According to on-chain information, a particular pattern indicated by Chainlink’s on-chain data has historically resulted in an approximate 50% price surge for LINK.

Chainlink 30-Day MVRV Ratio Has Plunged

Analyst Ali shared insights on X’s newest post about Chainlink’s recent trend in the 30-day MVRV ratio. The “Market Value to Realized Value (MVRV) ratio” is a commonly used on-chain measurement that calculates the relationship between the market value and the realized value of LINK.

The market capitalization represents the total worth of a cryptocurrency based on its current market price and the number of coins in circulation. However, the realized capitalization is a distinct valuation methodology that determines the currency’s total value by considering the last transaction price for each coin in existence on the network.

In simpler terms, the price of a coin during its last transaction is likely its current purchase price for those who own it. Thus, the total value of all coins in circulation, calculated as their realized capital, represents the amount originally paid for each coin.

From this perspective, the realized cap is simply an indication of the amount of capital investors have actually spent to acquire the asset. On the other hand, market cap reflects the current value of their holdings.

The MVRP (Market Value to Realized Value) ratio serves as a comparison between the two models, offering clues about whether Chainlink’s market value is greater or lesser than its realized value in the overall market.

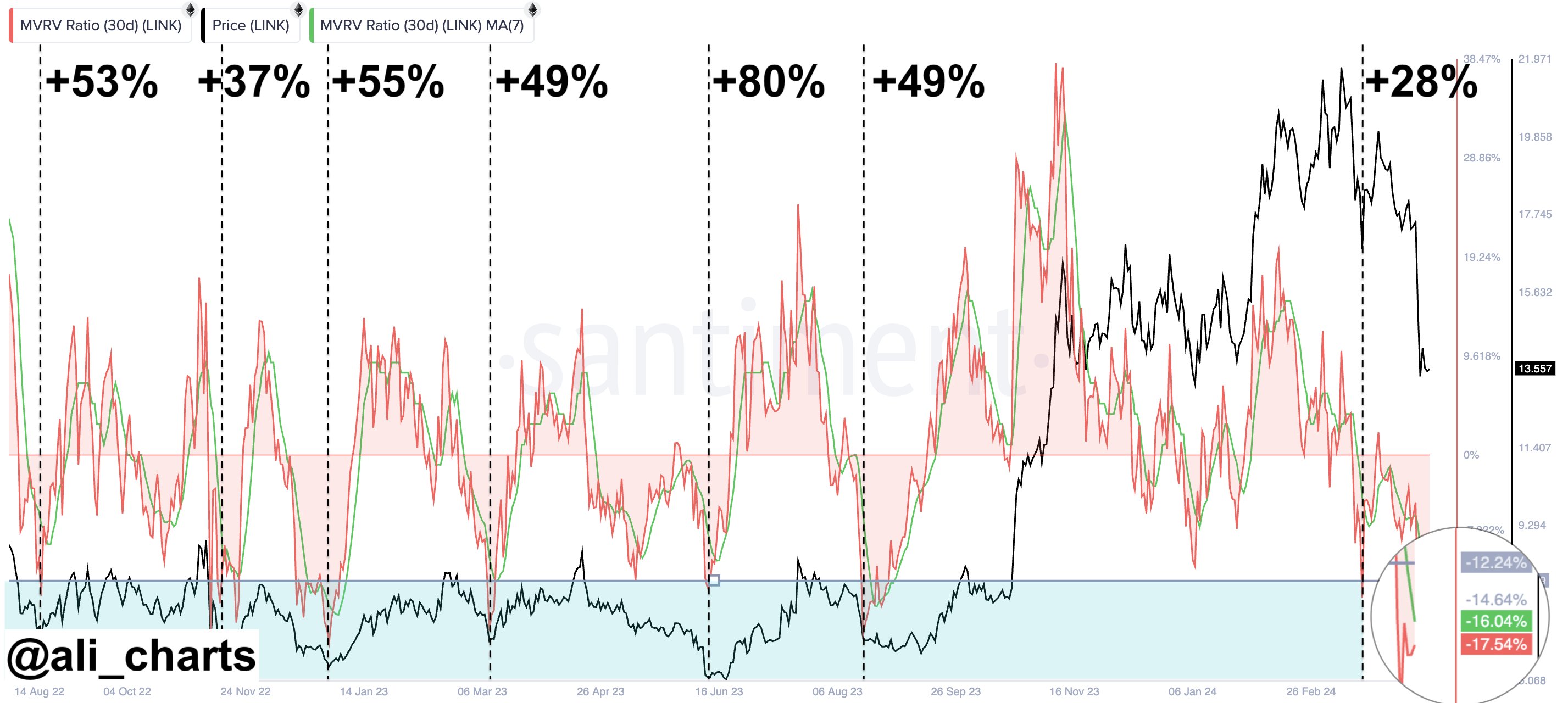

Regarding the present discussion, we zero in on the 30-day variant of this specific indicator. This means we concentrate solely on investors who made purchases within the last month. For your perusal, here’s a chart from the analyst displaying the development of this LINK indicator over the past two years:

According to the graph above, the Chainlink 30-day MVRV ratio has experienced a significant drop and now sits below the 0% threshold. The 0% mark represents the point where market capitalization and realized capitalization are equal. With the ratio falling beneath this level, it indicates that the realized capitalization surpasses the market cap.

If the situation holds, investors find themselves bearing losses due to this latest downturn. The cryptocurrency’s price drop has inevitably led to this outcome, causing 30-day buyers to be at a loss.

In the graph, Ali has marked a distinct trend for Chainlink’s MVRV 30-Day Ratio. Every time this indicator has dipped below -12.24% since August 2022, it has presented a promising buying chance, resulting in an average return of 50%. (Analyst’s note)

Lately, the percentage of this indicator has dropped to around 17.54%, a level that has previously presented lucrative purchasing opportunities for the coin. However, it’s uncertain if the trend from the previous two years will repeat itself in this instance.

LINK Price

Over the last seven days, Chainlink investors have experienced significant losses. The value of the asset has dropped by over 23%, leaving its current price at around $13.3.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

2024-04-19 10:19