As a seasoned crypto investor, I’ve seen my fair share of market volatility and price swings. The recent decline in Bitcoin’s price below $60,000 is certainly concerning, but it’s important to keep things in perspective.

The Bitcoin price is currently dipping below $60,000 following a steep 20% drop that caused widespread turmoil in the cryptocurrency market. This downturn has brought several important support levels for Bitcoin into focus, with some of them already surpassed. In response to this situation, well-known crypto analyst Norok has disclosed the critical price threshold the BTC must not breach to preserve its bullish momentum.

Bitcoin Price Must Hold Above $51,800

In a recent examination published on TradingView, cryptocurrency analyst Norok highlighted that $51,800 currently represents a significant support line for Bitcoin. Notably, Bitcoin has revisited this pivotal support level, last seen in December 2023, emphasizing its importance.

During this period, the structural support established by bulls at the $62,000 mark was shattered by bears. Consequently, this level now acts as a resistance for Bitcoin’s price advancement. However, the cryptocurrency analyst remains optimistic and does not view the recent market downturn as a definitive sign of bearish sentiment for Bitcoin.

To shift from bullish to bearish for Norok, he indicated that the Bitcoin price must fall below the $51,800 support level. This action would undermine any existing bullish arguments for Bitcoin, thereby concluding the uptrend observed in 2023-2024.

In the immediate future, Norok asserts that $56,900 serves as a crucial support level for bulls. Maintaining this level could strengthen the ongoing bullish trend. As Norok puts it, “The price needs to cling to this support and subsequently retake the moving average to reinitiate the bullish momentum.” He emphasizes, “This is a pivotal point in the price movement today.”

BTC Suffers As A Result Of ETF Outflows

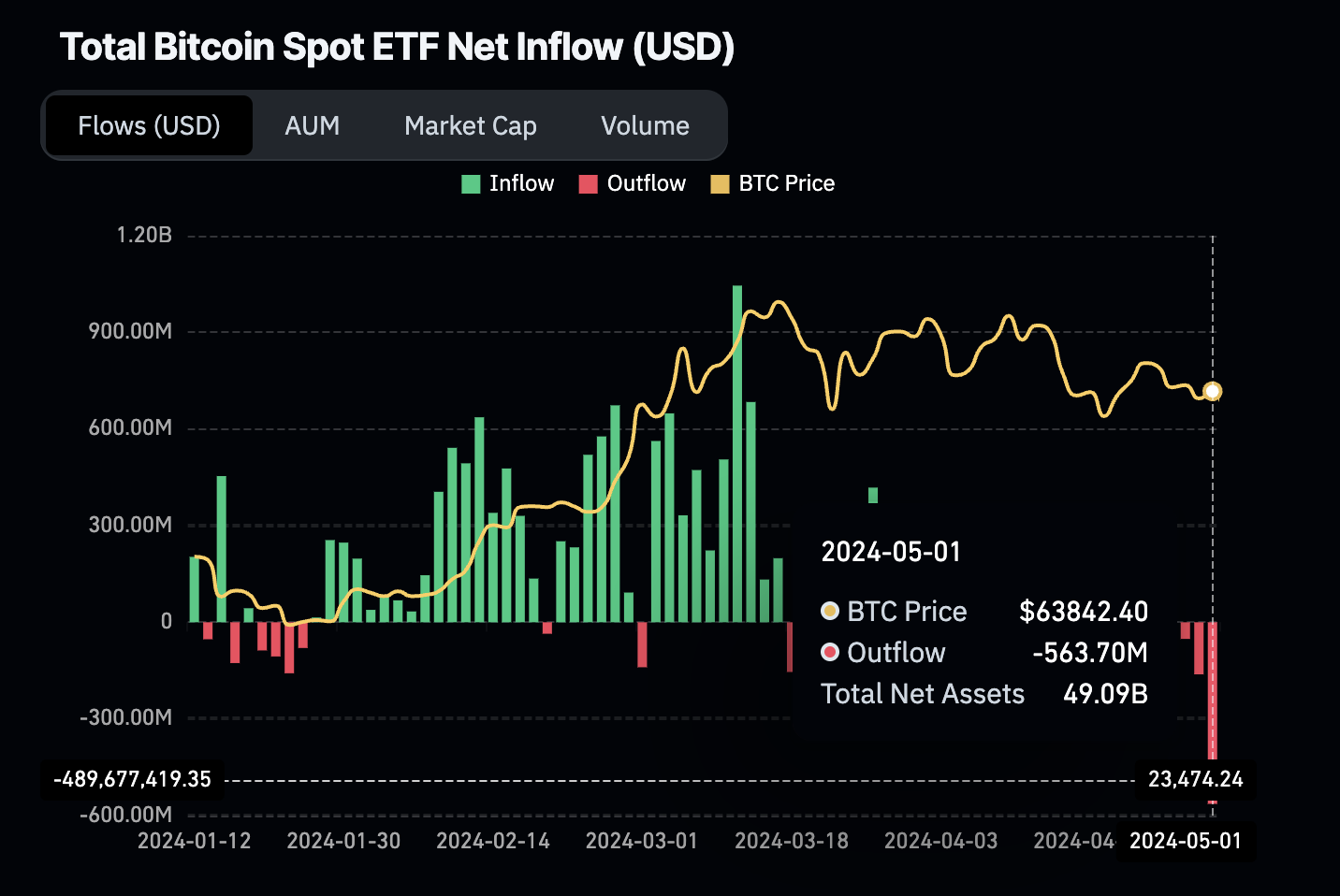

As a crypto investor, I’ve noticed one significant factor contributing to the recent drop in Bitcoin’s price: a shift from purchases (inflows) to sales (outflows) in Spot Bitcoin Exchange-Traded Funds (ETFs). When these ETFs experience inflows, it’s a bullish sign because issuers must acquire Bitcoin to back the shares they sell to investors. Conversely, outflows mean that issuers are selling off their Bitcoin holdings.

Despite investors previously pouring money into Bitcoin ETFs, there’s been a recent trend of withdrawals. Consequently, selling pressure has intensified, with six successive days of outflows reaching a peak of $563.7 million on Wednesday, as per Coinglass data.

If the current outflows persist, the price of Bitcoin (BTC) may continue to fall and could reach Norok’s $51,800 mark soon. Conversely, if inflows return, it would mean that issuers are purchasing Bitcoin again, which could potentially lead to a price recovery.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-02 21:04