As a seasoned researcher with over two decades of experience in financial markets and technology, I must admit that the recent surge in demand for cryptocurrencies and the associated apps like Coinbase is nothing short of fascinating. Having closely observed the dot-com boom and bust, I find striking similarities between the fervor around Bitcoin and altcoins today and the hype surrounding internet stocks back then.

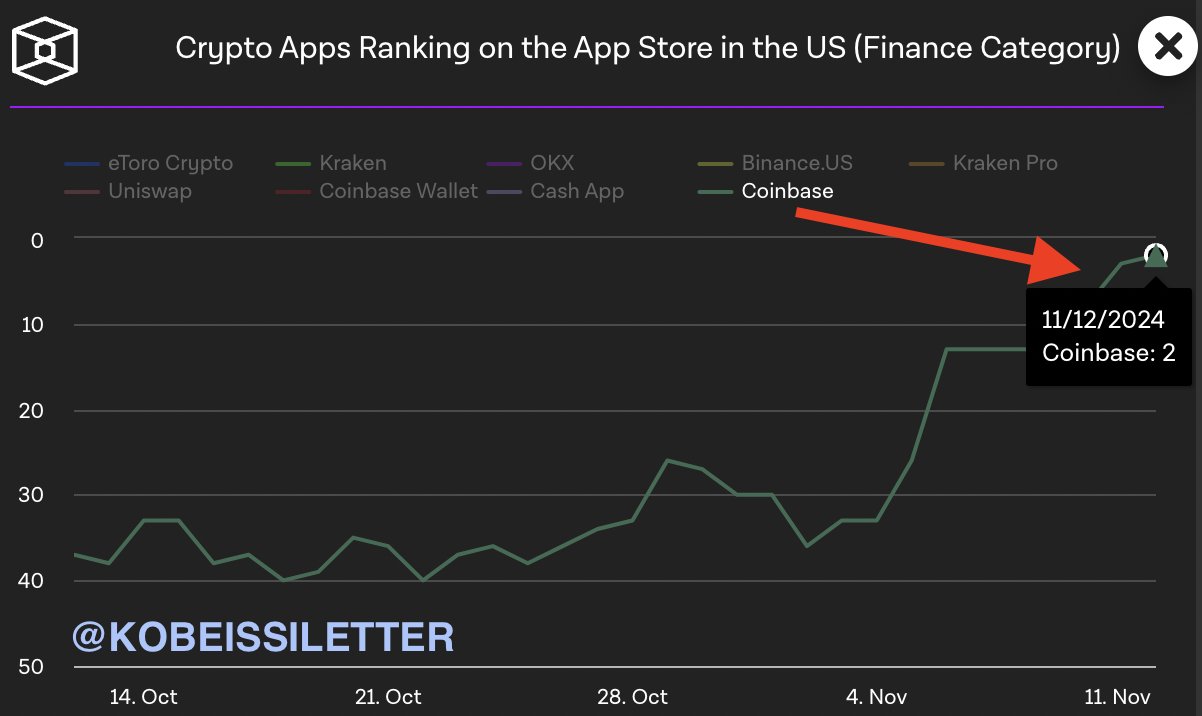

The strong Bitcoin and altcoin rally followed by Donald Trump’s victory last week has led to a major surge in demand for crypto among users. The latest data shows that Coinbase became the second most downloaded app in the Apple App Store for the US region and within the finance category.

There’s a significant jump from being ranked 33rd just a week ago, which underscores the excitement among cryptocurrency enthusiasts. This rise coincides with Bitcoin hitting an unprecedented high of $90,000 for the first time ever. (Paraphrased)

According to Kobeissi’s forecast, it’s possible that Coinbase may top the download charts shortly, indicating a surge of interest and fear-of-missing-out (FOMO) behavior among investors as they react to Bitcoin’s exceptional market performance.

Courtesy: The Kobeisse Letter

Since Trump’s election win a week ago, Coinbase has been causing quite a stir on Wall Street as the COIN stock surged by 45%, nearing its peak value of $324 once again. This surge has boosted the COIN stock’s year-to-date gains to well over 103%.

In the September 2024 quarter, the company witnessed a significant 81% increase in its revenue, mirroring the broader recovery of the cryptocurrency market. Meanwhile, the exchange has been preparing for potential favorable regulatory decisions under the Trump administration. Recently, Coinbase CEO Brian Armstrong mentioned during an interview on CNBC that they are anticipating positive regulatory developments.

“We need to have a clear path for people to register crypto securities. For the last four years, the door has just been shut in our face. It’s really the dawn of a new crypto era with this election, because it’s the most pro-crypto Congress ever.”

Coinbase Unveils the COIN50 Index

On the 12th of November (Tuesday), the cryptocurrency exchange declared the initiation of their very own crypto index fund, known as Coinbase 50 or COIN50.

This investment fund groups together approximately 50 distinct cryptocurrencies. Notably, Bitcoin, Ethereum, and Solana account for more than 80% of its holdings. Additionally, the COIN50 encompasses XRP, Dogecoin, and an additional 45 digital currencies within its diversified portfolio.

Absolutely, by facilitating transactions involving the COIN50 index, Coinbase stands to generate income. However, according to Greg Tusar, the head of institutional product at Coinbase, this index fund is primarily a publicity move. He explained that there’s a chance for them to showcase the crypto market developments, which in turn offers a marketing advantage.

Coinbase isn’t the first to establish a metric for tracking crypto market performance. Both CoinDesk and Bloomberg have their own index-style benchmarks for cryptocurrency. However, Tusar believes there’s still room for competition. He added: “Given our brand position and the strength of the company, this is a gap in the space today”.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-13 13:42