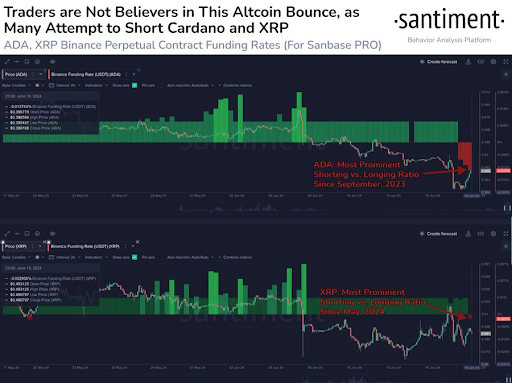

As a seasoned crypto investor with a keen interest in market analysis, I find Santiment’s recent observation about the heavy trader shorting in Cardano (ADA) and XRP intriguing. Having closely followed the performance of these two tokens over the past few years, I can attest to their underperformance this year, especially when compared to other top 50 crypto tokens by market cap.

As an analyst, I’ve noticed that on-chain analytics platform Santiment has identified a potential factor that could lead to Cardano (ADA) and Ripple (XRP) experiencing additional price increases. Both cryptocurrencies experienced brief rallies following the recent market downturn, but many traders in the market view this as merely a relief rally rather than a bullish reversal.

Heavy Trader Shorting Could Lead To Price Rises For Cardano And XRP

As a cryptocurrency market analyst, I’ve noticed an intriguing observation made by Santiment in a recent post on X (formerly Twitter). They suggested that the significant short positions against Cardano and XRP could potentially serve as “rocket fuel” for further price surges of these altcoins. Previously, Santiment had highlighted that both Cardano and XRP were among the altcoins with the most substantial short positions after their relief bounces.

It’s intriguing that investors view the mass liquidation of short positions in Cardano and XRP as a positive indicator for these cryptocurrencies. The rationale being that this sell-off could provide the necessary fuel for these altcoins to regain momentum and surge higher in value. The fact that both Cardano and XRP are among the most heavily shorted coins in the top 50 crypto tokens, given their underperformance in the market this year, comes as no surprise.

As a researcher studying the cryptocurrency market, I’ve observed that Cardano (ADA) and Ripple (XRP) have historically underperformed during significant relief rallies experienced by Bitcoin (BTC) and the broader crypto market. However, this time around, things might be different. While some altcoins are struggling to keep up with the market’s momentum, Cardano and Ripple have shown modest price recoveries.

As a crypto investor closely monitoring market trends with the help of Coinglass data, I’ve noticed an intriguing development regarding Cardano and Ripple: Santiment’s theory might be materializing. In the last 24 hours, bearish positions on Cardano and Ripple have experienced considerable losses, leading to the liquidation of over $50,000 in Cardano short positions and around $30,000 in XRP short positions. Surprisingly, there were no long position liquidations reported for either asset during this period.

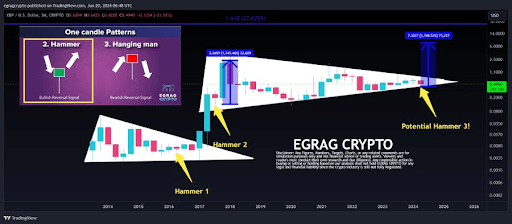

A Major Move Might Be On The Horizon For XRP

Crypto expert Egrag Crypto has forecasted a potential price surge of approximately 1,700% for XRP, which could begin as early as July. This prediction is based on XRP’s historical pattern of quarterly hammer formations. In the past, these hammer formations occurred between April-June 2016 and July-September 2017 preceding significant price increases. For XRP to repeat this bullish trend, it must close its 3-month candlestick above the resistance level of $0.55 to $0.58 within the next ten days.

If the hammer formations in XRP‘s price chart resemble those from 2016, Egrag predicts that the crypto token could initiate a remarkable price surge of approximately 1,700% starting in July, potentially reaching a value of $8. Conversely, if the hammer formations mirror those from 2017, XRP investors may need to be patient for an additional six months before experiencing a significant rally around 5,500%, pushing XRP’s price up to $27.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-06-20 20:46