As a seasoned crypto investor with several years of experience under my belt, I’ve learned to pay close attention to on-chain data and trends when making investment decisions. The recent decline in Chainlink (LINK) supply on exchanges has piqued my interest due to its historical correlation with price rallies.

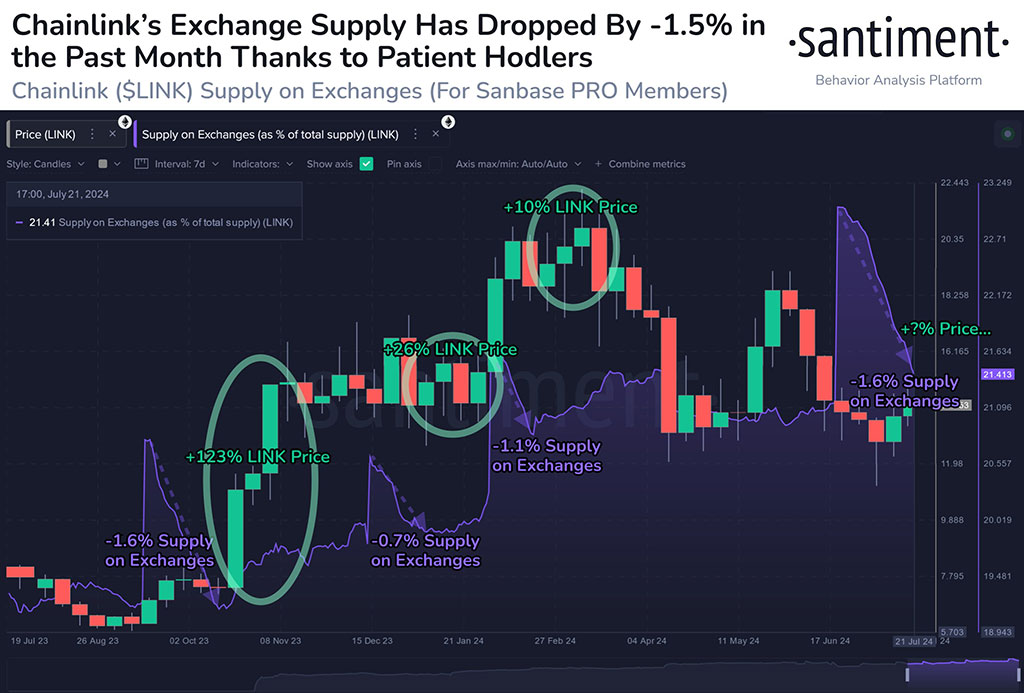

The amount of Chainlink (LINK) tokens held on cryptocurrency exchanges has decreased noticeably over the past month, which could be a sign of an approaching price increase for LINK. Based on data from Santiment, the percentage of LINK’s total supply situated on exchanges has gone down from 23% to 21.4%.

According to the data from on-chain intelligence providers, the decrease in cryptocurrency exchange activity during late 2023 resembled the pattern observed before a market rally.

Previously, a drop in LINK coins’ value on exchanges comparable to the one observed between September 15 and October 14 resulted in a remarkable surge of approximately 123% for the 15th largest market cap coin within the subsequent four weeks.

Photo: Santiment

Historical data indicates that following a substantial decrease in LINK‘s supply on exchanges, there has typically been a price increase, with the exception of the occurrence in 2023.

Based on the Santiment chart I’ve attached, an altcoin experienced a 26% surge following a 0.7% decrease in the metric known as “On-Chain Sentiment” (SoE) in December 2023. This trend repeated itself in February 2024, resulting in a 10% increase that brought its price above $20 after a 1.1% decline in SoE earlier that month.

Will the Trend Repeat and Rally LINK?

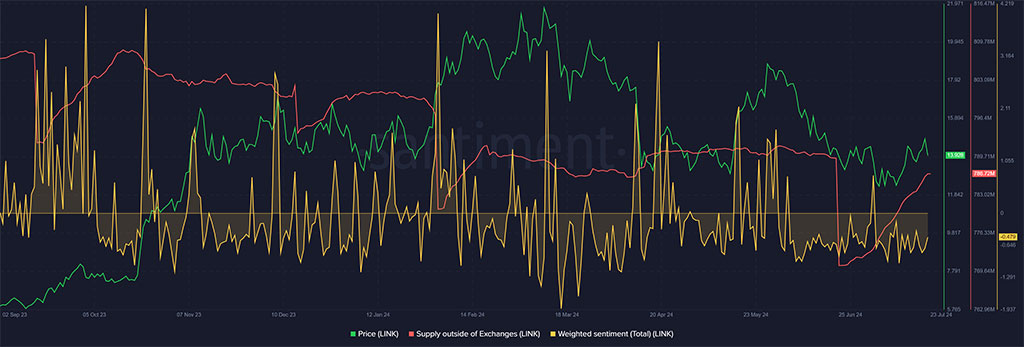

After a dip in the quantity of LINK held in cold storage (SoE), previous LINK price surges were accompanied by an increase in LINK supply outside of exchanges (red) and a significant rise in optimistic investor feelings (orange). In essence, these rallies took place following a substantial accumulation phase for LINK and the enhancement of market sentiment.

Photo: Santiment

At the moment of publication, there was a rise in LINK‘s hoarding from outside the exchanges. This signified an uptick in buying frenzy. Nevertheless, the market mood remained bearish overall, as indicated by the prevailing pessimistic attitude.

LINK Price Prediction: Is a +20% Gain Likely in the Short Term?

On the price graph, LINK held its ground above the significant demand area priced at around $12, denoted by the cyan marking. A favorable market outlook and heightened interest at this level might propel LINK towards the potential bullish objective situated near $16. This target aligns with the resistance trendline.

Photo: TradingView

Such an upswing could tip a 22% potential gain for LINK bulls.

At present, the RSI indicator reflects a steady demand with a reading of average value, suggesting no significant change as of now. A potential drop below the current demand zone could postpone the projected bullish trend for LINK, currently priced at $14.10 and registering a 3% increase on a monthly adjusted basis.

Approximately 79,000 LINK holders faced losses as the token price dipped, particularly those who purchased it between $15 and $18. These investors might have tried to sell their tokens in an attempt to recoup their investment, momentarily halting the anticipated LINK price rise.

Photo: IntoTheBlock

Based on my extensive experience in analyzing market trends and observing investor behavior, I believe that LINK could potentially see a short-term gain of around $16, which would represent a 20% increase from its current price. However, I’ve seen firsthand how eager some investors can be to secure profits, and if the price surges above $15, a significant number of holders might decide to cash out. This could potentially disrupt the anticipated upswing in the market for LINK.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-07-23 16:42