As a seasoned crypto investor who has weathered multiple market cycles, I must admit that the recent surge of stablecoins to a staggering $190 billion market cap is nothing short of remarkable. My journey began during the early days of Bitcoin, and I’ve seen firsthand how the ecosystem has evolved from a niche interest into a legitimate financial force.

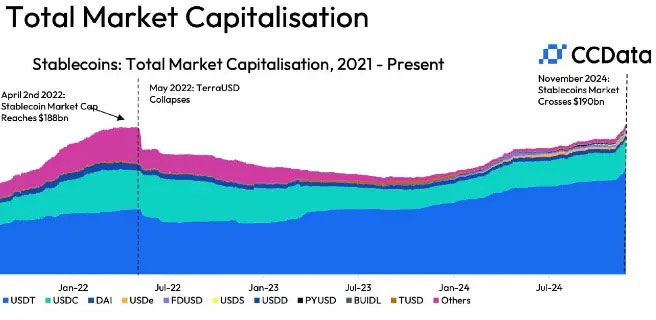

Stablecoins have become a stealthy force, gradually altering the landscape of the digital currency world without much fanfare. The latest figures from CCData show an impressive achievement: the market value of stablecoins has soared to an astounding $190 billion, breaking past its previous high and suggesting a significant shift in the stablecoin sector.

The rise occurs amidst a landscape marked by substantial political and financial transformations. Bitcoin and Solana are setting new records, while stablecoins are gaining traction due to increased enthusiasm. These assets, created to preserve consistent values often linked to traditional currencies such as the US dollar, play a crucial role in cryptocurrency trading and investment tactics.

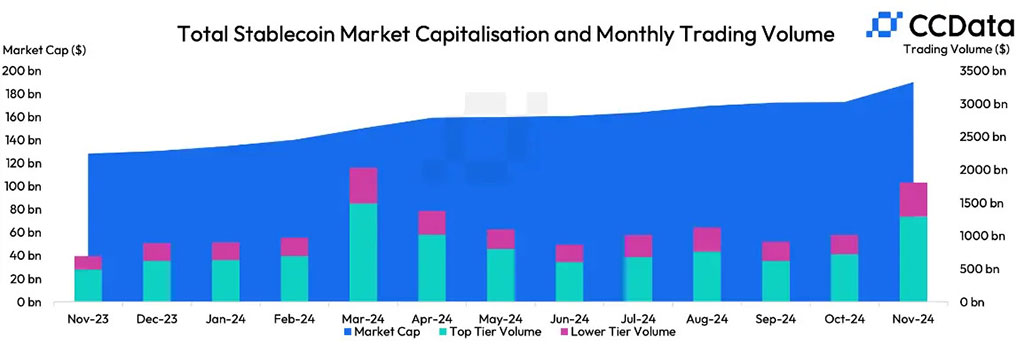

In terms of dominance within the expansion of the stablecoin market, Tether’s USDT leads the way with an impressive 69.9% share and a record-breaking value of $132 billion. Meanwhile, Circle’s USDC has shown strong growth, reaching close to $39 billion and accounting for about 20.5% of the overall stablecoin market landscape.

Ethena’s Synthetic Dollar Soars 42%

The ecosystem of stablecoins has experienced an unprecedented growth spurt, with numerous creative token-based products emerging. Beyond the conventional options, entities such as BlackRock’s BUIDL and Ethena’s USDe are pioneering unique methods for ensuring digital asset stability. For example, Ethena’s synthetic dollar has seen a significant surge of 42%, reaching $3.8 billion in November, and offers an attractive 25% annualized return by employing advanced trading techniques.

The market’s expansion reflects more than just numerical growth. It demonstrates a sophisticated evolution in cryptocurrency infrastructure, with stablecoins serving as crucial liquidity mechanisms for traders and investors. The ability to maintain value while providing flexibility has positioned these digital assets as essential tools in the modern financial toolkit.

As an analyst, I’ve observed a significant increase in trading activities, with the volume of transactions involving stablecoin pairs on centralized exchanges soaring by 77% from one month to another, reaching a staggering $1.8 trillion. It’s worth noting that Tether (USDT) remains the undisputed leader, representing approximately 83% of these volumes. Following closely is First Digital’s FDUSD and USDC.

Stablecoin’s Testament to Resilience

The current market value of $190 billion for this sector stands out when compared to its past difficulties. Remember the Terra-Luna crash just two years ago that sent ripples throughout the crypto world, often labeled as “the crypto winter”? Despite such hardships, the stablecoin market not only bounced back but has flourished, demonstrating exceptional resilience and adaptability.

The variety of stablecoin choices has been instrumental in driving this revival. The market has broadened to encompass more than just one-to-one representations of traditional currencies, extending to tokens tied to conventional money as well as sophisticated financial instruments such as perpetual futures and crypto carry trades. Now, investors find themselves in a vibrant landscape teeming with choices offering stability, income opportunities, and strategic versatility.

Over the past month, a system involving 38 components (each tracking approximately 200 different digital currencies) has hit record highs in supply. This vigor within the stablecoin sector underscores an extraordinary level of activity. It’s evident that these digital assets are no longer just experimental financial ventures on the fringe, but a maturing and significant economic player with real-world importance.

Read More

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-11-27 19:39