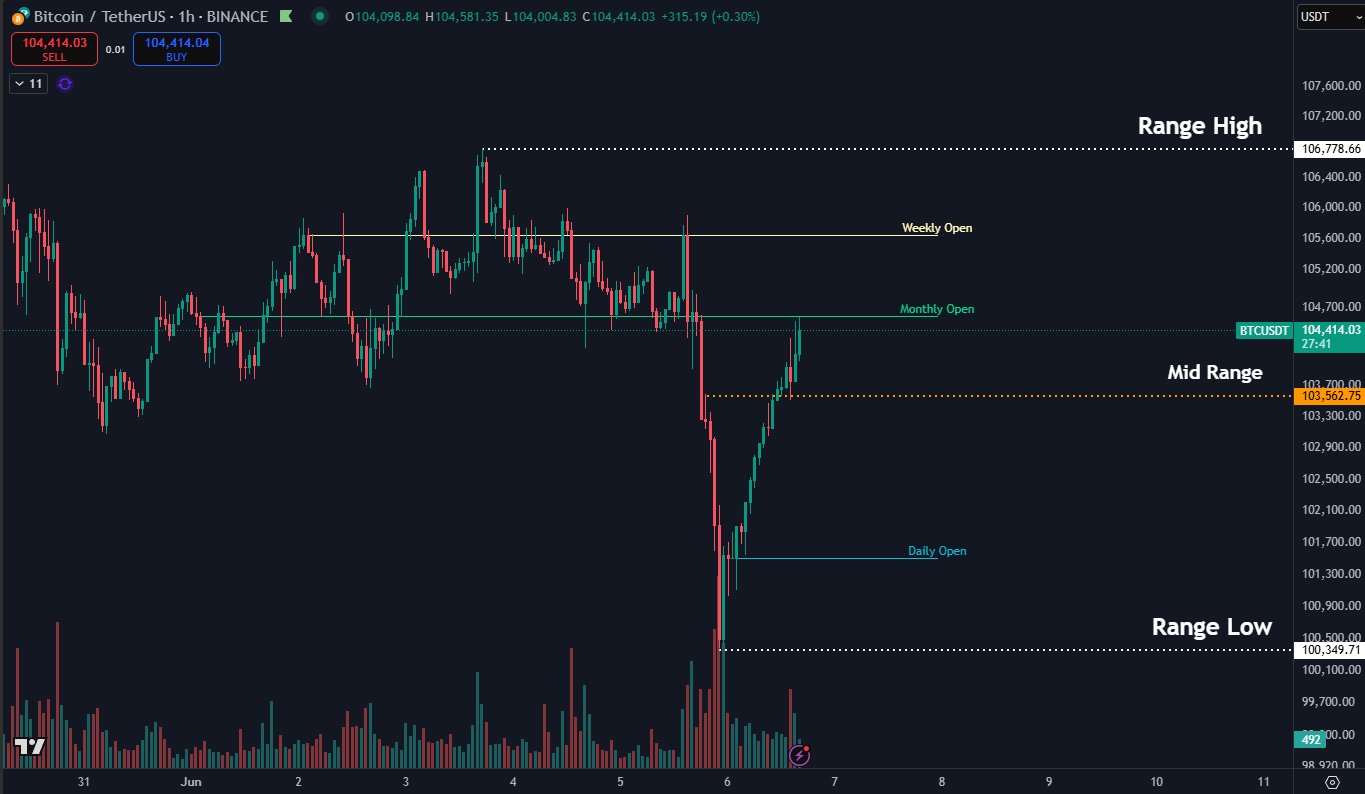

May was a month of reckless optimism, as Bitcoin soared from $95,000 to flirt with $112,000, only to be slapped back down—nature’s way of saying, “Calm down, young crypto.” Now, caught in a tightrope between $100,000 and $106,000, the digital asset lounges in the middle—comfy, for now. Support levels tease at $95,000 and $85,000, should the bears extend their reign, while the bulls dream of smashing past $106,000 for a ticket to $120,000.

Meanwhile, the market whisperers—charts, graphs, and RSI indicators—tell us Bitcoin might be done with its correction. At $104,650 and rising, the king of cryptocurrencies is strutting slightly above the $2 trillion mark, eyeing, perhaps, that overbought zone of 70+ RSI. Ah, the suspense! Will Bitcoin soar, or will it stumble? Stay tuned to this soap opera of digital riches. 🎭📉