As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends. In my career, I’ve seen the rise and fall of tech stocks, commodities, and now, digital assets like Chainlink (LINK). After closely monitoring the crypto market for several years, I can confidently say that Chainlink has shown remarkable resilience in the face of adversity, and its recent surge is a testament to its potential as a standout performer.

In my analysis, the recent price action suggests that LINK’s bullish momentum could be just beginning, with the potential for a massive rally if current trends continue. The structural shift in Chainlink’s short-term trend, as highlighted by top analyst Jelle, is particularly intriguing. Flipping a key resistance level into support often signals substantial upward movement, and this bullish signal has reignited optimism among investors.

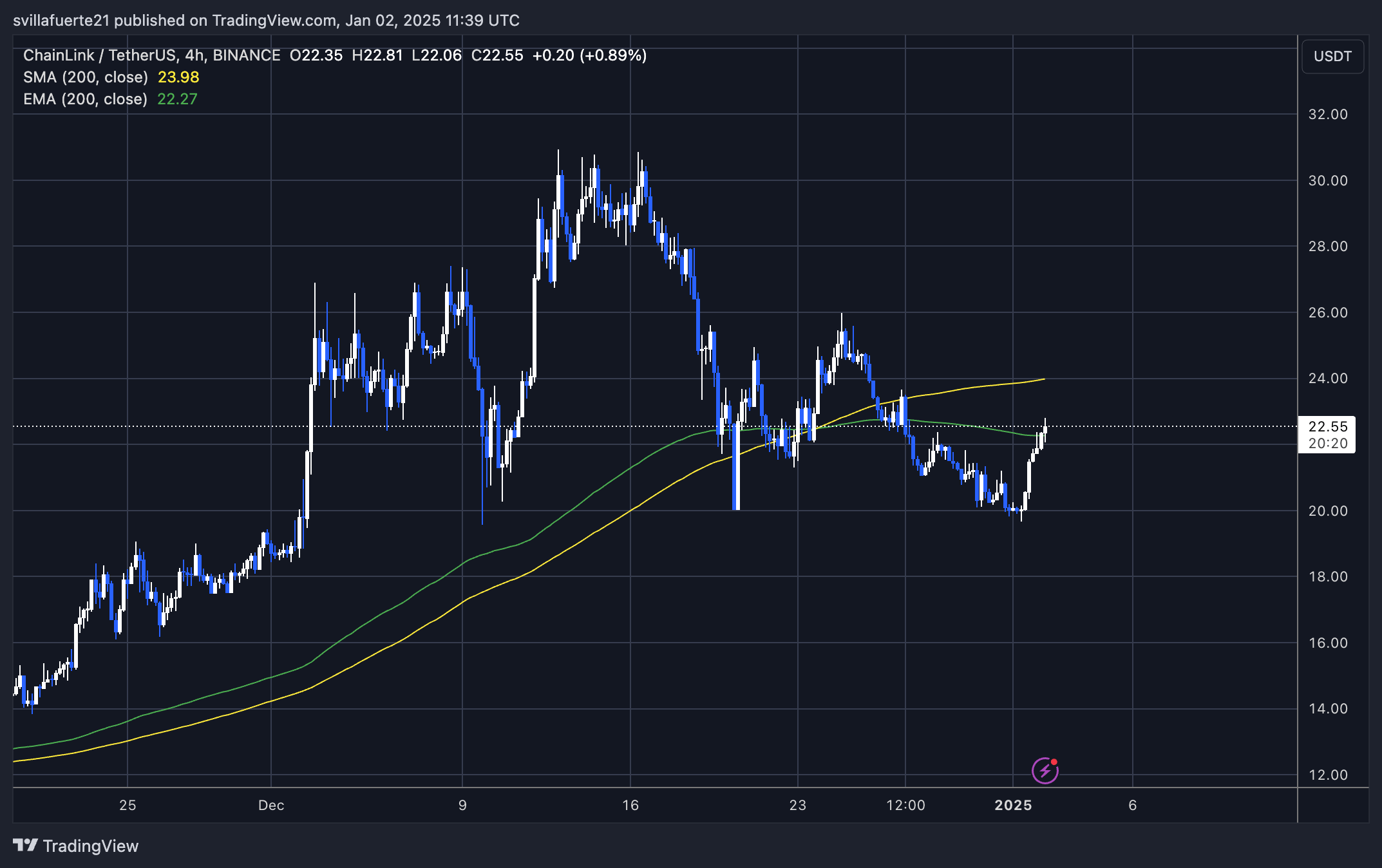

However, it’s essential to remember that the crypto market can be unpredictable, even for a veteran like myself. As LINK tests crucial supply zones in the coming days, traders and investors will closely watch technical levels such as the 4-hour 200 EMA at $22.27. A successful breach of these levels could pave the way for an aggressive rally, while failure to hold the 200 EMA as support could expose LINK to renewed selling pressure.

In terms of humor, I’d like to add a lighthearted note: If you thought the crypto market was volatile before, just wait until we hit all-time highs again – it’ll be like riding a roller coaster without seatbelts! But for those brave enough to hold on tight, the potential rewards could be well worth the ride.

Yesterday, there were indications that the cryptocurrency market was rebounding. Many assets witnessed substantial price increases following a period of relatively low activity. Among these, Chainlink (LINK) particularly shone, rising by more than 15% within a day, thus reinforcing its status as one of the robust altcoins in the current climate. This abrupt rise underscores increasing attention toward LINK as market sentiment evolves.

Expert analyst Jelle recently discussed the technical aspects of X, highlighting an essential change in Chainlink’s price movement. Based on Jelle’s assessment, LINK has managed to transform a significant resistance barrier into a support level – a bullish indication that frequently precedes strong uptrends. This structural alteration might open up opportunities for Chainlink to aim at higher pricing tiers as it readies to challenge key supply areas.

The market seems revitalized, and Chainlink appears strong at crucial points. If the positive trend continues, Chainlink could soon test significant resistance levels, potentially leading to a major breakthrough. With the market waking up, Chainlink’s recent growth highlights its potential to shine among other altcoins.

Chainlink Investors Waking Up

As an analyst, I’ve observed a significant selling pressure on Chainlink since it peaked at $30 on December 13, leading to a pullback that challenged its bullish structure. However, recent price movements hint at a potential change in momentum, as bulls seem to be re-emerging. This could potentially signal the start of a substantial upward trend, a possibility many market analysts are considering closely.

Analyst Jelle has just released a technical analysis on X, pointing out an important shift in Chainlink’s short-term pattern. As per Jelle, Chainlink seems to have turned a significant resistance level into support – a change that is usually a sign of impending positive movement. This bullish indication has rekindled investor enthusiasm, leading Jelle to predict that Chainlink could potentially reach new highs soon if the current trend persists.

From my perspective as an analyst, the focus now shifts to LINK’s capacity to penetrate crucial resistance zones over the coming days. Should LINK successfully breach these levels, it could trigger a robust surge as buyers move to capitalize on the strengthened market conditions. With the broader crypto market displaying signs of revival, LINK’s potential to reverse its recent slide places it in a strategic position as a possible frontrunner among altcoins.

Testing Crucial Liquidity

At the moment, Chainlink (LINK) is being exchanged for approximately $22.55, marking a robust rebound from its local demand points. The current price action is testing a significant resistance area, which could influence its impending significant move. Optimistically, LINK is trading above the 4-hour 200 Exponential Moving Average (EMA) at $22.27, an essential technical benchmark that frequently indicates bullish energy when consistently providing support.

To continue its short-term upward trajectory, it’s crucial for LINK that it holds its current position. If LINK manages to stay above the 200 Exponential Moving Average (EMA) and gains strength, the next considerable barrier will be at approximately $24. Overcoming this level in the near future might initiate a substantial surge, allowing LINK to aim for higher resistance levels and potentially reach new record highs.

If the 200 EMA (Exponential Moving Average) isn’t maintained as a support level, Chainlink (LINK) might face increased selling pressure, potentially causing prices to fall once more towards areas of local demand. The attention of traders and investors is keenly focused on these technical indicators because the ongoing market recovery offers promising circumstances for altcoins to regain their former positions.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2025-01-02 23:48