As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-evolving cryptocurrency market, I must admit that watching Cardano (ADA) defy gravity is nothing short of exhilarating. After years of patiently waiting for its potential to be realized, it seems like the stars are finally aligning for this promising blockchain project.

Cardano (ADA) currently trades above the significant $1 mark, stirring hope amongst investors who see potential for more growth in the upcoming weeks. Following a robust surge in the last few weeks, this recent dip seems like a momentary halt in an overall uptrend.

Crucial on-chain data supports this outlook, indicating robust network activity that reinforces the bullish sentiment for ADA.

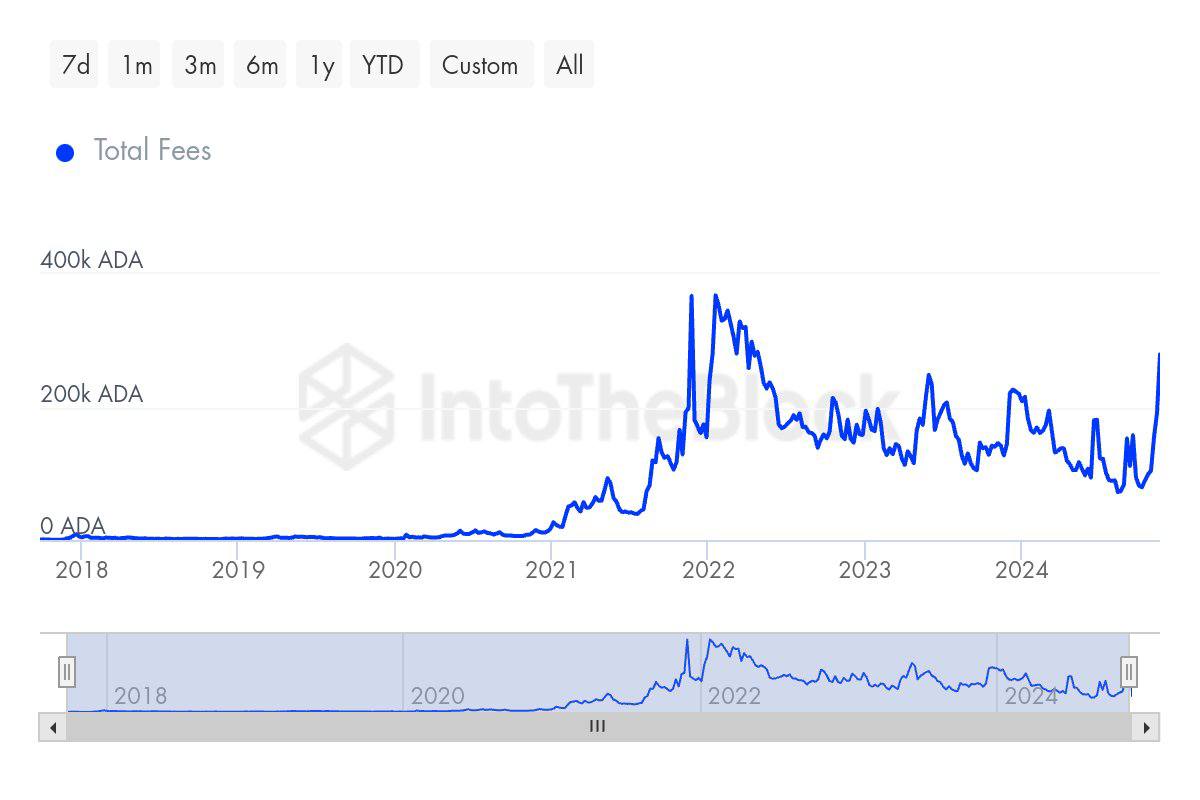

According to IntoTheBlock’s shared metrics, approximately 840,000 transactions have taken place on the Cardano network, accumulating a total of 279,000 ADA in fees. This data highlights the increasing use and interest in the Cardano blockchain, reinforcing its underlying robustness. Typically, such high network activity aligns with price growth, implying that ADA might continue to show strong performance.

If ADA surpasses $1, the market will scrutinize whether it can maintain this significant threshold and continue climbing higher. Both investors and analysts are hopeful, emphasizing the expanding usage of the network and robust transaction statistics as major elements contributing to its positive forecast. The upcoming weeks could prove crucial for Cardano, with a prolonged rise above $1 possibly indicating the continuation of its price increase.

Cardano Activity Growing

Cardano is currently reaching peak prices not seen for years, suggesting it could keep up its remarkable surge. Having breached the crucial $1 barrier at the start of this bull market, ADA has displayed robust momentum due to growing usage and investor trust. Data from IntoTheBlock analyst C Thumbs indicates several important achievements, indicating a consistent expansion in the Cardano network.

The latest data reveals that Cardano recently surpassed 840,000 transactions, with total fees reaching 279,000 ADA. Notably, the last time transaction volumes and fees were this high was in March 2022. This resurgence reflects the growing utility of the Cardano blockchain, transitioning from being primarily speculative to demonstrating real-world value.

Taking a more detailed examination of holding patterns supports this change. Since July 2022 up to now, there has been consistent growth in ADA holders, pointing towards growing faith in the blockchain’s future prospects. In contrast to earlier cycles, where ADA’s price fluctuations were mostly due to speculation, the current surge seems to be rooted in actual network activity and adoption.

As the popularity of Cardano grows, investors are zeroing in on the next major supply threshold. Given the strong network action and optimistic mood, ADA seems poised to aim for fresh records, thereby solidifying its position as a top-tier blockchain in the cryptocurrency market.

ADA Testing Crucial Supply

In just under a month, the digital currency Cardano (ADA) has seen an impressive surge of approximately 250%, demonstrating robust bullish energy as it gains ground in the financial market. At present, ADA is trading at around $1.06, edging ever closer to its annual peak of $1.15 – a significant resistance point that could shape its future price trend.

If ADA surpasses the $1.15 mark, it might trigger a substantial surge aiming for the next resistance levels at $1.25 and possibly $1.60. This breakthrough could indicate increased investor trust and enduring interest, further strengthening Cardano’s reputation as one of the most vibrant cryptocurrencies within the current market cycle.

Should ADA not maintain its strength above the $1.15 mark, there’s potential for the price to slide downwards and retest support levels at $1.00 or even lower. This could suggest a brief halt in the upward trend, giving investors and traders an opportunity to evaluate the market situation.

Keeping an eye on Cardano’s price fluctuations as it approaches critical points, investors and traders alike will scrutinize its movement to decide if the upward trend continues or if a pause in growth is imminent, shaping the near future trajectory of this swiftly ascending cryptocurrency.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-11-30 05:10