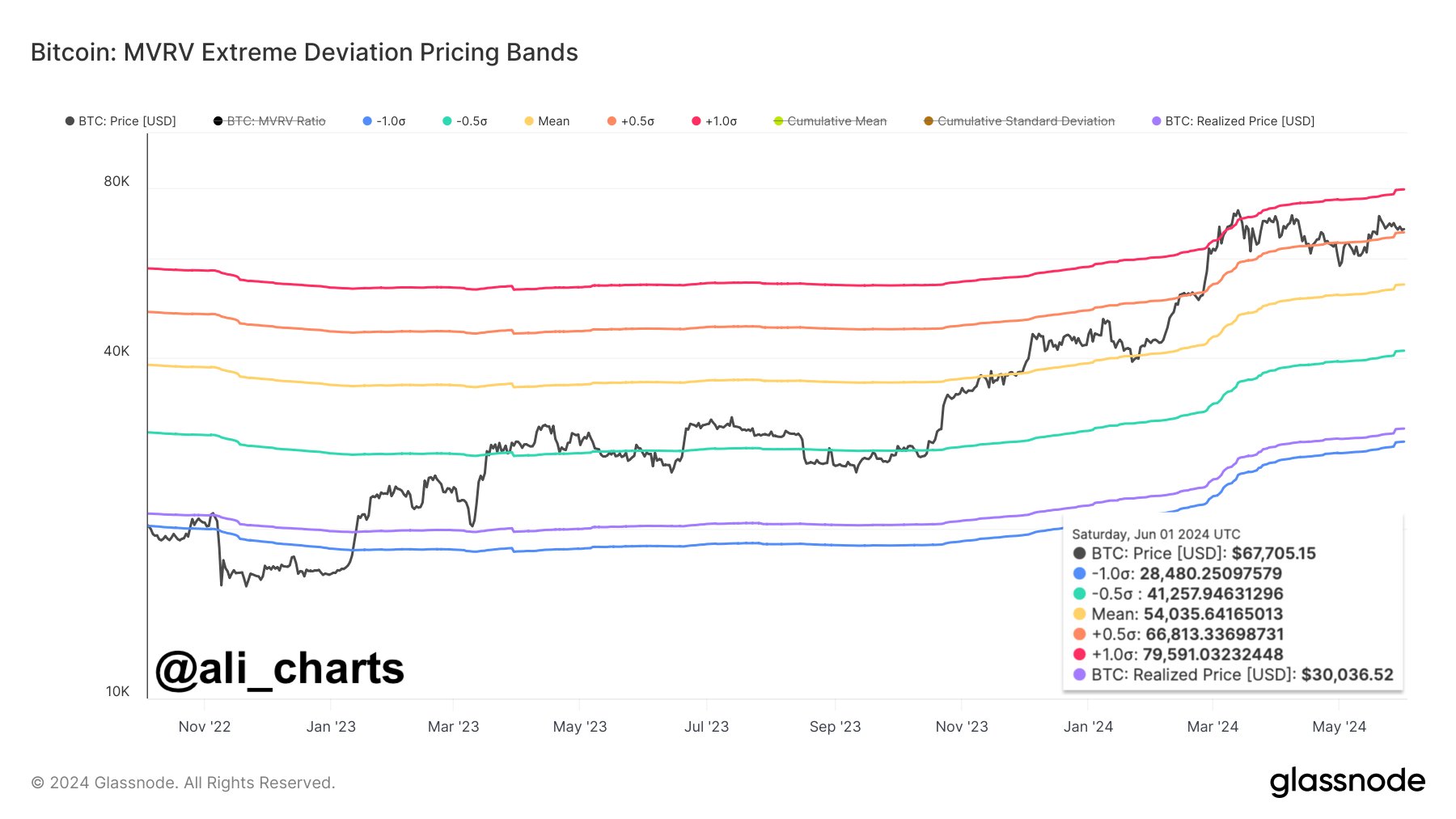

The standard deviations of this model’s Mean Value Realized Value (MVRV) indicate significant price thresholds. Here’s a chart depicting those current levels for Bitcoin.

According to the graph’s representation, Bitcoin is presently transacting above the $66,800 mark, which is associated with a +0.5σ pricing band. At this price point, Bitcoin’s MVRV (Market Value to Realized Value) ratio stands 0.5 standard deviations above its average value.

Based on the given model, I identify the next level of interest as the +1σ level, which corresponds to a Movin Average Risk Ratio (MVRR) that is one standard deviation above its mean. The specific price point at which this condition is met is $79,600.

Historically, the cryptocurrency market has seen price peaks where the Market Value to Realized Value (MVRV) ratio has been exceeded. A glance at the chart reveals that Bitcoin surpassed this threshold earlier in the year when it set its new record-high price, which currently represents the pinnacle of the ongoing rally.

If Bitcoin manages to stay above the $66,800 mark, which represents a +0.5σ pricing band level, it’s probable that the cryptocurrency will surge towards the next pricing band at $79,600, implying a significant gain of over 14% from its current value.

As a researcher studying market behavior, I’ve noticed an intriguing pattern: tops in financial markets tend to form above the +1σ Moving Average to Realized Value (MVRV) pricing band. The explanation for this phenomenon could be rooted in investor behavior. When MVRV reaches such elevated levels, investors have accumulated substantial profits. Consequently, they become more inclined to sell en masse due to profit-taking motivations or fear of missing out on potential future gains. This mass selling pressure can contribute to the formation of market tops.

BTC Price

Previously, Bitcoin encountered a re-examination of the $69,500 price point, which represents a +0.5σ deviation from its average. Despite this challenge, the cryptocurrency has managed to bounce back and currently trades around this level.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-06-03 20:10