To start the year, Bitcoin experienced a powerful price increase on January 6th, reaching over $100,000 for the first time in weeks. Subsequently, its price rose even further to $102,760 before undergoing a normal pullback, causing it to dip below $100,000. At this moment, Bitcoin is being traded between $96,000 and $102,000, with the total trading volume amounting to $6.58 billion.

Although Bitcoin’s latest price trends appear robust, the tale told by its funding rate data is somewhat contrasting. According to Glassnode’s statistics, the average Bitcoin funding rate has dipped to 0.009%, which falls below its neutral threshold of 0.01%. This unusually low funding rate indicates a prevailing long-term sentiment among traders that leans towards caution when it comes to investing in Bitcoin.

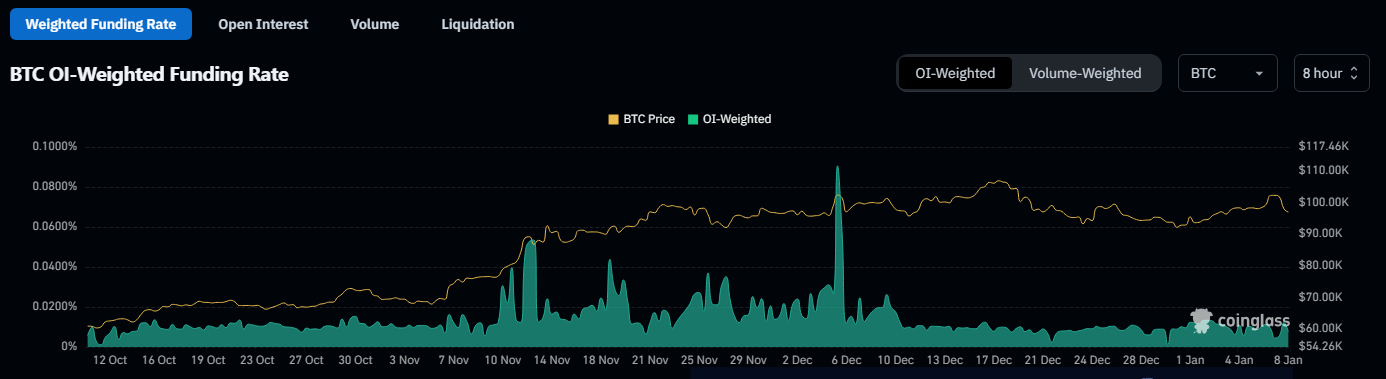

Following a high of 0.026% around mid-December, the moving average for continuous funding rates per week has dropped to 0.009%. This figure now sits slightly under the neutral point of 0.01%.

This implies a conservative approach, as speculators seem reluctant to pay higher prices for extended positions.

— glassnode (@glassnode) January 7, 2025

A Look At Bitcoin’s Average Funding Rates

One method of analyzing the market’s opinion on Bitcoin and other investments is by considering the average funding rate, which is among several technical indicators. The funding rate, represented as a percentage, is established by cryptocurrency exchanges for their perpetual futures contracts. In cases where the rate is positive, long positions are occasionally compensating short positions; however, when it’s negative, it means that short positions are periodically settling long positions.

Based on recent data, the average weekly funding rate has decreased to 0.009%, which is lower than the neutral benchmark of 0.10%. This week’s adjusted funding rate shows a significant drop compared to the 0.0026% recorded in mid-December, indicating that investors are generally being more cautious towards long positions.

Is Bitcoin’s Price Rally Sustainable?

Coinglass reported that the Open Interest-based Funding Rate rose slightly to 0.0058%, though it remains lower than its peak on January 5th at 0.0113%. Similarly, Coinshares disclosed that the Volume-based Funding Rate increased to 0.0051%, but this value is significantly less than its previous high of 0.0111%.

It’s intriguing to note that the drop in funding rates suggests that many traders are being cautious because Bitcoin has difficulty reaching and maintaining the $100k mark. This hesitance in investing in leveraged positions indicates a lack of confidence among traders about Bitcoin’s ability to continue its price increase in the near future.

What’s Next For Bitcoin?

This week has brought some positive developments in the market, with trading activity for certain assets picking up significantly. The daily trading volume for these assets jumped by 42%, reaching a staggering $85 billion. Additionally, open interest experienced a slight increase of 2%. As for the Long/Short ratio, it currently stands at 1.0243, indicating that investor sentiment remains relatively neutral. Furthermore, Bitcoin’s Chande Momentum Index (CMI) rose to 58.71 during its price surge above $100k, but momentum slowed as the price dipped below this level.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-01-08 21:04