As a seasoned crypto investor with a decade of market experience under my belt, I find the latest analysis by Ali Martinez on Chainlink (LINK) intriguing. Having weathered numerous bull and bear markets, I can attest to the crucial role of on-chain cost basis distribution in shaping price movements.

A specialist has outlined a potential route for Chainlink to reach a new record high (PR) if it manages to surpass its current resistance barrier.

Chainlink Could Find Major Resistance At The $20 Level

Analyst Ali Martinez recently shared insights on X about the current state of resistance levels for LINK, focusing on the distribution of on-chain cost basis.

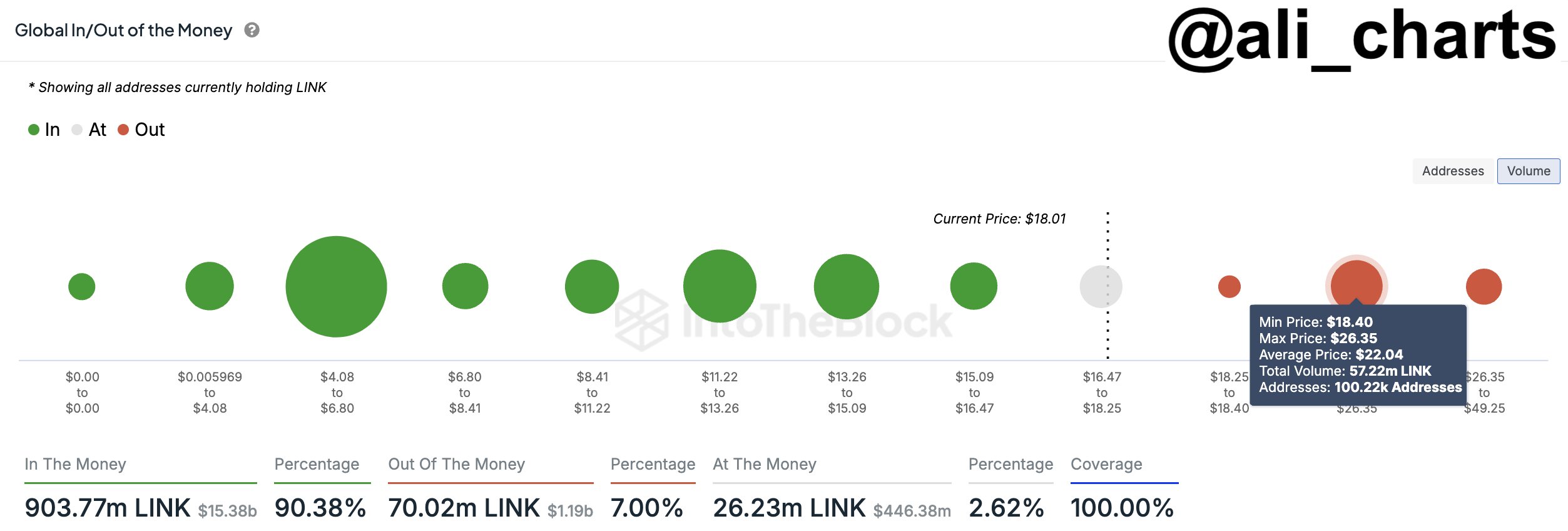

Below is the chart from the market intelligence platform IntoTheBlock shared by the analyst. It shows the amount of the asset acquired at each price range that Chainlink has visited in its history.

According to the graph, a significant number of Chainlink token buyers made purchases within the price range of approximately $18.4 to $26.3. To be more precise, roughly 100,220 investors collectively acquired about 57.2 million LINK at these particular pricing points.

When examining on-chain data, the likelihood that a particular price level will function as either support or resistance is determined by the quantity of coins purchased within that range. This approach is based on the behavior and mindset of investors.

In general, individuals view their cost basis as significant because a reassessment could switch their profit or loss standing. This sensitivity makes them more likely to act impulsively during such reassessments.

Before the retest, investors who are currently experiencing a loss might worry that the price will drop again, prompting them to consider selling to recover their funds.

In a similar fashion, those who have seen their initial cost basis rise could choose to amass additional holdings, hoping that the price level will recover and prove profitable in the future.

In simpler terms, when only a handful of investors’ initial costs are reassessed, it generally doesn’t have a significant impact on the asset. However, if multiple addresses have their initial costs clustered together, a reassessment could potentially trigger a noticeable shift in the asset’s value.

Based on the previously mentioned price range for Chainlink (LINK) hovering near its average value of about $22, this price level may serve as a significant barrier for many investors due to their cost basis. Consequently, it might be challenging for LINK to surpass these resistance levels.

If Martinez is correct, and the cryptocurrency manages to overcome this challenge, it might find smooth sailing towards a fresh all-time high (ATH), as few investors have positioned themselves to buy at prices within the range above the $22 demand zone.

Concerning the prices at present, there are a few significant ranges close by – around $13 to $15 and $11 to $13. If the asset experiences a downturn, these zones might offer some support and potentially lessen the impact of a drop.

LINK Price

Over the past day, Chainlink has seen a surge of nearly 10%, pushing its value up to $18.4.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-26 05:10