As an analyst with over a decade of experience in the crypto market, I have seen my fair share of bull runs and bear markets. However, Chainlink (LINK) has piqued my interest with its recent impressive surge above the $13 resistance level, breaking free from months-long price stagnation. The increased whale activity, as reported by Santiment, is a clear sign that major investors are confident in LINK’s future potential, which makes me optimistic about this asset’s prospects.

Over the past few days, the price of Chainlink (LINK) has skyrocketed significantly, soaring beyond the crucial barrier at $13 and registering a notable 35% increase. This latest surge has sparked enthusiasm among analysts and investors, as LINK encountered persistent resistance near $13 since late July, failing to maintain any positive momentum. Now, though, there seems to be a shift in market sentiment, with many expecting further growth for Chainlink.

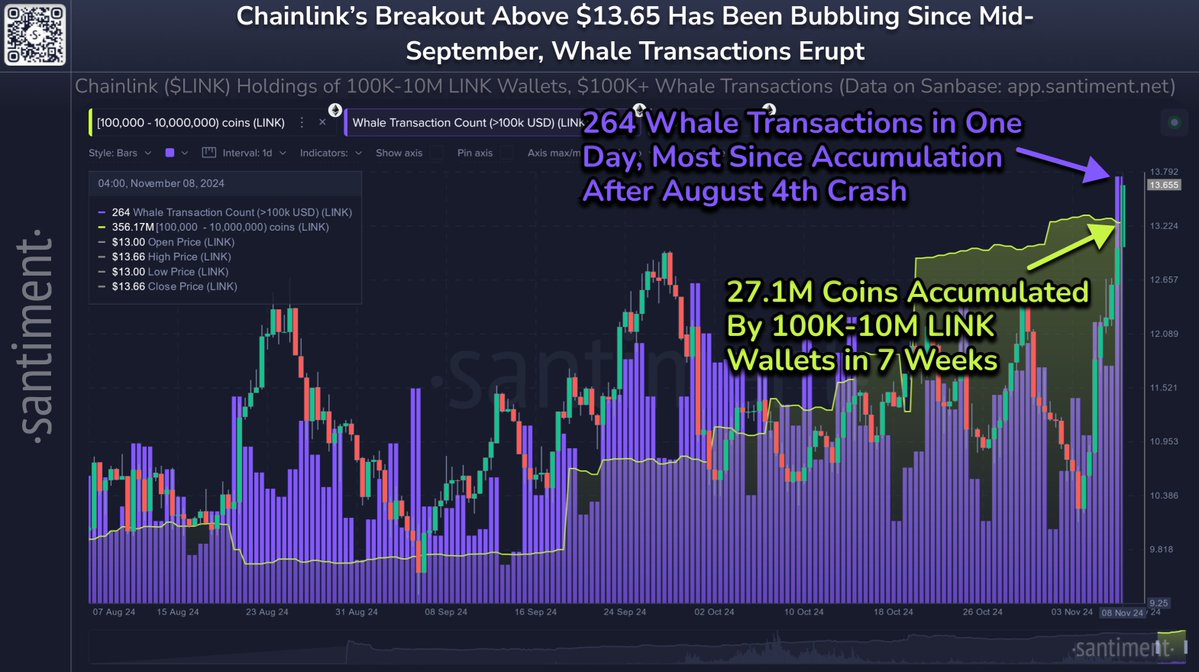

Boosting this optimistic perspective, data from on-chain analytics provider Santiment shows that the activity of LINK’s large holders (whales) has hit a 3-month peak. These big investors are amassing LINK in substantial amounts. Such increased whale activity typically signals confidence among major investors, implying that Chainlink’s recent surge might be initiating a longer-term upward trend.

Over the past several months, Chainlink has managed to break through its previous resistance and regain momentum. The upcoming days are vital for predicting whether this surge will continue to push prices higher or if it will face new obstacles. At present, analysts are intrigued by the possibility of Chainlink sustaining its bullish trend in the near future.

Chainlink Whales Waking Up

Chainlink appears to be regaining its vigor, as its price soars over important resistance points that it hadn’t been able to surpass for months. For the first time since July, LINK has managed to climb above $13.65, indicating a notable change in its price trend. This upward momentum coincides with positive indicators suggesting a bullish future for this asset.

Based on Santiment’s analysis, Chainlink appears to be performing distinctly from the overall altcoin market, demonstrating exceptional price trends during market recovery. A notable sign is the surge in whale activity that has peaked at a level not seen for three months. Investors holding between 100,000 and 10,000,000 LINK have amassed approximately $369.8 million worth of the token over the past seven weeks, marking an increase of 8.2% in their holdings.

A significant increase in whale activity tends to indicate optimism about a token’s future price rise, as major investors prepare to capitalize on the upcoming phase of expansion.

As an analyst, I’m observing a significant accumulation of Chainlink (LINK) by prominent investors, or ‘whales’, coupled with its successful breach of crucial resistance levels. This points towards a promising continuation of growth for LINK in the forthcoming weeks.

LINK Testing New Supply

At present, Chainlink is being exchanged at $13.5. It has surpassed its 200-day moving average (MA) at $12.9, an important milestone that indicates a robust, optimistic long-term perspective. This leap has empowered the bulls, fortifying positive opinions about LINK’s price dynamics. For the upward trend to persist, it is essential that LINK maintains its 200-day MA as a support level, as this point typically denotes a shift in the struggle between bearish and bullish phases.

As I’ve been closely monitoring the performance of LINK, I notice it consistently demonstrates strength above $13. However, a slight retracement to approximately $12.5 might offer the necessary momentum for continued growth if this level proves resilient as a support. This temporary pullback would enable the bulls to regroup and fortify their positions, laying a stronger groundwork for the next phase of upward movement.

Investors are looking at $14.5 as a potential resistance point for LINK, where it might encounter obstacles as it nears this price. If LINK surpasses $14.5, it could suggest strong demand and pave the way for possible increases in the near future, given the activity of large investors and the positive overall market mood.

Read More

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

2024-11-09 23:10