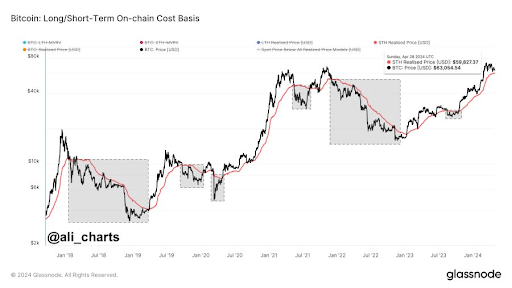

As a seasoned crypto investor with a keen interest in Bitcoin’s price movements, I find Martinez’s analysis insightful and intriguing. The $59,800 level is a crucial price point for me as well, given that it represents the short-term holder’s realized price. Historically, Bitcoin has shown a tendency to bounce off this level during an uptrend. However, if Bitcoin fails to do so and falls below this level, we could be in for some notable corrections.

Expert insight from crypto analyst Ali Martinez: The significant price point of $59,800 in Bitcoin‘s future trend is explained by him, revealing potential consequences should Bitcoin dip to this level.

Why $59,800 Is An Important Level For Bitcoin

Martinez pointed out in a recent post on X (previously Twitter), that the current realized price for short-term Bitcoin holders is around $59,800. Notably, Bitcoin typically rebounds from this price point during bull markets. Consequently, if Bitcoin were to dip to this level, it could potentially trigger a significant price surge.

Martinez issued a cautionary statement about Bitcoin’s current price level. He explained that if Bitcoin fails to rebound from this point, the consequences could result in significant corrections. Although he didn’t specify an exact figure, his use of the term “notable” implies that a potential Bitcoin price drop might be substantial.

As a crypto investor, I closely monitor the STH (Short-Term Holder) metric, which represents the average price at which Bitcoin was purchased by those holding the asset for less than a year. When this metric drops significantly, it signals that short-term investors have sold off their holdings and realized profits. This mass selling creates an opportunity for Bitcoin to rebound and potentially surge forward once more after these sell-offs have subsided.

From my perspective as an analyst, Martinez’s caution about Bitcoin holding the $60,000 mark is crucial. Should this support fail, his warning of potential further drops resonates with DonAlt’s prediction. The latter suggests a possible decline in BTC‘s price between $52,000 and $47,000.

At the same time, Martinez highlighted the importance of the $61,900 mark for Bitcoin in the crypto sphere. He pointed out that this level has historically acted as a significant support for the cryptocurrency. If Bitcoin manages to stay above this threshold, it could potentially reach new heights and surge up to $71,000.

Is The BTC Top In?

In a more current article published by X, Martinez expressed his perspective on whether Bitcoin has attained its market peak. He explored the issue from different angles. Initially, he pointed out that a significant surge in Bitcoin’s realized profits has traditionally corresponded with market peaks. Later, he disclosed that the realized profits for Bitcoin surged to an astonishing $3.52 billion when it reached $73,880 last month.

Based on current market conditions, it’s plausible that the market peak has already occurred. Nevertheless, Martinez cautions that he needs an additional sign before asserting that the market peak definitively holds. He believes this confirmation will materialize if Bitcoin records a prolonged closing price beneath its short-term realized value, which is approximately $59,800 at present.

As an analyst, I’ve put forth the hypothesis that Bitcoin reaching a price of $66,250 could potentially invalidate the market top theory. However, if Bitcoin manages to surge above this price point and establishes support there, it will regain its momentum and push towards the resistance level of $69,150. Once BTC breaks through that resistance, I believe it has the potential to reach new heights, potentially setting a new all-time high (ATH) at $92,190.

As a crypto investor, I’m observing that Bitcoin’s current price is approximately $62,300 based on the latest data I’ve checked from CoinMarketCap. However, in the past 24 hours, its value has decreased.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-04-30 21:04