A well-known cryptocurrency trading platform anticipates a significant surge in the market for alternative coins within the next few weeks, following Donald Trump’s inauguration as U.S. President on January 20th. Coinbase analysis advises crypto investors to prepare their positions in the altcoin sector, as a massive rally for these alternatives may be imminent.

Coinbase Reports Rise Of Altcoins

According to Coinbase, a significant surge in the altcoin market may occur in the coming weeks following Donald Trump’s return to the White House, indicating a potential market rally.

The digital currency trading platform recently shared its weekly analysis, offering opinions on how Trump’s upcoming inauguration could influence the cryptocurrency sector. They noted that despite Trump being supportive of cryptocurrencies, it may take some time before all proposed crypto-related policies are fully enacted.

Following Trump’s inauguration on January 20th, Coinbase analysts anticipate an increase in altcoins due to their conviction that the digital asset sector is gearing up for a significant altcoin boom.

As an analyst, I’ve observed a potential strategy among crypto traders: they appear to be strategically arranging their trades in anticipation of another bull run for altcoins, potentially under the Trump administration.

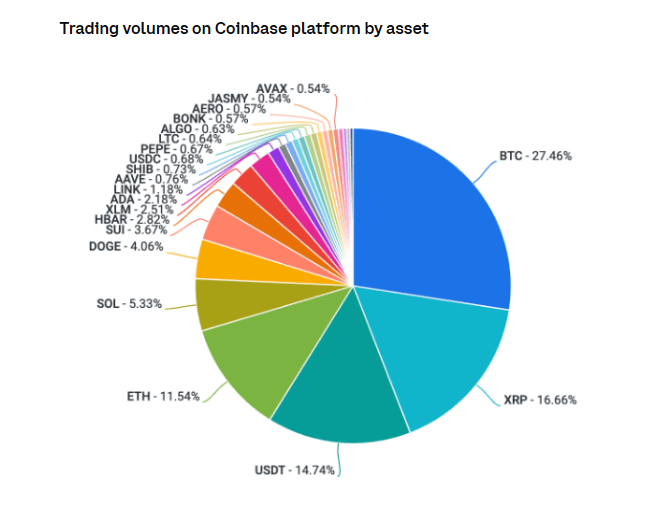

Based on Coinbase’s report, the recent increase in altcoins can be attributed to a minor decrease in Bitcoin‘s dominance in the crypto market.

In simpler terms, when the dominance of Bitcoin dropped from 58.5% to 57.3% during the inflation relief rally on January 15, as reported by Coinbase, it indicates that traders might be preparing for a significant surge in altcoins. This could be due to favorable conditions for risk assets and cryptocurrencies.

BTC’s Fading Dominance

It was noticed by a cryptocurrency expert that the influence of the globally recognized digital currency, Bitcoin, might be experiencing a slight decline, which in turn created an opportunity for the recent surge in altcoins.

Significantly for the ‘long tail’ of cryptocurrencies, the dominance of Bitcoin (BTC) has been gradually decreasing since late November ’24, according to Chris Burniske, a partner at VC firm Placeholder and former head of crypto at ARK Invest. If this trend persists, it could lead to exciting developments in the future.

As an analyst, I’ve noticed a significant trend in the cryptocurrency market: The dominance of Bitcoin ($BTC) has been gradually decreasing since late November ’24. If this trend persists, it could potentially lead to some exciting developments in the long tail of the market.

— Chris Burniske (@cburniske) January 17, 2025

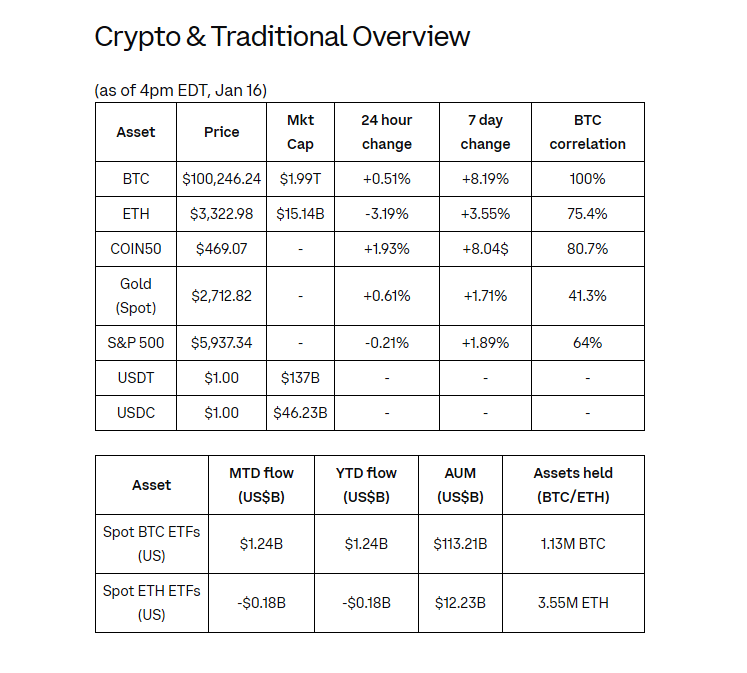

According to the insights they shared in their report, Coinbase outlined a potential Bitcoin price prediction using the Deribit options agreements.

As a researcher examining Deribit BTC options, I’ve discovered some intriguing data points. The maximum strike prices for options expiring on January 31 and February 28, 2025 are set at $94K and $98K respectively. However, the maximum strike price for the March 28 expiry decreases to $80K. While this doesn’t necessarily predict future Bitcoin price movements, it does hint at potential market positioning biases among market makers and options sellers who might be managing their liabilities by setting these prices. This is according to the insights shared in the crypto exchange analysts’ weekly commentary.

Stablecoin Inflows A Cue

crypto analysts noticed a significant increase in investments towards stablecoins, implying according to Coinbase analysts David Duong and David Han, that a potential rise in the altcoin market might be on the horizon.

As an analyst, I’d rephrase it like this: A significant portion of the robust investment into stablecoins has been channeled towards altcoins, whereas Bitcoin and Ethereum have seen a decrease in investments.

According to the Coinbase report, the amount of stablecoins in circulation grew by approximately $1.3 billion last week. This increase mirrors patterns we’ve seen over the past two months, suggesting a rise in investment into these less popular assets, as far as our perspective is concerned.

Additionally, Coinbase mentioned that Bitcoin saw a total withdrawal of approximately $457 million, whereas Ethereum’s net outflow amounted to around $206 million.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2025-01-20 01:35