As a seasoned researcher and cryptocurrency analyst with years of experience tracking the market dynamics of various digital assets, I find myself observing yet another challenging period for Cardano (ADA). Despite the recent dismissal of the SEC’s complaint regarding ADA, Polygon (MATIC), Solana (SOL), and other tokens in the Binance lawsuit, the market outlook remains gloomy for ADA.

As a seasoned cryptocurrency investor with years of experience under my belt, I’ve learned to navigate the volatile waters of the digital asset market with a steady hand and keen eye. Recently, I’ve been closely monitoring the performance of Cardano (ADA). Despite the recent ruling by the U.S. Securities and Exchange Commission (SEC) that dropped its complaint about ADA and other tokens like Polygon (MATIC), Solana (SOL), in the Binance lawsuit, I find myself disappointed with the lackluster response from the market regarding ADA’s price movement.

Cardano Price and Technical Indicators

Based on technical analysis, it appears that selling pressure is currently pushing down the price of ADA, and its on-chain data isn’t showing any positive signs at the moment. Over the past 24 hours, the value of ADA has decreased by 0.56%, causing it to trade at approximately $0.4014. This decline also resulted in a decrease in ADA’s market capitalization by the same percentage, ranking it as the tenth largest cryptocurrency in terms of market cap.

As someone who has been actively involved in the cryptocurrency market for several years now, I have learned to read between the lines when it comes to trading volume and market sentiment. Looking at the trading volume of a particular coin being at $287.58 million with a 1.86% drop over the last 24 hours, I can’t help but notice the downward trend. It seems that investors are losing interest in this coin in the short term, and if this market sentiment continues, we might see a sell-off trend emerge. This is not the first time I’ve seen this pattern, and unfortunately, it often signals a potentially difficult period for those invested in the coin. So, I would advise caution to anyone considering investing or trading this particular asset.

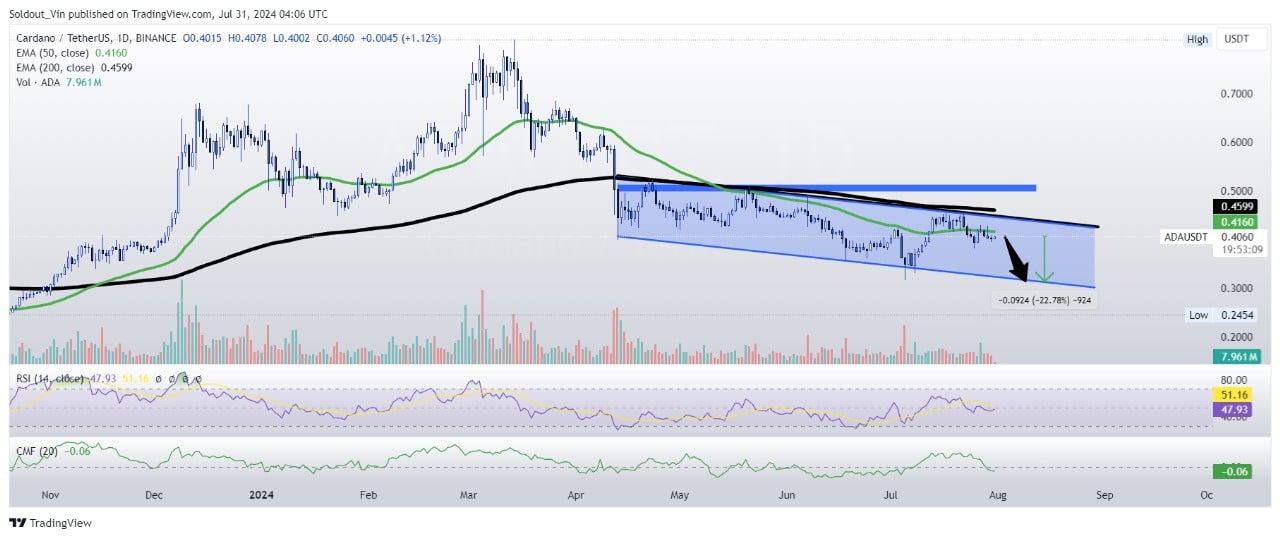

It seems that the decline in ADA‘s price might be due to a pattern of successive highs and lows becoming progressively lower, as well as the fact that its trading value is below both the 50-day (represented by the green line) and 200-day (illustrated by the black line) Exponential Moving Averages (EMA), which could suggest a downward trend.

Photo: TradingView

- Ordinarily, the lower boundary of the descending channel and historical price action have shown that the primary support level for Cardano price is around $0.30. A continuously negative performance may trigger a 22% drop in price to find support at the yearly low of $0.3165. The next resistance level is at $0.42 and this is close to the 50-day EMA.

As I delve into the analysis, I notice a notable resistance at approximately $0.50, a point where the 200-day Exponential Moving Average (EMA) aligns with previous highs. This convergence suggests a stronger barrier for price increases.

Currently, the Cardano’s Capital Miscellaneous Factor (CMF) stands at -0.07, suggesting a higher rate of outgoing funds or negative money flow compared to incoming funds, also implying more significant seller pressure relative to buyer pressure.

The Emergence of Chang Hard Fork

Despite facing pressure from ADA metric challenges, Cardano has more reasons to cheer. Just last week, the network launched the Cardano node version 9.1.0, marking the arrival of the eagerly awaited Chang Hard Fork update. Notably, this new node version includes a Conway genesis file that starts up with the network, which was not present in the previous iteration (node 9.0.0).

As a result of the Chang Hard Fork, the development company IOHK is now free from the obligation of directly managing Cardano’s seven-year-old blockchain. From this point forward, the responsibility for its management and operation will be handed over to the community members.

Moreover, Cardano introduces a novel governance structure, aiming at fostering a more distributed network environment as it advances.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Bitcoin’s Record ATH Surge: Key Factors Behind the Rise and Future Predictions

2024-07-31 15:28