As a seasoned crypto investor, I’ve witnessed the volatile nature of Bitcoin’s price movements firsthand. The insights shared by analysts Pierre, Michael van de Poppe, and Rekt Capital regarding the significance of the $69,000 price level for Bitcoin have piqued my interest.

As a crypto investor, I’ve been following the analysis of Pierre, a seasoned cryptocurrency expert. He’s shed light on why $69,000 is an important price level for Bitcoin. In his view, if Bitcoin manages to sustain its position above this range, it could potentially reach a new all-time high (ATH) and set a new record in the crypto market.

A Breakout Above $69,000 Could Lead To A Bitcoin Recovery

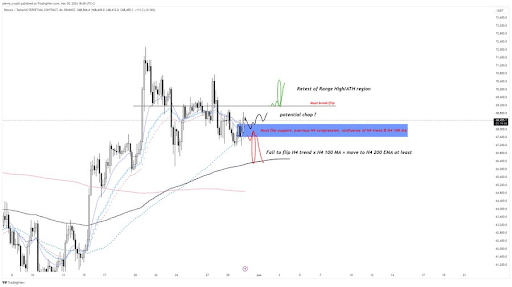

In my research, I came across Pierre’s post on X (previously known as Twitter) where he expressed his viewpoint that Bitcoin needs to surpass the $69,000 mark in order to revisit the vicinity of its all-time high (ATH) around $73,000. This potential development could potentially pave the way for Bitcoin achieving a new ATH if it experiences a significant breakout during this retest phase of the current ATH region.

During his discussion, Pierre highlighted the key steps for Bitcoin to prevent substantial decline. He emphasized the importance of Bitcoin maintaining its position above the support level of $67,500 to $68,200. Should Bitcoin fall below this range, he warned that it could result in a retest of the previous support zone at $65,000 to $66,500.

As a crypto analyst, I’ve expressed a viewpoint similar to Pierre’s, but with a focus on Bitcoin reaching the price level of $70,000. In my recent analysis posted on X, I stated that for Bitcoin to avoid any further downward pressure, it needs to maintain its position above the support levels of $66,000 and $67,000. Once Bitcoin successfully breaks through this resistance, we can expect a new all-time high (ATH) for the cryptocurrency.

As a researcher studying the cryptocurrency market, I’ve come across Rekt Capital’s perspective that Bitcoin needs to surpass the $70,000 mark for it to enter the ‘parabolic uptrend’ phase. However, this significant breakout might not occur right away and could take some time. On the other hand, Arthur Hayes, a co-founder and former CEO of BitMEX, anticipates that Bitcoin will continue trading within the range of $60,000 to $70,000 until August.

As a crypto investor, I’m keeping a close eye on the market predictions of industry experts. Van de Poppe has shared his perspective that Bitcoin might not take too long to surpass the $70,000 mark. He believes that the listing of Spot Ethereum ETFs could be the catalyst for this significant price movement and potential gains for Bitcoin and altcoins as well. Bloomberg analyst Eric Balchunas anticipates that we might see these funds become available for investment as early as June, or by July 4th at the latest. These developments are exciting news for the crypto community, and I’m eagerly waiting to see how the market reacts.

A Weekly Close Above $69,000 Could Alter History

In a recent post on X, Rekt Capital expressed that if Bitcoin managed to achieve a weekly closing price above $69,000, it could significantly change the future direction of the cryptocurrency. Nevertheless, he cast doubt on this occurrence, arguing that Bitcoin’s historical trends suggest it is unlikely for such a significant breakout to happen so soon after the halving event. According to Rekt Capital’s earlier analysis, it seems that this anticipated historic breakout remains several weeks in the future.

He noted that Bitcoin is just one weekly closing price above its resistance level before entering the explosive growth stage of its cycle, according to Rekt Capital’s recent analysis. Previously, it was believed that Bitcoin reaching a new all-time high prior to the halving could trigger a faster cycle, but Bitcoin might need more time to align with past halving trends.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-05-31 20:10