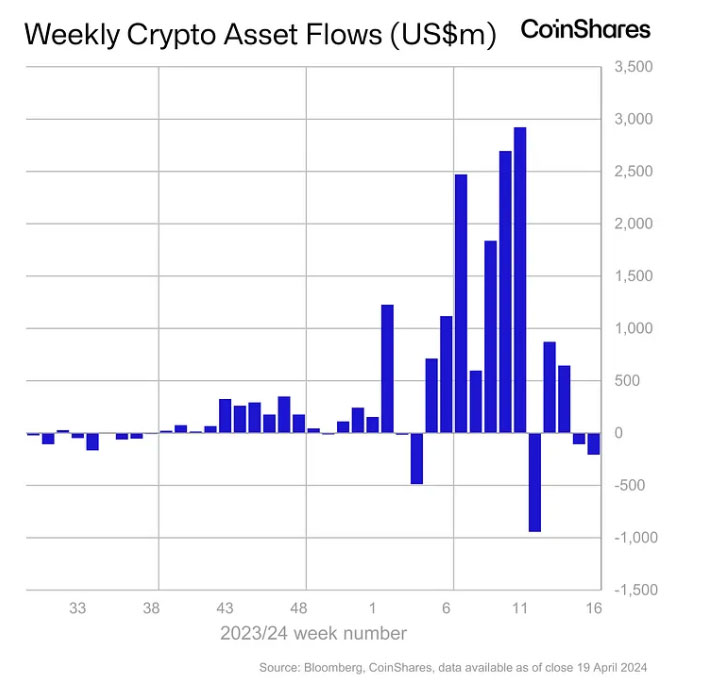

Last week, digital asset investment funds experienced withdrawals totaling $206 million as reported by CoinShares on April 22, 2024. This weekly outflow is a continuation of the previous week’s $126 million reduction, suggesting a possible change in institutional investor attitude.

Photo: CoinShares

Investment products experienced withdrawals, leading to a slight decrease in trading volume for Exchange-Traded Products (ETPs) to approximately $18 billion. It’s important to note, though, that this amount represents a smaller percentage of overall Bitcoin trading volumes compared to previous patterns.

The number of Bitcoin trading transactions is on the rise, and presently, only 28% of the total trades involve exchange-traded products (ETPs). This is a decrease from the 55% recorded just last month. This trend could suggest that investors are now opting to purchase Bitcoin directly instead of using ETPs.

FED Policy Drive ETP Outflows

The report indicates that investor apprehensions about the Federal Reserve’s policies (FED) could be causing the outflows. With the anticipation that the FED will keep interest rates high for an extended period, investors may lose interest in Exchange-Traded Products (ETPs), which are often seen as lower-risk compared to holding digital assets directly.

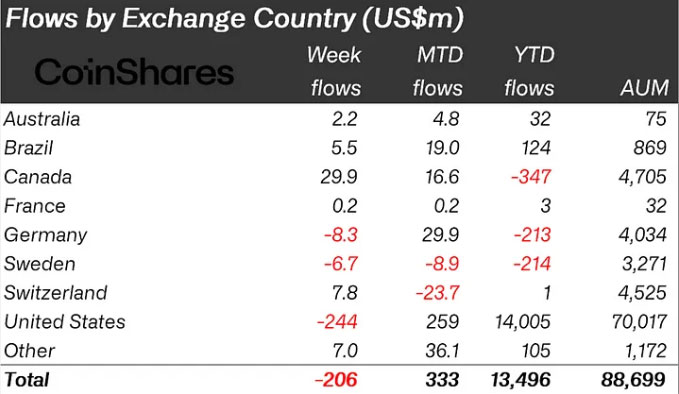

In recent times, there has been a noticeable shift in sentiment towards the US market, resulting in approximately $244 million being withdrawn from US-based ETFs. It’s worth noting that established ETFs experienced the brunt of these outflows, while new ETFs continued to attract investments, albeit at a more modest pace compared to previous weeks. This trend suggests that investors may be increasingly drawn towards newer exchange-traded products.

In contrast to many other countries that saw decreases, Canada and Switzerland made notable investments of $30 million and $8 million, respectively, in digital assets. On the other hand, Germany observed a more subtle reduction of $8 million in this domain.

Ethereum’s 6th Consecutive Outflow Week

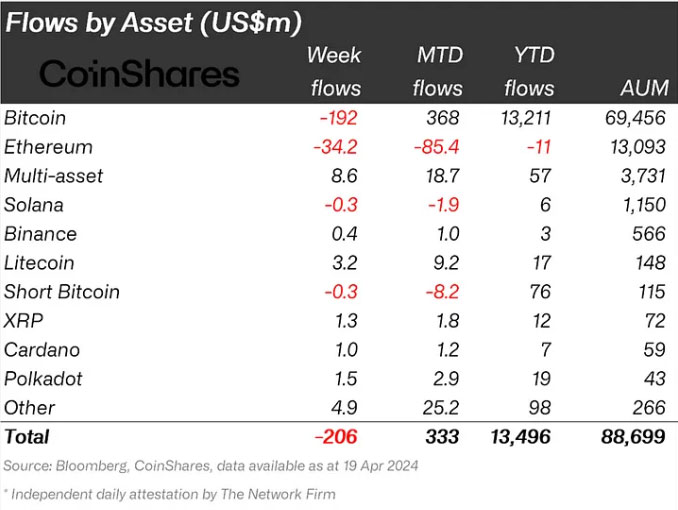

Last week, Ethereum once again saw a net withdrawal of funds to the tune of $34 million, marking its sixth consecutive weekly outflow. However, there were some positive signs as multi-asset investment products experienced increased demand, bringing in approximately $9 million. Additionally, Litecoin and Chainlink each recorded inflows of around $3.2 million and $1.7 million, respectively.

While Bitcoin experienced withdrawals totaling $192 million, the value bet against its price increase saw only minimal activity with $0.3 million in outflows. This suggests that investors holding short positions on Bitcoin were not very confident about a price drop.

Investor wariness towards risk is also affecting the market for blockchain stocks. For eleven weeks in a row, these stocks have experienced net withdrawals amounting to $9 million. This persistent pattern indicates growing doubts about how the upcoming fourth Bitcoin halving might impact the profits of mining companies.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-04-22 15:51