As a seasoned crypto investor with a keen interest in technical analysis, I find Santiment’s latest findings intriguing. Based on the RSI metric, Cardano (ADA) appears to be presenting a better buying opportunity than some of its top counterparts at the moment. With an RSI value close to the oversold level at around 32.4, ADA could potentially offer attractive entry points for investors.

According to the analysis conducted by Santiment, the current market conditions suggest that Cardano (ADA) may present a somewhat more attractive buying opportunity compared to other leading cryptocurrencies.

Cardano May Be Showing A Good Buying Opportunity According To RSI

Santiment analyzed the latest blog entry on X and delved into the recent RSI trends of the leading cryptocurrencies.

As a technical analysis (TA) expert, I would describe the RSI (Relative Strength Index) as a valuable tool I use to monitor the speed and size of price fluctuations in a particular commodity.

The momentum oscillator serves as a common tool for determining if an asset is currently overpriced or underpriced based on market trends. Its readings are presented on a range of zero to one hundred.

When the Relative Strength Index (RSI) of an asset surpasses 70, it’s often seen as a signal that the asset is overbought and may experience a correction. Conversely, when the RSI falls below 30, it can be interpreted as the asset being oversold, potentially setting up for a price rebound.

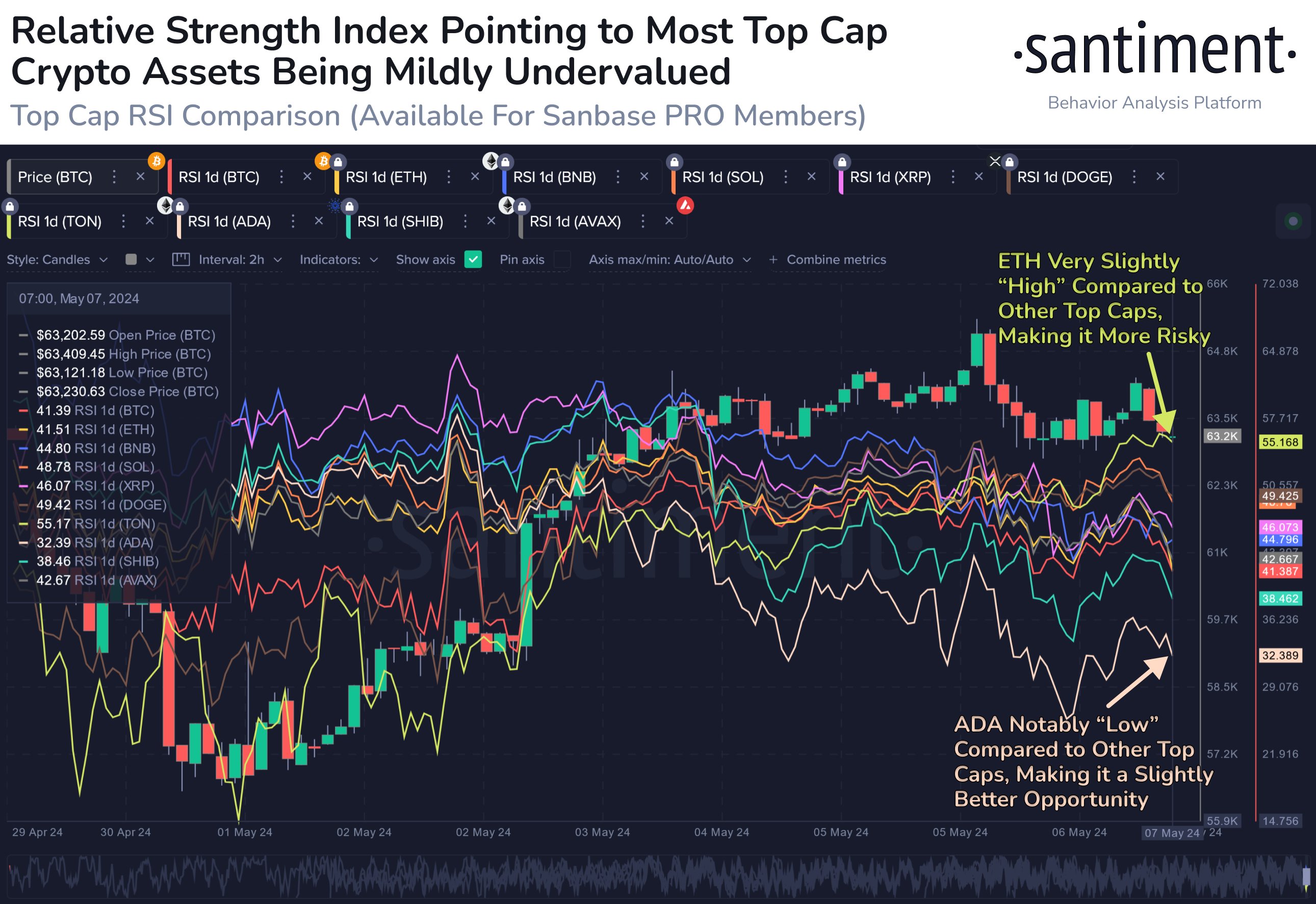

Here’s a look at the 1-day Relative Strength Index (RSI) trends for some leading cryptocurrencies, as depicted in the chart provided by the analytics firm.

Looking at the graph before you, as a crypto investor, I see that Cardano (ADA) has the least favorable RSI reading among these top cryptocurrencies, with a value of approximately 32.4 for the past day. While this RSI level doesn’t yet indicate an undervalued asset, it might be hinting at a promising entry point given its proximity to the underpriced zone.

From my perspective as a researcher examining the data provided by Santiment, it seems that most leading assets present a modest purchasing chance. Among these, Shiba Inu (SHIB) is currently the least expensive one, with a Relative Strength Index (RSI) reading of 38.4.

Bitcoin (BTC) and Ethereum (ETH) currently have prices that appear somewhat underpriced, as their Relative Strength Index (RSI) values hover around the 41 threshold. Dogecoin (DOGE), on the other hand, is relatively neutral at present, with its RSI slightly below the 50 mark.

Based on the RSI metric, Toncoin (TON) seems to be the most risky investment among these top assets at the moment, with an RSI reading of 55.1. However, it’s important to note that this value is relatively close to the neutral level of 50.

It is yet to be determined how the price of Cardano will progress moving forward, considering that the Relative Strength Index (RSI) indicates it may be the most underappreciated coin among the leading cryptocurrencies.

ADA Price

Cardano’s value has yet to bounce back since its setback in the previous month. Every effort to regain momentum has proven unsuccessful, resulting in the cryptocurrency returning to a holding pattern at approximately $0.44.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-08 21:04