As a seasoned cryptocurrency analyst with over a decade of experience under my belt, I find myself intrigued by Chainlink’s current bullish pattern and the anticipation surrounding its potential surge. The extended consolidation phase has kept me on the edge of my seat, much like a cat waiting for the perfect moment to pounce on a prized feather.

At present, Chainlink is following a bullish trend that’s been building for around seven months, drawing interest from analysts and investors alike. Many are excitedly looking forward to Chainlink experiencing a rise during this cycle and eventually setting new record highs once again. The prolonged consolidation phase has left traders on tenterhooks, as they wait for a major breakout to occur.

Crypto expert Lucky has offered an enlightening forecast on the possible path for Chainlink. According to him, the crucial step is for LINK to exceed its current holding pattern, paving the way for a robust upward trend. Upon this breakthrough, Chainlink might swiftly climb towards a short-term goal of $15.

As optimism grows about this significant barrier, the upcoming movements in Chainlink’s price may hold the key to its future trajectory. The investment community is keeping a keen eye on the market, looking for indications that LINK might finally burst free from its prolonged range and embark on a new journey of expansion.

Chainlink Price Action Turning Bullish

Chainlink’s price trend has predominantly been bearish since it reached its annual peak in March, and it currently finds itself in a lengthy period of sideways movement. Yet, several market experts speculate that this consolidation could be about to conclude. A well-known analyst, Lucky, has recently provided a bullish technical analysis on Chainlink, suggesting a positive forecast for the cryptocurrency.

Lucky’s analysis reveals that LINK is trading within a falling wedge pattern, a formation often associated with potential bullish reversals. According to his chart, Chainlink has touched the lower boundary of this wedge three times, signaling strong support, and now appears to be gearing up for a breakout from its yearly consolidation range. He predicts that this breakout could happen as early as October, potentially triggering a surge in LINK’s price.

As a researcher, I’ve identified potential bullish price targets for Chainlink should it break free from its current consolidation phase. The initial target I’ve marked is at $15, followed by more aggressive targets at $19 and $22. Reaching these price points would signify substantial growth from Chainlink’s current value and indicate a robust rebound from the bearish trend that has largely characterized 2024.

As optimistic patterns develop, investors keep a keen eye on Chainlink’s upcoming actions, expecting that a significant surge might push the value of LINK towards those promising projected prices.

Technical Analysis: Key Prices To Watch

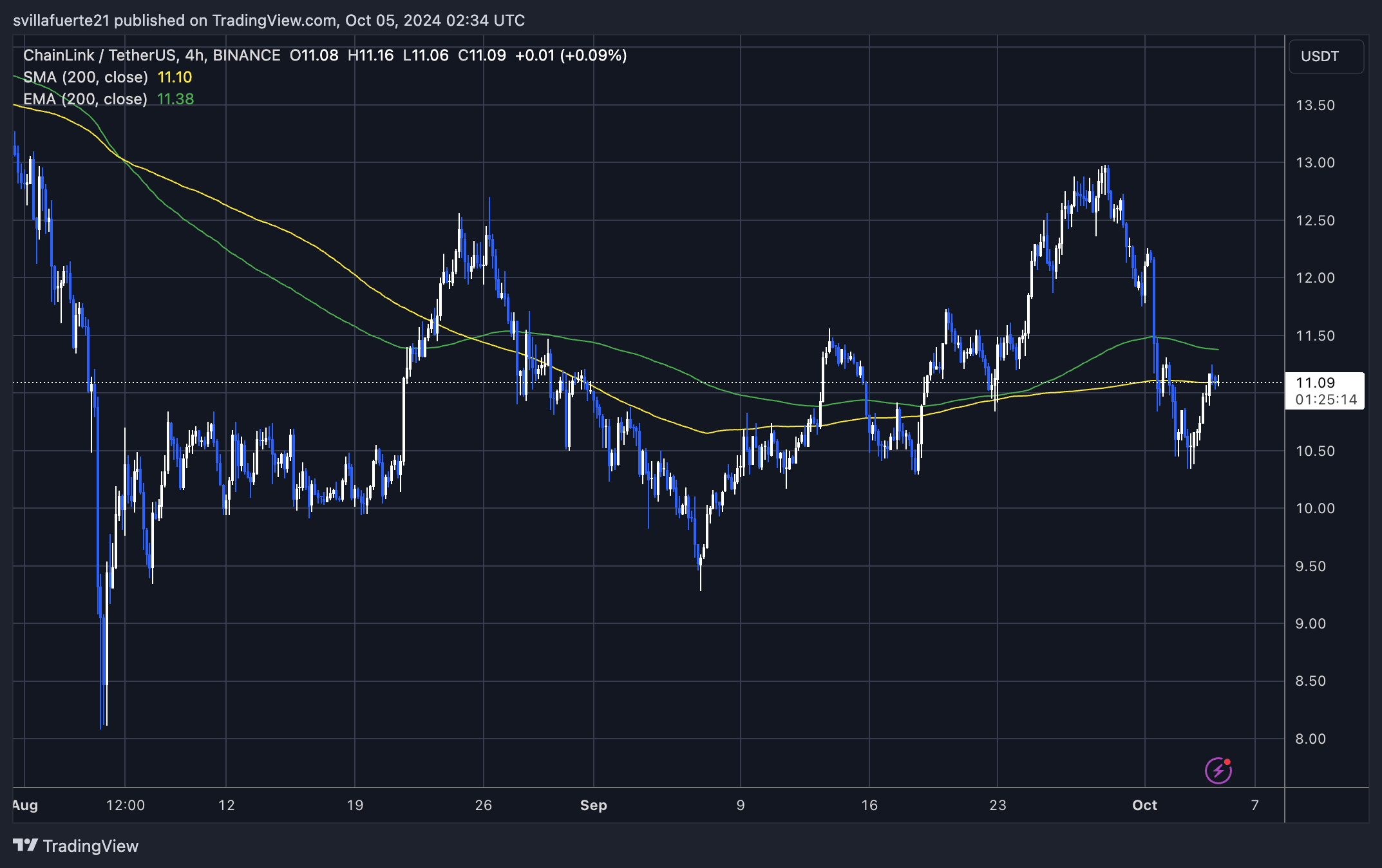

As a researcher observing the market dynamics, I find Chainlink (LINK) currently hovering at approximately $11.09. Notably, it’s encountering a critical resistance level – the 4-hour 200 moving average (MA) situated at $11.10, following a substantial 7% growth since Thursday. This particular level seems to be acting as an impediment for bullish momentum, as the price has been unable to surpass this marker so far. For the bullish trend to persist, it’s crucial that LINK manages to overcome this indicator and target higher supply zones around $13.

Presently, the market trends indicate that bulls are struggling to establish momentum at this crucial point. If Chainlink (LINK) doesn’t surpass $11.10 and regain the upper resistance, there might be a reversal, potentially causing the price to drop towards a lower buying zone. The next significant support level in such a case would be around $9.2.

Upcoming days could decide if LINK continues its price surge or experiences a decline. If it manages to break through the 4-hour 200 Moving Average, this might indicate more growth; otherwise, it may lead to a downward correction, potentially suggesting a bearish trend.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-06 02:46