As a seasoned researcher with years of experience navigating the unpredictable world of cryptocurrencies, I find myself cautiously optimistic about Chainlink (LINK) at this juncture. The head-and-shoulders pattern highlighted by top analyst Ali Martinez is undeniably concerning, but it’s not uncommon to see altcoins bounce back from such bearish setups.

Lately, Chainlink (LINK) has demonstrated strength following a 35% drop from its peak this year, soaring more than 30% to probe liquidity near $23. However, even with this rebound, there’s still a lot of pessimism surrounding altcoins, and Chainlink isn’t exempt from this trend. The digital currency has been battling to retake its previous highs, causing some uncertainty as to whether the recent uptick in price possesses enough energy to push for additional increases.

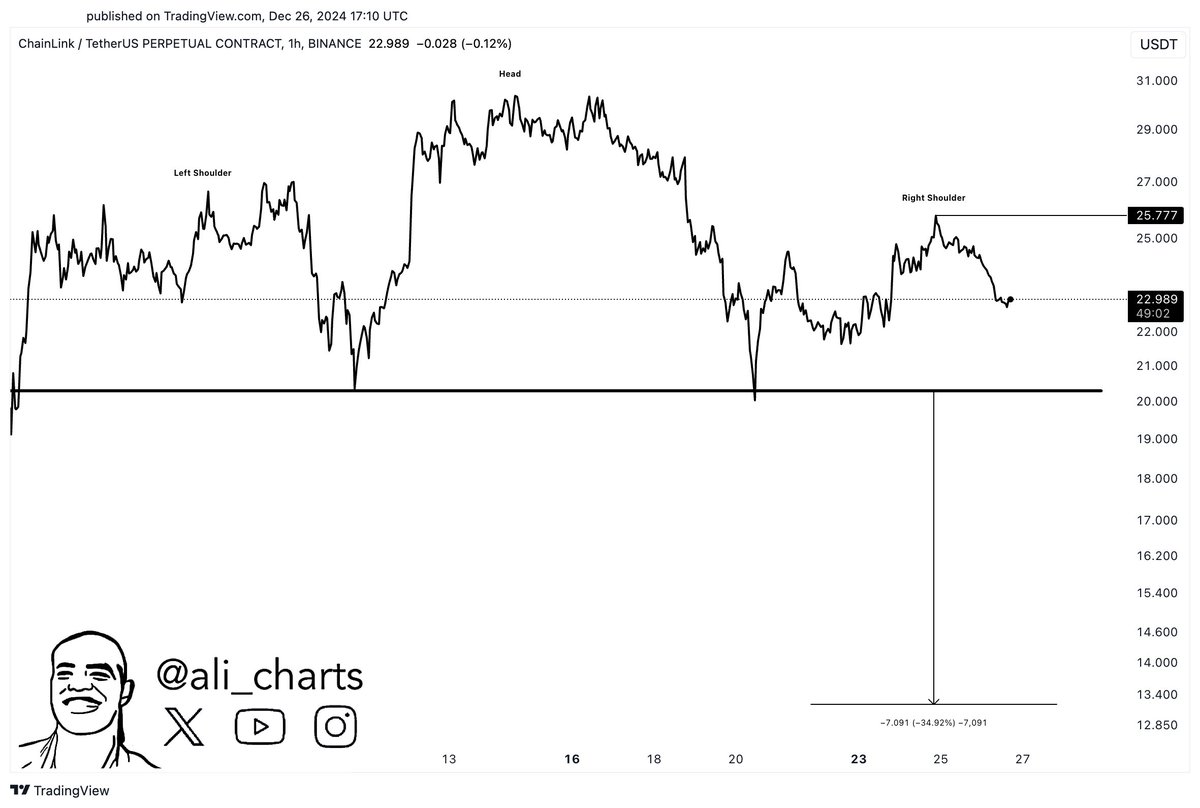

Analyst Ali Martinez has shared an in-depth analysis of X, emphasizing a key trend that may influence Chainlink’s future direction. Martinez suggests that Chainlink is developing a head-and-shoulders pattern, which is typically linked to price reversals in a bearish manner. If this pattern holds true, Chainlink might experience a substantial drop, possibly dipping down to around $14 within the next few weeks.

In this critical stage, it’s essential for Chainlink to maintain its current price level to prevent more significant adjustments from happening. The price movement is being closely observed by investors and traders, with $23 serving as a significant hurdle. Whether Chainlink can break through the bearish trend or continue to slide depends largely on broader market conditions and its capacity to disprove the negative pattern. At this point, the future of Chainlink appears uncertain, leaving everyone in the market on tenterhooks.

Chainlink Price Action Showing Weakness

Since its descent from its highest point this year, Chainlink (LINK) has been navigating a tough price landscape, mirroring a general pessimistic attitude in the altcoin market. Although it’s exhibited some signs of recovery, LINK’s price movements have essentially been confined, with a substantial barrier emerging near $26. Overcoming this level is crucial for dismissing bearish predictions and sparking renewed bullish energy.

According to analyst Ali Martinez’s latest technical assessment on X, there appears to be a developing head-and-shoulders configuration. If this bearish prediction is realized, the value of LINK could experience a steep drop, potentially reaching $14. This decline would signify a substantial decrease from its current prices and emphasize the hurdles LINK encounters in regaining its previous peak values.

Nevertheless, there’s still some room for optimism. According to Martinez, surpassing the $22 level could offer Chainlink a solid foundation to steady itself and potentially halt the downward trend. If it manages to break through $27, it would significantly boost bullish sentiment, suggesting a possible shift towards a more positive perspective.

Presently, there’s a lot of uncertainty in the market regarding the direction of LINK. The overall market trends, including Bitcoin‘s movement, could significantly impact LINK’s trajectory. If LINK manages to surpass some crucial resistance points, it might break free from the negative outlook and prepare for a longer bullish trend. However, until then, it is advisable for both traders and investors to exercise caution.

LINK Testing Liquidity

At the moment, Chainlink (LINK) is being exchanged for approximately $23, having confidently checked the demand level at $22. Even though it’s clinging onto this vital support, the market dynamics are uncertain as there isn’t a clear direction of movement right now. For now, bears seem to be in charge, with the recent pullback from yearly highs casting a shadow over sentiment. However, the $22 level has shown remarkable resilience, implying that demand could suddenly spike at any moment to resume the upward trend.

To escape its current hesitant state, LINK needs to conquer the significant obstacle at $26. If it manages to exceed this point, it will undermine the present pessimistic view and probably spark a tremendous upsurge, with the possibility of reaching and surpassing past peaks once more. This move could rebuild trust among traders and encourage new investors to fuel additional momentum.

On the negative side, if LINK doesn’t maintain its value above $22, it could face stronger selling forces. This might cause it to challenge lower resistance levels, potentially extending the bearish phase. At this moment, the market stands at a crucial juncture, as both bulls and bears are watching for the next significant move. The upcoming days will be vital for LINK as it navigates through the broader market instability in search of its direction.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-27 21:04