As a seasoned crypto investor with a decade of experience under my belt, I can confidently say that the current market conditions have me intrigued, especially when it comes to Cardano (ADA). Having witnessed its meteoric rise in 2020 and subsequent performance, I find myself drawn to its recent price action.

The cryptocurrency market is getting hotter as Bitcoin is nearly touching record highs and there’s a strong sense of an imminent surge across various assets. Interestingly, Cardano (ADA) is standing at a significant point, mirroring its price trend from 2020—a year that witnessed ADA’s remarkable rise by more than 4,000% within just one year.

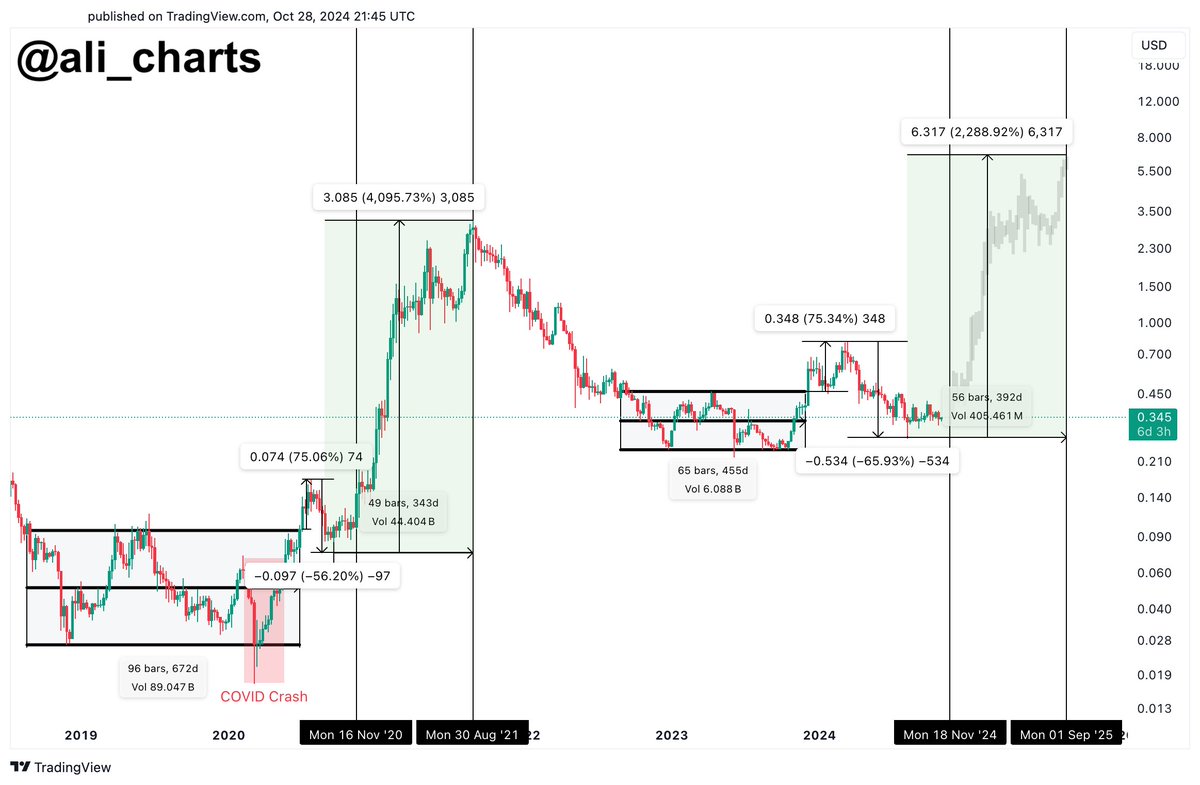

In simple terms, well-known analyst Ali Martinez recently discussed some technical analysis that suggests Cardano (ADA) is currently structured similarly to November 2020. He believes that ADA’s recent period of consolidation at significant points might lead to a substantial price increase, potentially following the U.S. election in the near future.

Martinez’s study underscores that Cardano often experiences rapid expansion following phases of accumulation. If Bitcoin achieves new record-breaking prices, this pattern might lead to a powerful surge for Cardano. Given this, investors are intensely focusing on ADA’s price fluctuations, hoping it will mirror its past bullish trends. As the market readies itself for a potential transition, the behavior of Cardano in the forthcoming weeks could provide valuable clues about the overall altcoin trend during this cycle. In other words, the next actions could be critical, making ADA an essential token to monitor in the fast-changing crypto environment.

Cardano Following 2020 Bullish Pattern

Analysts and investors are intrigued by Cardano right now because they believe the recent consolidation could mean that people are accumulating it, suggesting a significant increase is coming soon. Renowned analyst Ali Martinez recently provided a technical analysis on this topic, noting similarities between Cardano’s current price trends and its behavior in 2020 – a year when ADA skyrocketed by an astonishing 4,000%.

Based on Martinez’s analysis, Cardano’s price behavior seems to be mirroring a comparable setup, hinting at a potential breakout around November 18. This timing is approximately two weeks post-U.S. elections and is consistent with historical trends. During such periods, ADA tends to gather strength before significant upward surges.

According to Martinez’s assessment, the long-term forecast for Cardano (ADA) suggests a bullish goal of $6.30, which would signify a possible 2,000% rise from the current value. If this trend develops, it could culminate in a peak for the Cardano market around September 2025. This projection is grounded on ADA’s recurring price patterns, where substantial rallies have typically transpired following phases of reduced volatility and accumulation, fueled by investor sentiment and broader cryptocurrency acceptance.

Multiple investors are now keeping a close eye on ADA, as a surge in its value wouldn’t just be significant for Cardano but might also indicate a broader upward trend among alternative cryptocurrencies. The current price point of Cardano has drawn both institutional and individual investors who are looking for opportunities before what appears to be a major price increase.

Looking at both the on-chain information and technical signs, it seems likely that ADA’s future price movements might shape the altcoin market trend in the near future. If past trends hold true, Cardano could be gearing up for one of its strongest rallies, potentially drawing in fresh attention and investments into its ecosystem.

ADA Technical Levels

Currently, Cardano is being traded at approximately $0.346. It faced a noticeable resistance when it approached the 4-hour 200 exponential moving average (EMA) at around $0.351. If Cardano manages to break through this level and sustain it as support, it could indicate a possible transition towards a short-term upward trend.

To reestablish dominance over the price trend of ADA for the bulls, it’s crucial to secure a solid position above the 200 Exponential Moving Average (EMA). This strategic placement could draw in more buyers, thereby enhancing the positive price movement.

Furthermore, the $0.37 region poses a considerable challenge for Cardano (ADA), as its upward momentum has been hindered at this price point since early October. This level has acted as a strong resistance, suggesting that substantial buying power is required to surpass it and maintain growth beyond this point. A bullish trend might gather momentum if ADA manages to exceed the 200 Exponential Moving Average (EMA) and the $0.37 supply zone.

If these levels aren’t taken, it’s probable that Cardano’s (ADA) price will keep moving in a horizontal direction temporarily. This kind of trend could help the market to settle down and perhaps draw new investors, but it might postpone any substantial increase in ADA’s value.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-10-29 21:05