It has come to light, through the esteemed channels of Reuters, that the illustrious nation of China may be contemplating the liquidation of vast quantities of confiscated Bitcoin. This endeavor, one might say, could very well exert a most unfortunate downward pressure upon the price of BTC, which is already in a rather precarious state. Local governments, in their infinite wisdom, have engaged private enterprises to convert these seized digital treasures into cash, all in a bid to alleviate the burdens of a beleaguered economy. How quaint! 💸

Chinese Authorities Could Offload 15,000 Bitcoin

Ah, the delightful irony! While the Chinese government has imposed a ban on Bitcoin and crypto trading, it appears they are simultaneously orchestrating a grand liquidation. Legal experts, judges of high standing, and law enforcement officials are now clamoring for clearer regulations. Professor Chen Shi, a learned man from the Zhongnan University of Economics and Law, has aptly described these disposals as “a makeshift solution that, strictly speaking, is not fully in line with China’s current ban on crypto trading.” One can only chuckle at the absurdity of it all! 🤔

Moreover, the lack of transparency in the handling of these digital coins has given rise to concerns of corruption and further nefarious activities. The report from Reuters reveals a staggering increase in Bitcoin-related crimes, with the sum involved soaring to 430.7 billion yuan (approximately $59 billion) in 2023. It seems that the country’s top procurator has recorded a rather alarming 3,032 individuals sued for money laundering related to Bitcoin last year. What a scandal! 😱

Despite the prohibition of crypto trading, local governments have found themselves in a rather curious position, relying on the proceeds from these forced liquidations. A Shenzhen-based technology company, Jiafenxiang, has reportedly sold cryptocurrencies worth over 3 billion yuan in offshore markets for various municipal authorities. The US dollar proceeds were then exchanged for yuan and sent to local finance bureaus. Truly, a tale of two economies! 💵

As the debate on potential reforms unfolds, it occurs amidst heightened tensions between China and the US, particularly during the second presidency of Donald Trump, who has been keen on deregulating cryptocurrencies. Guo Zhihao, a lawyer of some repute, suggests that China’s central bank should adopt a similar strategy for seized Bitcoin, positing that it is better equipped to handle such assets. How very forward-thinking! 🧐

Other legal analysts, such as Sun Jun from Shanghai Landing Law Offices, see a veritable goldmine for private firms assisting local governments in disposing of large crypto holdings. However, he emphasizes the necessity for robust guidelines and vetting procedures. According to Winston Ma, an adjunct professor at NYU Law School, a more centralized approach could help maximize the value of these seized cryptocurrencies. A crypto sovereign fund in Hong Kong, perhaps? How delightfully modern! 🌐

It is worth noting that the potential for Beijing to retain some of these seized assets has sparked considerable speculation, especially since local governments are estimated to hold around 15,000 Bitcoins, making them one of the largest institutional holders worldwide. What a curious position to be in! 🤷♂️

Observers have noted that a portion of these crypto holdings likely stems from the crackdown on illicit activities, including the infamous PlusToken Ponzi scheme, which resulted in the seizure of 194,775 Bitcoin. According to the crypto intelligence firm Arkham, these tokens were transferred to the national treasury in November 2020, though it remains a mystery whether they have been sold or still reside in China’s possession. How thrilling! 🎭

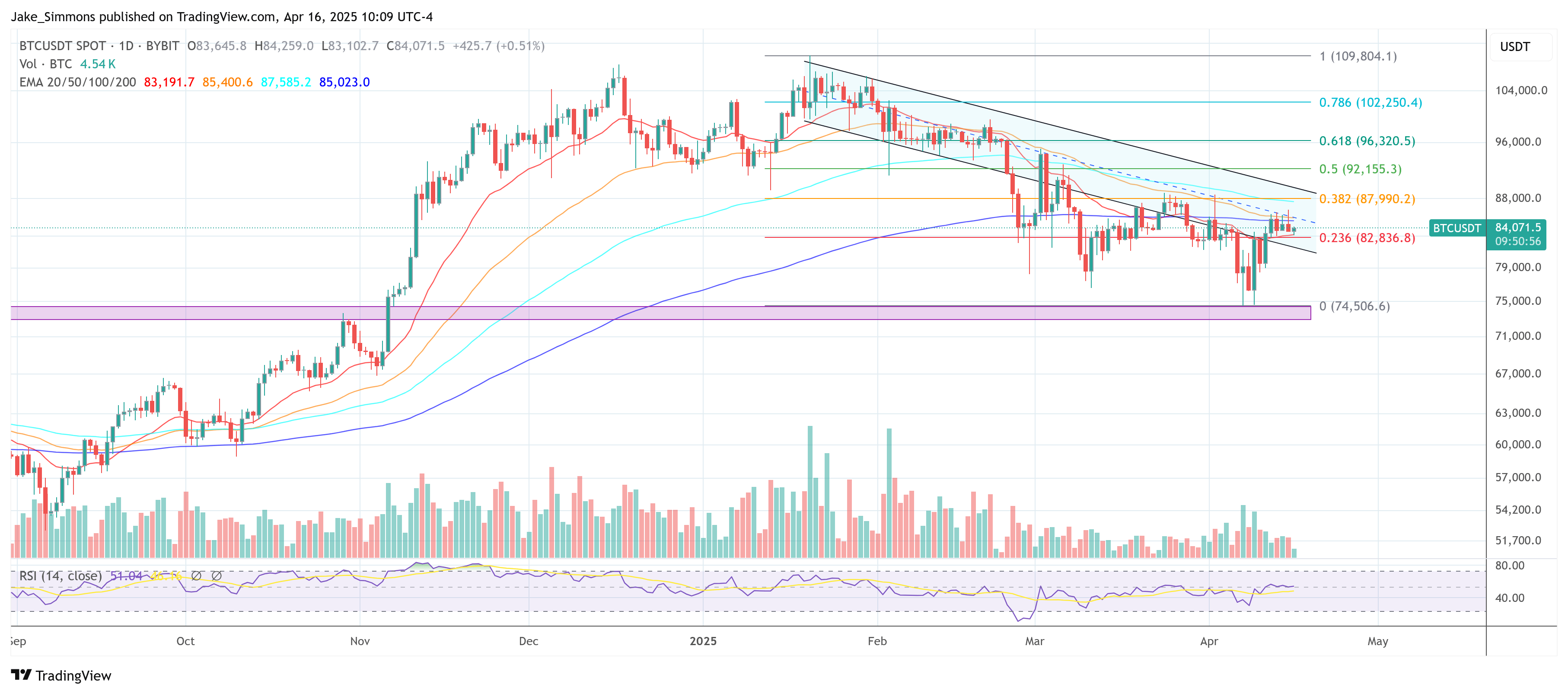

As of the latest reports, BTC is trading at a rather impressive $84,071. One can only wonder what the future holds for this digital currency! 💰

Read More

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2025-04-17 07:35