As a seasoned crypto investor with battle-scarred fingers from navigating the tumultuous waters of this market, I must admit that the current state of Chainlink (LINK) leaves me feeling a mix of trepidation and opportunity. The price volatility this week has been relentless, and I’ve seen enough market cycles to know that these are the moments when fortune favors the bold.

This week, the value of Chainlink (LINK) has experienced considerable fluctuations, with its price dipping more than 13% from its peak on Monday. Currently, LINK is approaching a vital support level approximately at $11.20, which is under close scrutiny by traders and investors alike.

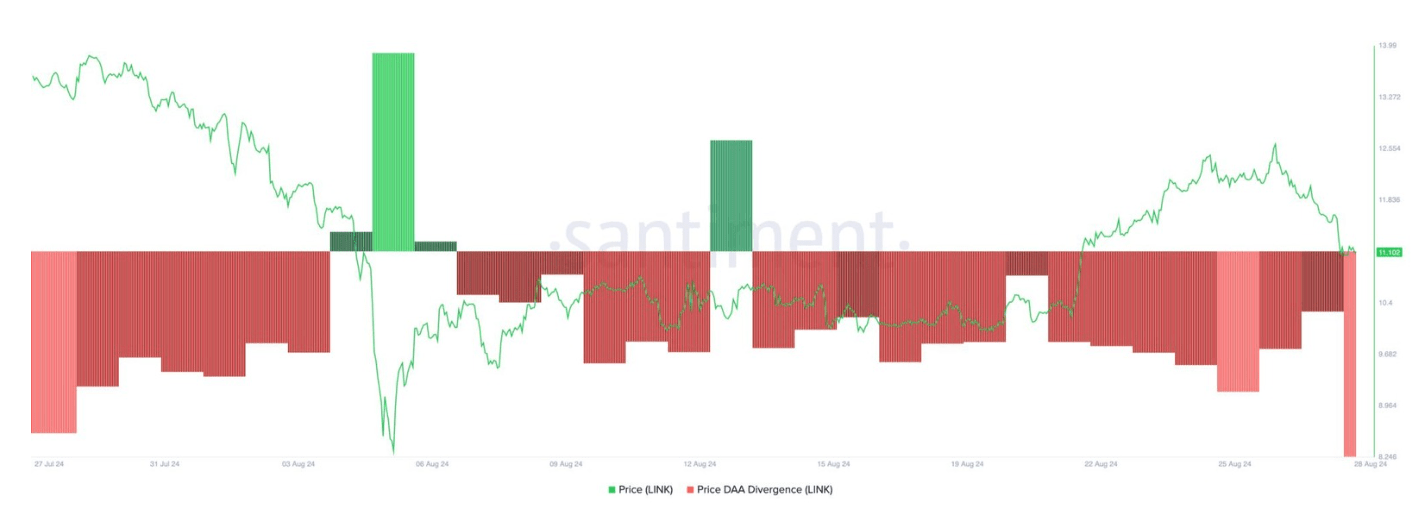

The importance of this level is further emphasized by on-chain data from Santiment, which shows that demand for LINK is cooling off. This adds to the uncertainty surrounding the asset’s near-term price action.

Over the coming days, Chainlink’s position may prove decisive. If it manages to hold onto this significant support, there’s a chance it could recover and stabilize. However, if it falters, it might face additional declines. This stage could serve as a foundation for LINK‘s next significant market shift, making it a key focus area for investors and traders alike.

Chainlink Demand Cooling Off?

At the moment, uncertainty and apprehension seem to be influencing investor attitudes towards Chainlink (LINK). The cryptocurrency’s value is being put to the test at a significant support threshold due to decreasing interest from buyers.

According to data recorded on the blockchain, Santiment’s analysis indicates a downward trend in the market. A divergence between the price and daily active address (DAA) for LINK suggests that demand for this cryptocurrency has been decreasing lately. This metric examines the relationship between an asset’s price fluctuations and its number of daily active addresses, offering insights about whether the network activity aligns with the price movement.

Presently, the Price Divergence Against Active Users (DAA) for LINK is sitting at -61.2%. This large disparity between its price and the number of active users on the network implies a strong disconnect. Given such a considerable negative divergence, it suggests a weakening market condition and potentially forecasts further price drops.

Concerns arise as the current network activity seems insufficient to sustain LINK‘s price at its present level. Traders and investors are fearful that Chainlink (LINK) may find it challenging to hold its ground above the significant $11.20 support. If demand doesn’t increase promptly, LINK could encounter extra downward force, potentially leading to a more substantial correction in the near future.

LINK Price Action Shows Indecision

Currently, Chainlink (LINK) is valued at $11.22, having dropped below its 4-hour 200 moving average (MA). This significant marker now functions as a resistance barrier for lower timeframes. This change in position makes LINK vulnerable, with the nearest support level situated at the $10.91 low point reached on Tuesday.

Maintaining a position above this point is crucial to keep the trend moving upward. If LINK manages to hold its current support, it might lead to a phase of price stability, paving the way for a possible surge towards new short-term peaks within the next week.

If LINK can’t maintain its current support at $10.91, it might encounter more downward pressure. Important levels to keep an eye on are $9.50 and the previous low of $8.12. A fall below these levels could indicate a more significant correction, possibly leading to a bearish trend.

Conversely, if LINK maintains a value above $10.91, it might establish a base for recovery. This positioning could enable LINK to revisit higher resistance points and potentially sustain its upward momentum. The community of traders and investors are keeping a keen eye on these price thresholds to predict LINK’s future direction.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-08-29 14:11