As a researcher with experience in cryptocurrency markets, I find Chainlink’s (LINK) recent surge of more than 21% within the last 24 hours to be quite intriguing. While most cryptocurrencies have seen minimal or flat returns during this period, LINK has displayed unexpected bullish momentum.

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing development with Chainlink (LINK). In just the past 24 hours, its price has surged by over 21%. Let me share some insights based on current data that could potentially explain this rally.

Chainlink Has Surprised Crypto Market With Breakout In The Past Day

As a crypto investor, I’ve noticed an intriguing development in the past 24 hours. While many cryptocurrency sectors have remained stagnant or posted minimal gains, Chainlink has bucked the trend with noticeable bullish momentum. This decoupling is an interesting phenomenon to observe and could indicate positive price action for Chainlink in the near term.

Here is a chart that displays how LINK’s recent performance has looked like:

Recently, Chainlink unexpectedly reached a new high of $16.7 for the first time since early April’s market downturn. Although the price has bounced back significantly, it hasn’t completely regained its losses yet.

If LINK‘s positive trend persists, it might not take much longer for the cryptocurrency to regain the $17.8 price mark it held prior to the market downturn.

Regarding Chainlink’s position in the larger cryptocurrency market, the following table indicates that it holds the 15th largest market capitalization among all coins.

If the current trend continues, it’s plausible that LINK may soon surpass Polkadot (DOT) in terms of market capitalization, potentially claiming the 14th position on the cryptocurrency ranking.

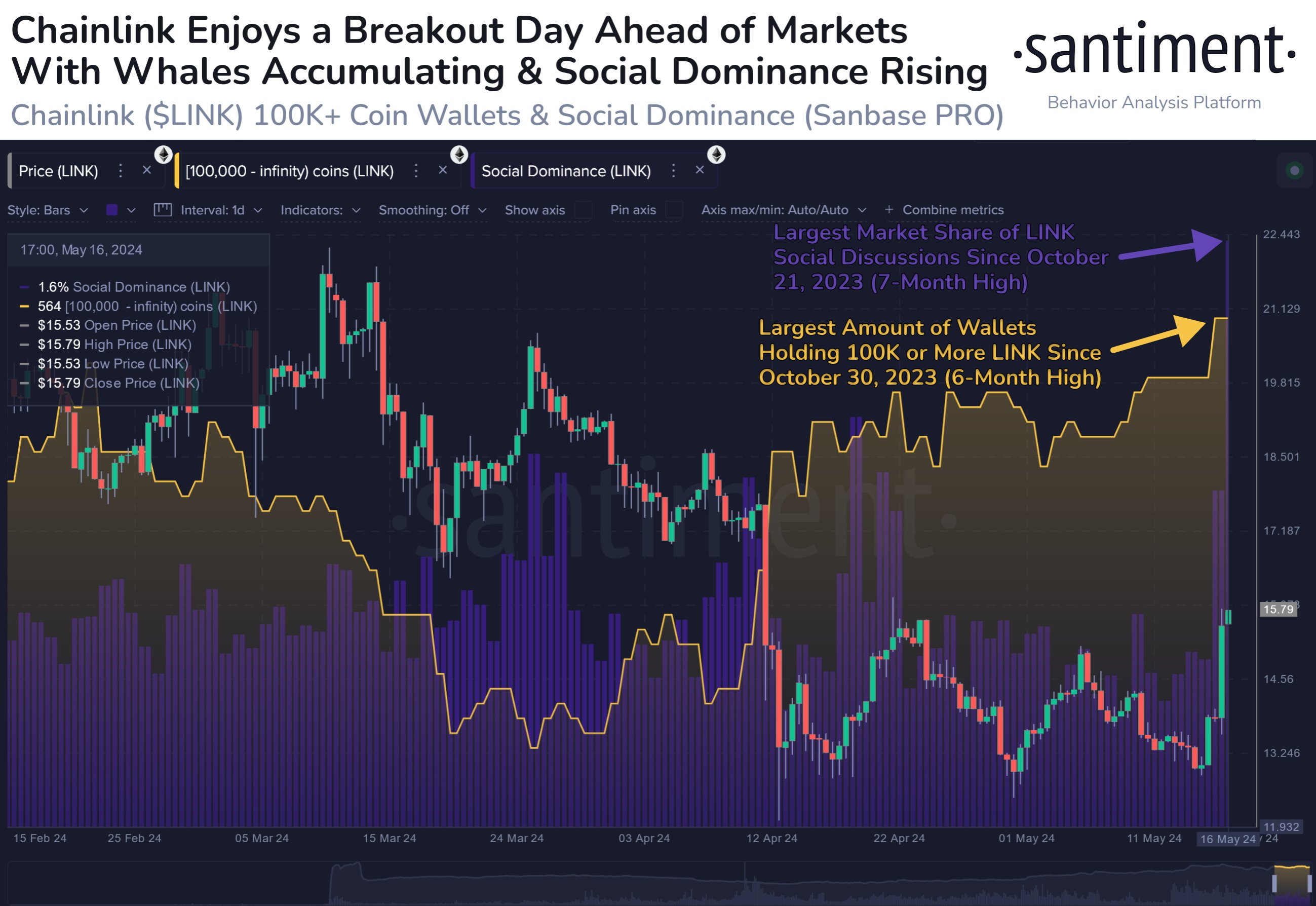

Perhaps we can explore why Chainlink (LINK) has recently diverged from the broader market trends. Insights from the on-chain analysis provider, Santiment, might shed light on potential explanations.

The Total Number Of LINK Whales Is At A 6-Month High Now

According to a post by Santiment, there has been an uptick in the number of Chainlink investors holding over 100,000 tokens as of late.

A cutoff amounting to approximately 1.67 million dollars according to the present LINK exchange rate is commonly labeled as a significant investment, often referred to as that of a “whale” investor.

Whales hold significant power in financial markets due to their ability to trade massive volumes quickly. Keeping an eye on their actions could provide valuable insights.

As a researcher analyzing Chainlink’s (LINK) graph, I’ve observed an intriguing development: the total count of whale addresses has recently reached 564 – the highest figure since last October. This surge in whale addresses could be contributing to the price uptick that LINK has experienced more recently.

The analytics company has added social dominance data for another measure in the same graph. This measurement indicates the proportion of conversations about cryptocurrencies on social media currently dedicated to LINK.

This indicator has surged in tandem with this rally, indicating a significant increase in public interest towards the cryptocurrency. Previously, such heightened attention has often signaled bearish trends for the asset. It remains to be seen if this trend will persist. According to Santiment, “If social excitement subsides and fear of missing out (FOMO) doesn’t drive further demand, a bullish market scenario could unfold.”

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-05-17 21:04