As a seasoned crypto investor with a knack for navigating the choppy waters of the digital asset market, I find myself standing at a crossroads with Cardano (ADA). The recent price action has been less than inspiring, and we’re currently hovering near yearly lows. The $0.36 resistance level seems to be an insurmountable hurdle, and the lack of whale activity raises red flags about potential downside pressure.

Currently, Cardano (ADA) is approaching its annual minimum prices following several months of lackluster performance in the market. Since early August, the price has been battling to stay above the important $0.36 mark, which has proven challenging. This downturn has put ADA in a delicate state, prompting investors and traders to closely monitor for indications of a potential rebound.

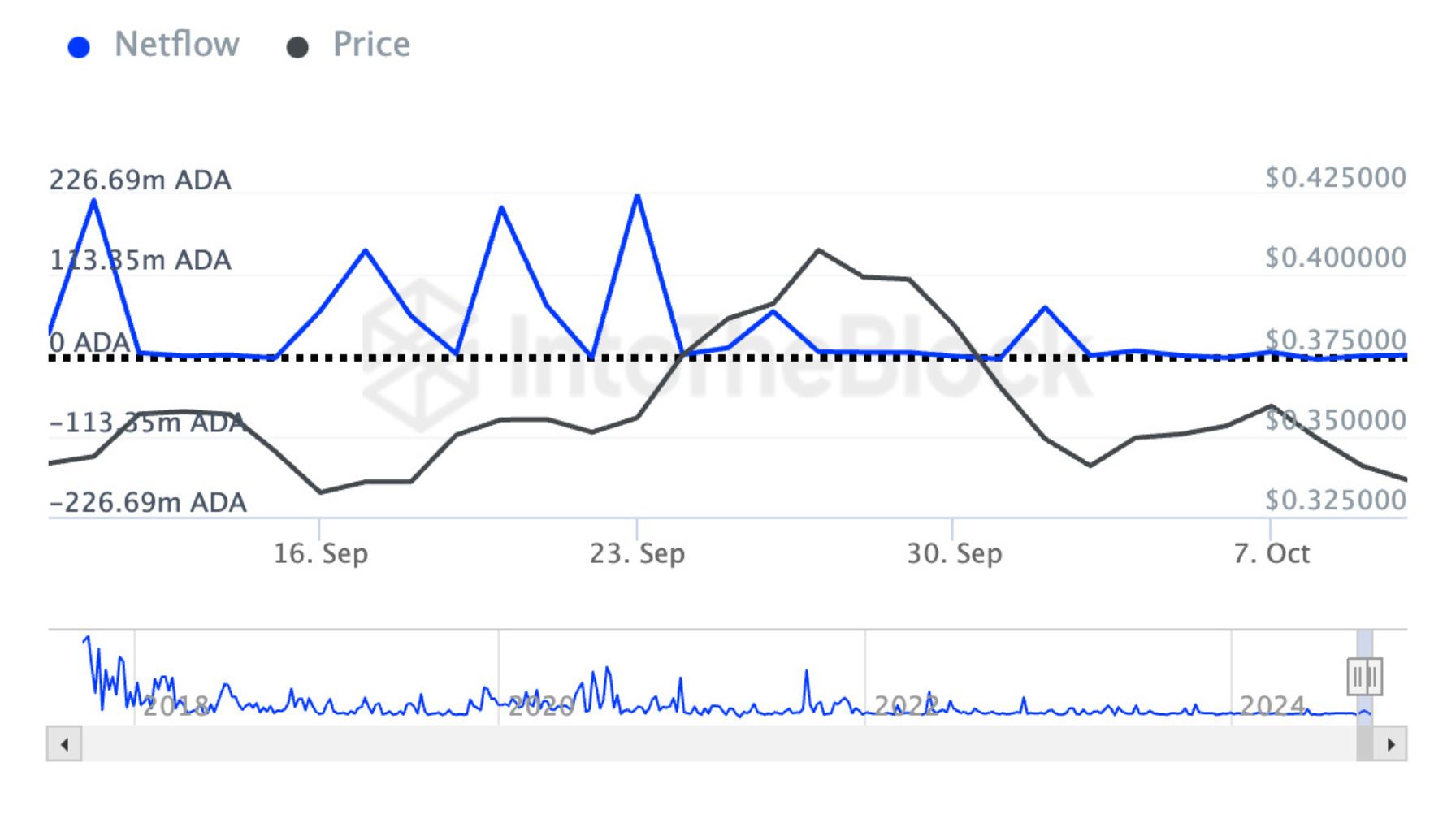

According to insights from IntoTheBlock, there’s been a substantial decline in whale activity during the last month, potentially hinting at increased downward price influence. The reduction in big-scale transactions indicates that prominent investors might be withdrawing, thereby increasing the probability of a more pronounced correction for the altcoin.

If Cardano (ADA) doesn’t manage to surpass the $0.36 resistance in the near future, it seems likely that a 30% drop back to lower demand zones could occur. Traders are watching closely for signs of either a breakthrough or continued decreases, as the overall market remains volatile. The upcoming days will play a significant role in predicting Cardano’s short-term trend.

Cardano Whales Leaving Early?

Currently, Cardano finds itself at a pivotal point in terms of liquidity, as on-chain data suggests a possible continued drop, considering the substantial decrease in whale activity. Recent findings from IntoTheBlock reveal an alarming pattern: Large ADA investors, or ‘whales’, have been increasingly disposing of their holdings for the past month. This trend is underscored by the 100% drop in ADA’s large holders’ netflow, which signifies the imbalance between the amount these addresses are purchasing and the amount they are selling.

A significant number of investors control a large portion (over 0.1%) of the circulating Cardano supply. When the rate at which they’re selling exceeds their buying activity, it could indicate a decrease in confidence towards Cardano. This reduced faith can sometimes spread to smaller retail investors, causing them to also sell off their holdings.

Over the past month, there’s been a decrease in large investors (whales) holding ADA, which suggests they’ve been selling. This has sparked worries among some investors that these ‘Smart Money’ players might be leaving the Cardano market. If this trend persists, it could drive ADA prices down below its current liquidity point, leading to a more significant price adjustment or correction.

Market observers are keeping a close eye on these recent events because the departure of major shareholders might indicate a pessimistic outlook, potentially causing a substantial drop in prices. During this crucial time for Cardano, investors will be on the lookout for indications of improvement or continued weakness in the near future.

Key Levels To Watch

At present, Cardano (ADA) is being traded at around $0.35. Over the past few days, its price action has been volatile and struggling to break through the significant resistance point at $0.36. The current price stands 15% below the 200-day exponential moving average (EMA), which lies at $0.40 – a level that bears have held firm against so far, making it challenging for bulls to reverse the ongoing downward trend. This critical level was lost in April, and since then, ADA has unsuccessfully attempted to close above it on four separate occasions.

If the price trend persists, there might be a more substantial drop towards new yearly lows at around $0.25. This move would equate to approximately a 30% pullback from current values, making the bearish outlook even stronger. Market participants are alert to these crucial price thresholds because if the moving average can’t be regained and the $0.36 resistance isn’t breached, it could lead to heightened selling activity.

Traders analyze trends in ADA‘s price fluctuations to decide whether it might experience an upcoming surge (breakout) or a significant drop in the near future, based on indications of its strength or weakness.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-12 16:16