As a seasoned crypto investor with over a decade of experience navigating the volatile world of digital assets, I have learned to remain cautious yet optimistic when it comes to market predictions. The recent analysis suggesting that Bitcoin could slide to $77,000 due to the CME gap and average drops observed during this cycle has caught my attention.

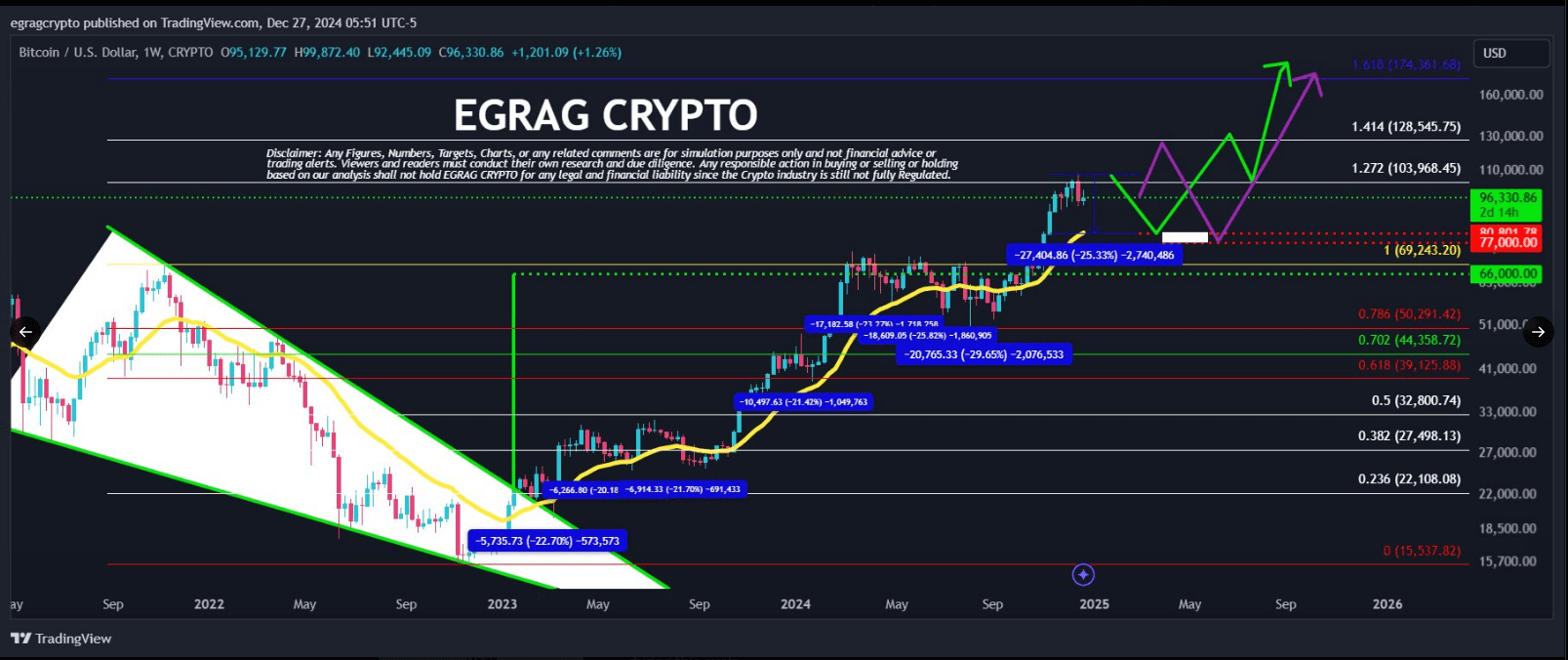

Having witnessed numerous bull and bear markets in the past, I am well aware that the crypto market is notoriously unpredictable, but patterns can sometimes offer valuable insights. The repeated significant drops mentioned by Egrag Crypto are concerning, and if history repeats itself, we might indeed see Bitcoin dip to the $77,000 mark.

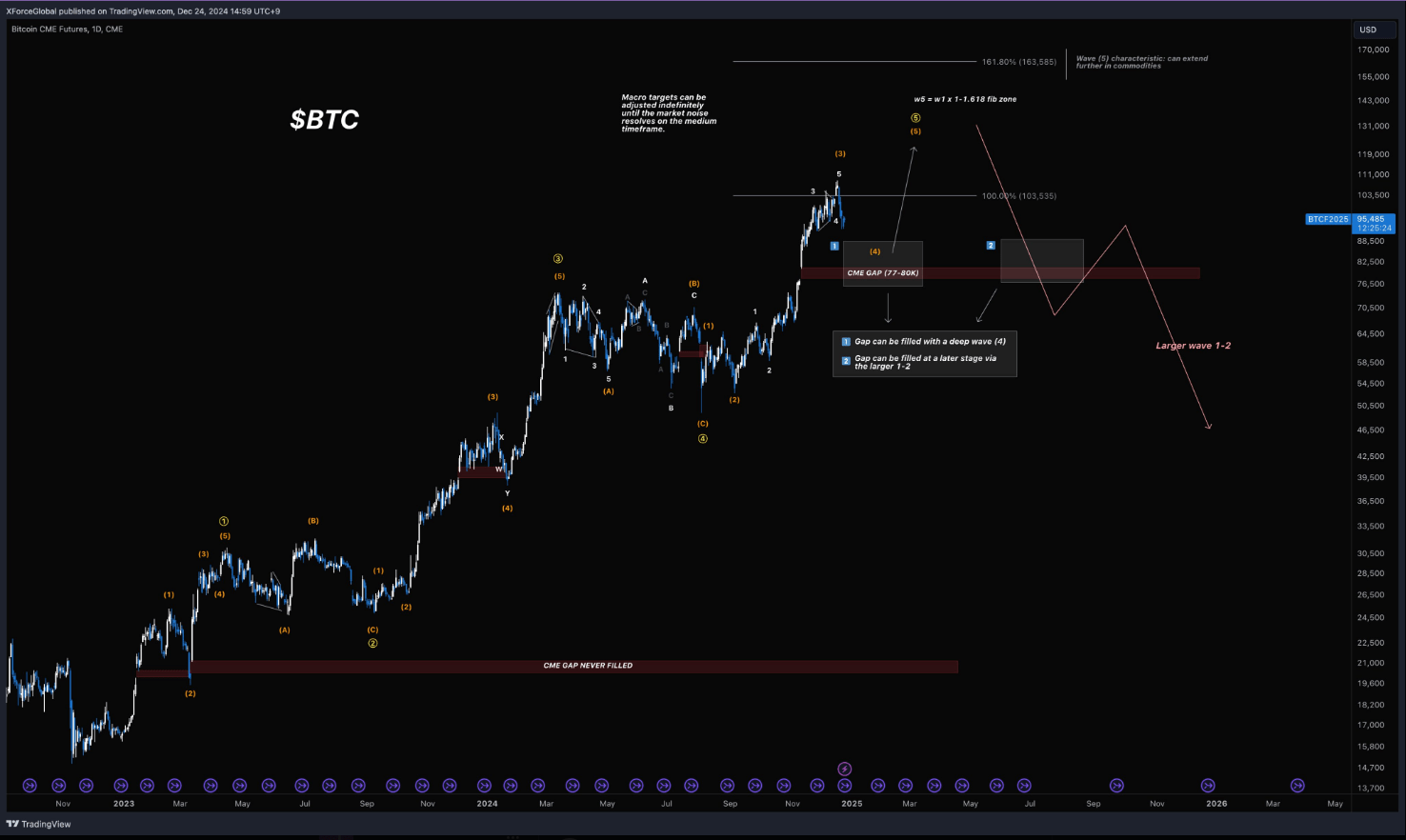

However, I am also mindful of the fact that the crypto market is influenced by numerous factors, some of which can be difficult to forecast accurately. As XForceGlobal pointed out, filling CME gaps can be unpredictable and may not occur immediately or in a straightforward manner.

In light of these considerations, I would advise fellow investors to exercise caution and diversify their portfolios accordingly. It’s essential to have a solid risk management strategy in place and avoid making hasty decisions based on short-term market fluctuations.

Lastly, I can’t help but chuckle at the timing of potential market dumps being linked to political events. As we all know, politics and finance often make strange bedfellows! So, while I take these predictions seriously, I also remind myself (and others) that sometimes even the most unexpected events can lead to unforeseen opportunities. After all, as a crypto investor, you’ve got to have a sense of humor to keep up with this wild ride!

Certain financial experts have voiced apprehensions about the potential for Bitcoin’s value to plummet, a situation they attribute to the unfilled gaps in pricing on the Chicago Mercantile Exchange (CME), which could result in a significant fall in its price.

As Bitcoin is expected to bridge this gap, crypto analysts anticipate it may approach the significant CME gap, implying a potential decrease in its value, possibly reaching around $77,000 per coin.

Bitcoin Could Slide To $77,000

According to crypto expert Egrag Crypto’s analysis, the significant drops Bitcoin has been undergoing might lead it to dip down to approximately $77,000 in value.

Egrag noted that from October 2022 onwards, the primary cryptocurrency has experienced around seven significant decreases. He further mentioned, “On average, these declines amounted to roughly 23.53%.

#BTC Drop – Average Dump & CME (70K-74K): How & Why?

As someone who has been closely following the cryptocurrency market for several years now, I have witnessed a rollercoaster ride of ups and downs. The latest trend with Bitcoin (BTC) is particularly concerning to me. Since October 2022, BTC has seen nearly seven significant drops. These percentage declines are not just numbers on a screen; they represent potential losses for many investors like myself. It’s important to remember that investing in cryptocurrency can be risky and volatile, so it’s crucial to do thorough research before making any investment decisions. While I remain optimistic about the long-term potential of BTC, I believe we should all exercise caution and prudence when navigating this market.

1) 22.70%

2) 20.18%

3) 21.70%

4) 21.42%

5) 23.27%

6) 25.82%

7) 29.65%The average drop across…

— EGRAG CRYPTO (@egragcrypto) December 27, 2024

As a researcher, I’m projecting a possible decrease in the current level of approximately 108,975, which could bring us close to the lower boundary of the CME GAP (ranging from 77K-80K). This predicted drop corresponds to roughly 25%, a figure that aligns quite well with the average decline we’ve seen during this cycle, as I mentioned in my recent post.

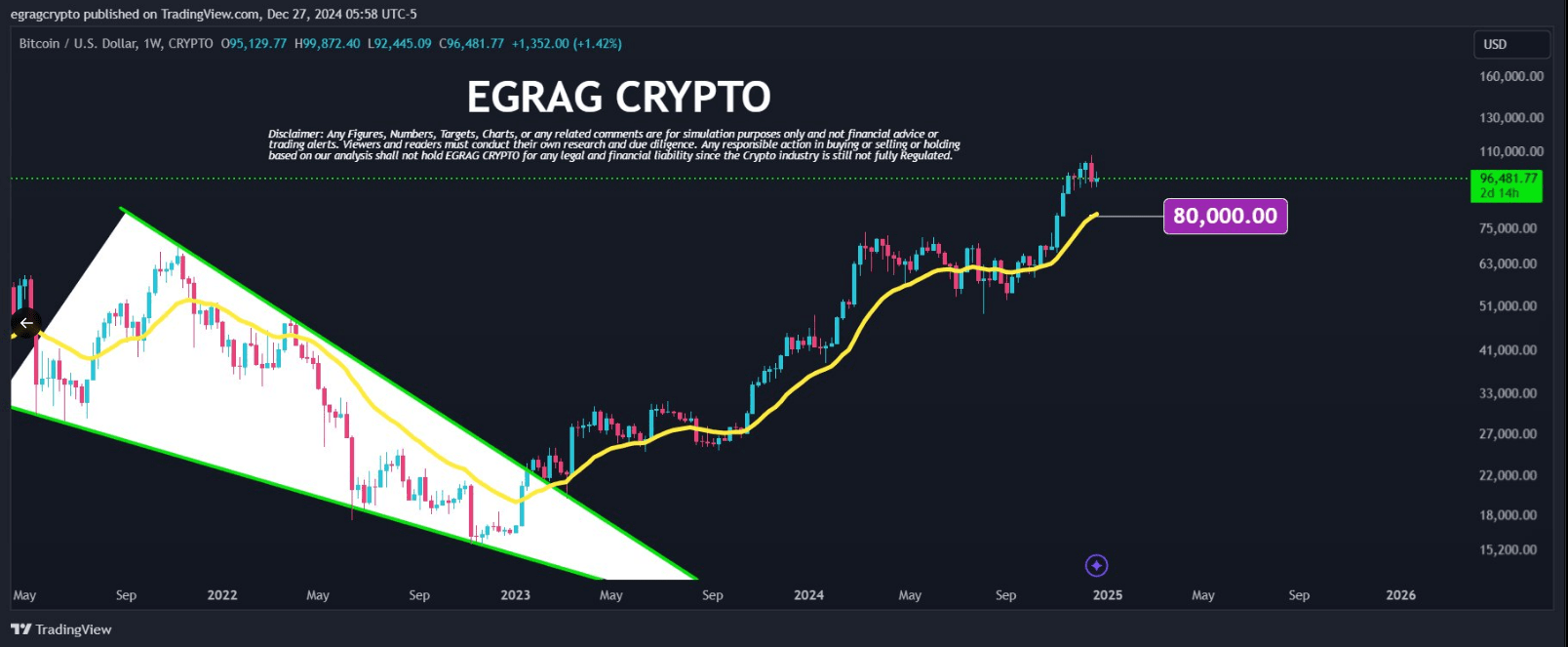

Additionally, Egrag pointed out that the present 21-week Exponential Moving Average (EMA) hovers near $80,000. This observation implies a potential warning for another significant price drop, or what might be referred to as “another sudden market plunge,” on the horizon.

CME Gap At $80,000

Another crypto analyst, XForceGlobal, reminded traders that “there’s a 1D CME gap at $80,000.”

According to XForceGlobal, about 9 out of every 10 instances of daily Charged Market Events (CME) with a size greater than what’s been observed since 2018 have subsequently been closed or “filled.

$BTC

Just a friendly reminder: there’s a 1D CME gap at $80,000.

As a seasoned analyst with years of market experience under my belt, I’ve observed a striking pattern in the stock market since 2018. This trend revolves around gaps in the 1-Day timeframe, particularly those exceeding $1,000. Based on my observations, it appears that an overwhelming 90% of these large gaps have eventually been filled. I’ve found it to be a consistent pattern, one that I’d advise traders to take note of when analyzing the market. It’s essential to remember, however, that this observation should not be applied blindly across all situations; the markets are dynamic and subject to various influences. But for those intraday gaps larger than $1,000, a watchful eye on potential fillings might prove beneficial.

The tricky part with CME gaps is…

— XForceGlobal (@XForceGlobal) December 24, 2024

On the other hand, the crypto expert pointed out that pinpointing when and how CME gaps will be filled can prove challenging.

When it comes to Coronal Mass Ejections (CME) gaps, XForceGlobal noted in a statement, the challenge lies in the fact that when and how they will be filled is often difficult to foresee.

According to the crypto analyst’s perspective, several potential outcomes are foreseen that might correspond with the CME gaps. One such scenario proposed by XForceGlobal indicates that these gaps could be bridged through a substantial dip or a wave-4 correction in Bitcoin’s price, which would cause it to drop around the $77,000 to $80,000 range.

In a different situation, XForceGlobal mentioned that it could potentially be filled “at a later point following a predicted 1-2 correction after we’ve concluded this bull market’s surge.” This hypothetical situation could lead Bitcoin’s price to drop down to approximately $46,000.

A Market Dump In January?

Egrag thinks it’s possible that market makers could take advantage of the upcoming inauguration of President-elect Donald Trump as a chance to instigate selling pressure for Bitcoin, potentially leading to a swift decline in its value.

Market makers are recognized for capitalizing on chances during turbulent times. It’s predicted that there will be a significant drop in the cryptocurrency market on Inauguration Day (January 20, 2025). This could potentially mark the peak of the sell-off, causing distress among new investors who may find themselves in a state of panic,” the crypto expert stated.

Egrag presented two possible outcomes stemming from the present market situation. In one instance, he suggested that the price of Bitcoin could surge as high as $120,000, only to later drop to a level below the CME Gap before resuming its upward trend in 2025 and continuing the bullish momentum.

In a different potential situation, the cryptocurrency expert predicted that Bitcoin might fall to between $70,000 and $75,000, according to the CME gap, before the continuation of the upward trend.

Read More

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Brody Jenner Denies Getting Money From Kardashian Family

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Death Stranding 2: On the Beach controls

- Capcom Spotlight livestream announced for next week

- All Elemental Progenitors in Warframe

2024-12-29 10:38