2025 has seen Bitcoin making a robust start, nudging towards the $100,000 mark once more as we celebrate its 16th anniversary. Since dropping the $100,000 level on December 19, 2024, I’ve been eagerly waiting for a strong bullish push to regain that lost ground with Bitcoin, but so far, it’s been a struggle to generate any substantial positive momentum as an investor.

Currently, it appears that the cost of Bitcoin is moving towards a revival, having risen nearly 5% over the last week. A well-respected cryptocurrency expert on social media platform X contends that the present price configuration indicates that Bitcoin is now at a crucial turning point.

Bitcoin Price Retests 50-Day MA — What Next?

Crypto expert Ali Martinez shared his insights about the current state and possible future direction of Bitcoin’s price using the X platform. In his analysis, the price of this leading digital currency appears to be at a crucial juncture.

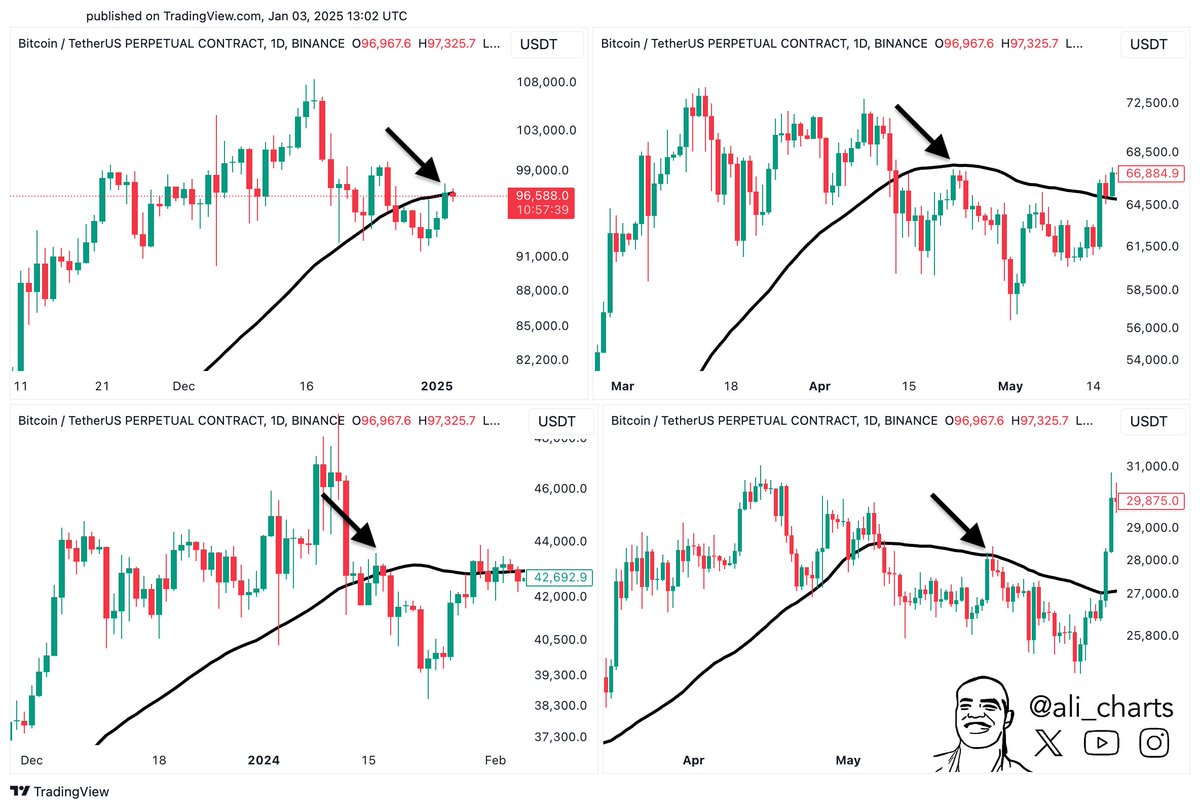

The reasoning for this assertion lies in Bitcoin’s behavior around its 50-day moving average (50MA) on the daily price graph. The 50-day moving average is a frequently used technical tool to follow the mid-term trend of an asset’s value, like Bitcoin in this case.

For Bitcoin, historically, the 50-day moving average has acted as crucial levels of both support and resistance. Recently, it seems that the Bitcoin price dipped below this 50-day average and is now attempting to revisit the previously broken support level.

As per Martinez’s analysis, there’s a possibility that the top cryptocurrency’s price might drop after the retest is over. Yet, if Bitcoin manages to maintain a close above its 50-day moving average, it could challenge the bearish prediction and potentially mark the end of the current price adjustment period.

Currently, the value of Bitcoin is approximately $98,358, showing a 1% rise over the past day. As per information from CoinGecko, Bitcoin has almost climbed 5% in the last week.

Can Growing Exchange Outflows Trigger Fresh Bullish Momentum?

In a recent post about X, Martinez disclosed that a large quantity of Bitcoin has been leaving exchanges over the last week. According to CryptoQuant, approximately 48,000 BTC, valued at over $4.5 billion, have been taken out of exchange platforms during the past seven days.

The transfer of funds from these wallets indicates a change in investor attitude, as they appear to be relocating their cryptocurrencies to personal, non-custodial wallets for potential long-term preservation. This might imply that investors are growing more assured about the long-term prospects of the market’s front runner.

An influx of coins moving away from centralized exchanges might suggest that new purchases are being made, as investors opt to keep their recently obtained cryptocurrencies off trading platforms instead. In essence, such an outflow could potentially serve as a positive indicator for the price trend of Bitcoin.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

- Gold Rate Forecast

2025-01-05 05:46