As a seasoned crypto investor with over a decade of experience in this dynamic and ever-evolving market, I find myself intrigued by the recent surge in Bitcoin‘s price towards the $100,000 mark. Over the years, I’ve witnessed numerous ups and downs, but the current bullish momentum is unlike any other I have seen.

The Coinbase Premium Index hitting a two-year low suggests that US-based investors may be less willing to pay a premium for Bitcoin, but the growing institutional interest in the asset is undeniable. The recent withdrawal trend of over 48,000 BTC from exchanges, amounting to billions of dollars, further validates this sentiment.

I’ve learned to be cautious when investing in cryptocurrencies and understand that Bitcoin is currently at a critical juncture. Maintaining the close above the 50-day moving average could signal the end of the recent correction and confirm a more robust bullish trend. However, a failure to do so might lead to a potential downward correction.

The Elliot Wave analysis provides further evidence of Bitcoin’s bullish outlook, suggesting that we may be in the fourth wave of a larger bullish cycle. If the ideal level of wave three has been surpassed, as per their analysis, we could see a strong upward move towards major bullish targets between $117,475.70 and $138,058.37.

Investors should remain vigilant and closely monitor critical price levels that could determine the market’s next move. I believe that the combination of significant withdrawals from exchanges, a low Coinbase Premium Index, and positive Elliott Wave analysis paints a compelling picture for Bitcoin’s future.

At the time of writing, Bitcoin is trading at $98,320, and I’m keeping my fingers crossed that it will break through the coveted $100,000 mark soon. After all, as they say, the best time to invest in Bitcoin is when your friends laugh at you for buying it!

Notably progressing, the value of Bitcoin is approaching the significant level of $100,000, having surpassed $98,000 for the initial time since late December.

According to crypto expert Ali Martinez, there are several key indicators that suggest a potential continuation of bullish trends in the top digital currency, as the market starts showing signs of recovery.

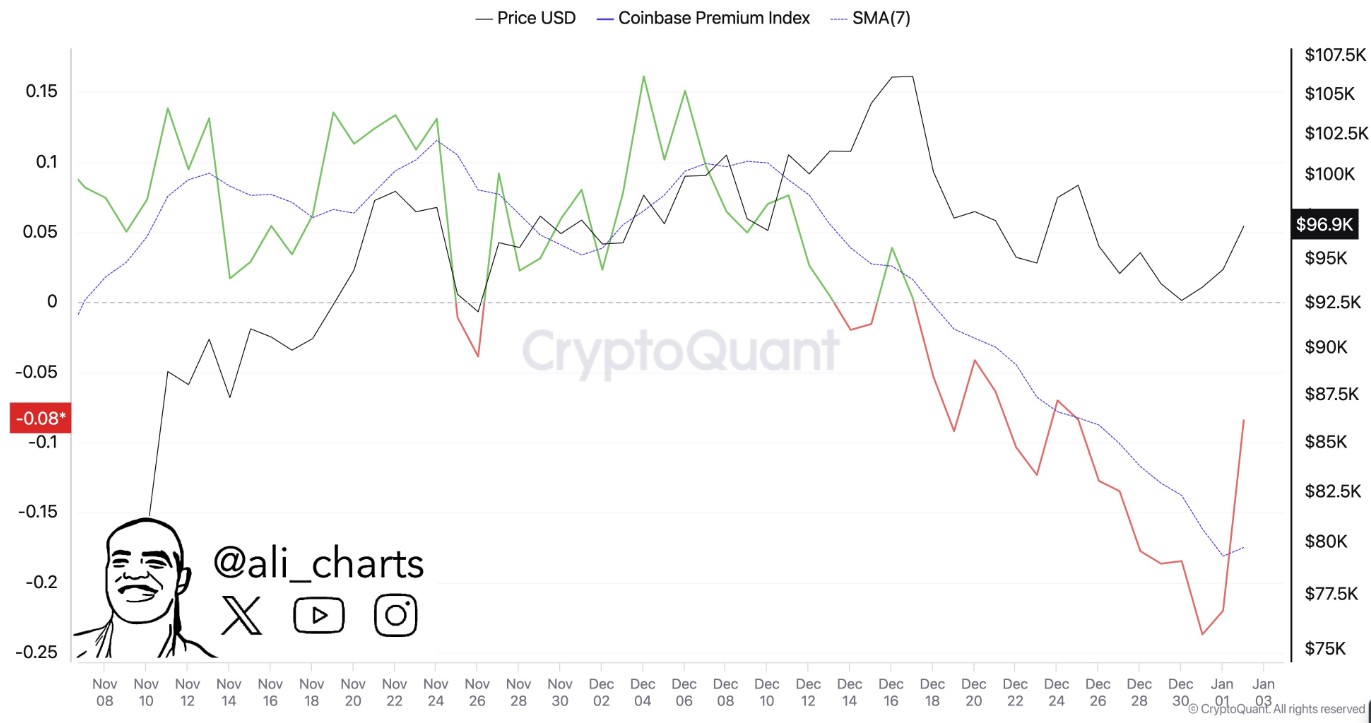

Bitcoin Price Surges Amid Coinbase Premium Index Low

One key factor highlighted by Martinez is the Coinbase Premium Index, which has just dropped to -0.23% – a two-year low. This index compares the price of Bitcoin on Coinbase with its value on other trading platforms.

(In simpler terms, when the index is negative like it is now (-0.23%), the price of Bitcoin on Coinbase is lower than on other exchanges.)

A low or negative premium on Bitcoin might imply that U.S. investors are less keen on paying more for Bitcoin than its perceived value. However, the recent upward trend could suggest an increase in institutional investment in this digital asset, indicating a potential change in sentiment among these investors.

Additionally, Martinez pointed out that the surge in Bitcoin’s value is taking place alongside a significant withdrawal pattern. In the last seven days, approximately 48,000 Bitcoins worth over $4.5 billion have been taken off exchanges. This action suggests a positive outlook among investors, even after a temporary price adjustment that happened towards the end of last year.

Though there are optimistic signs, Martinez warns that Bitcoin is at a critical point. He strongly advises maintaining a position above its 50-day moving average, which currently stands slightly above $96,000.

If we don’t keep up with this current standard, there might be an impending adjustment in the opposite direction. On the other hand, consistently closing above the 50-day Moving Average may indicate the conclusion of the recent downtrend and suggest a stronger bullish momentum instead.

Strong Upward Move Expected After Wave Three Breakout

Beyond Martinez’s perspectives, the Elliot Wave Academy offers an analytical breakdown of the latest fluctuations in Bitcoin’s value. They propose that at present, Bitcoin is presumably experiencing the fourth phase within a larger uptrend or bullish trend.

As a researcher, I’ve observed an impressive breakout from Bitcoin’s price channel, suggesting it has moved beyond the optimal peak of wave three. This could be a strong indicator of a significant upward trend ahead. Following this steep rise, the upcoming wave four is predicted to exhibit a sideways pattern, implying a temporary pause before further progression.

The possible areas where this wave might correct have been pinpointed. If these points are surpassed, the subsequent bullish wave may aim for a Bitcoin price range of $117,475.70 to $138,058.37. These numbers indicate significant optimistic objectives that could entice additional investment and propel Bitcoin’s price upward.

In summary, with Bitcoin’s price soaring in all directions, various indicators suggest a promising future for this digital currency. These include substantial withdrawals from exchanges, a low Coinbase Premium Index, and favorable Elliott Wave analysis.

Nevertheless, it’s important for investors to stay alert, monitoring crucial price points that might influence the direction of the market’s future movements.

At the time of writing, the market’s leading crypto is trading at $98,320.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2025-01-04 06:41