As a seasoned crypto investor with a knack for identifying promising projects and a portfolio that mirrors the ever-evolving digital asset landscape, I have to admit, Cardano (ADA) has caught my attention lately. Despite the bearish trend that swept through the global market this July, Cardano managed to stand tall amidst the storm, showcasing resilience and growing user engagement.

Starting from July, there’s been a significant drop in the total crypto market value, which was previously $2.7 trillion in May and fell to $2.5 trillion. Most cryptocurrencies followed this downward trend, but surprisingly, Cardano (ADA), one of the top 10 cryptos by market cap, has managed to resist this bearish pattern.

As a crypto investor, I’ve been closely observing the Cardano blockchain, and July has truly showcased its strength amidst market turbulence. Data from the Cardano Foundation highlights that not only is the network maintaining its activity levels, but it’s also gathering momentum – a testament to its resilience and growing user engagement.

Cardano July Growth

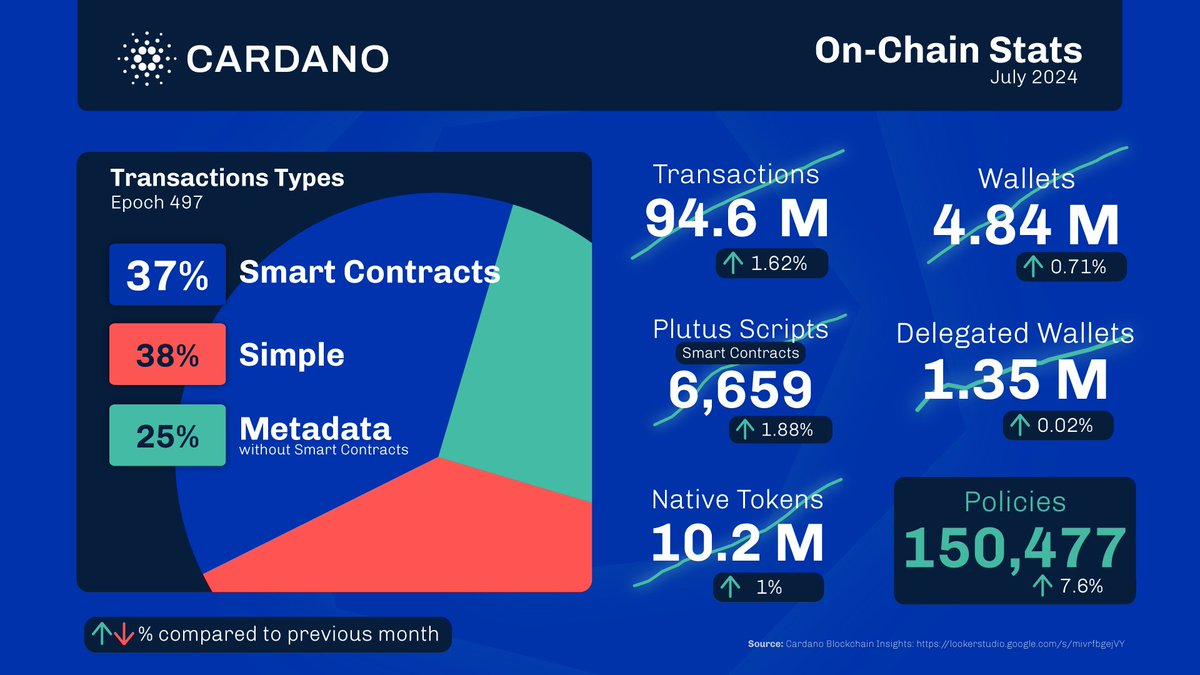

As a proud Cardano investor, I’m thrilled to share some exciting news about our network’s growth. According to data unveiled by the foundation, our transaction volume has witnessed a modest yet significant surge, reaching an impressive 94.6 million transactions – that’s a 1.62% increase from the previous month. This upward trend bodes well for Cardano’s future!

Related Reading: Cardano Goes Toe-To-Toe With Ethereum As Whales Scoop Up 120 Million ADA

As a crypto investor, I’ve noticed this recent surge is broken down into multiple transaction types, demonstrating a wide array of applications for blockchain technology. Interestingly, about 37% of these transactions were smart contracts, underlining the network’s robust capabilities that extend far beyond basic transactions, which accounted for 38%.

Furthermore, about a quarter of users utilized metadata instead of smart contracts, demonstrating the versatility of blockchain technology and its broad range of possible uses.

As a crypto investor, I’ve noticed significant progress in various crucial aspects of the Cardano network, according to the foundation’s latest data. This growth highlights the ongoing technological innovations and increasing user engagement within this dynamic ecosystem.

On Cardano, there was a 1.88% surge in usage of Plutus scripts – a key component for executing smart contracts – reaching 6,659 in total. This uptick demonstrates the rising interest from developers and the deployment of increasingly intricate applications on this platform.

Additionally, there was a 1% increase in the number of native tokens, bringing the total to approximately 10.2 million, and a substantial 7.6% jump in policies, raising the count to over 150,477.

As an analyst, I’ve observed that the growth in the Cardano community is becoming more inclusive, as evidenced by a rise in the total number of Cardano wallets. Specifically, this figure has grown by approximately 0.71%, reaching a significant milestone of 4.84 million wallets. Notably, delegated wallets have also seen a minor increase of 0.02%, now standing at 1.35 million.

The modest increase in ADA holders using delegated wallets indicates a consistent level of enthusiasm for staking and governance involvement among them.

ADA Current Market Performance

Despite a significant surge in on-chain activities for Cardano last month, its native token, ADA, has followed the broader cryptocurrency market’s downturn. In just the past day, ADA’s value has dropped by approximately 7.1%.

The drop in value caused the asset to be priced at $0.3202 as I write this – slightly higher than the $0.2789 it was earlier today.

Despite a recent dip, it’s worth noting that ADA‘s 24-hour trading volume has experienced a substantial increase. It was around $400,000 yesterday, but now it stands at approximately $1.25 million at this moment.

Read More

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- Brody Jenner Denies Getting Money From Kardashian Family

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

2024-08-06 11:10