As a seasoned researcher with years of experience tracking various cryptocurrencies in this rollercoaster market, I find myself constantly impressed by Cardano’s resilience and potential. The recent surge of over 10% is undeniably eye-catching, but it’s the on-chain data that truly piques my interest.

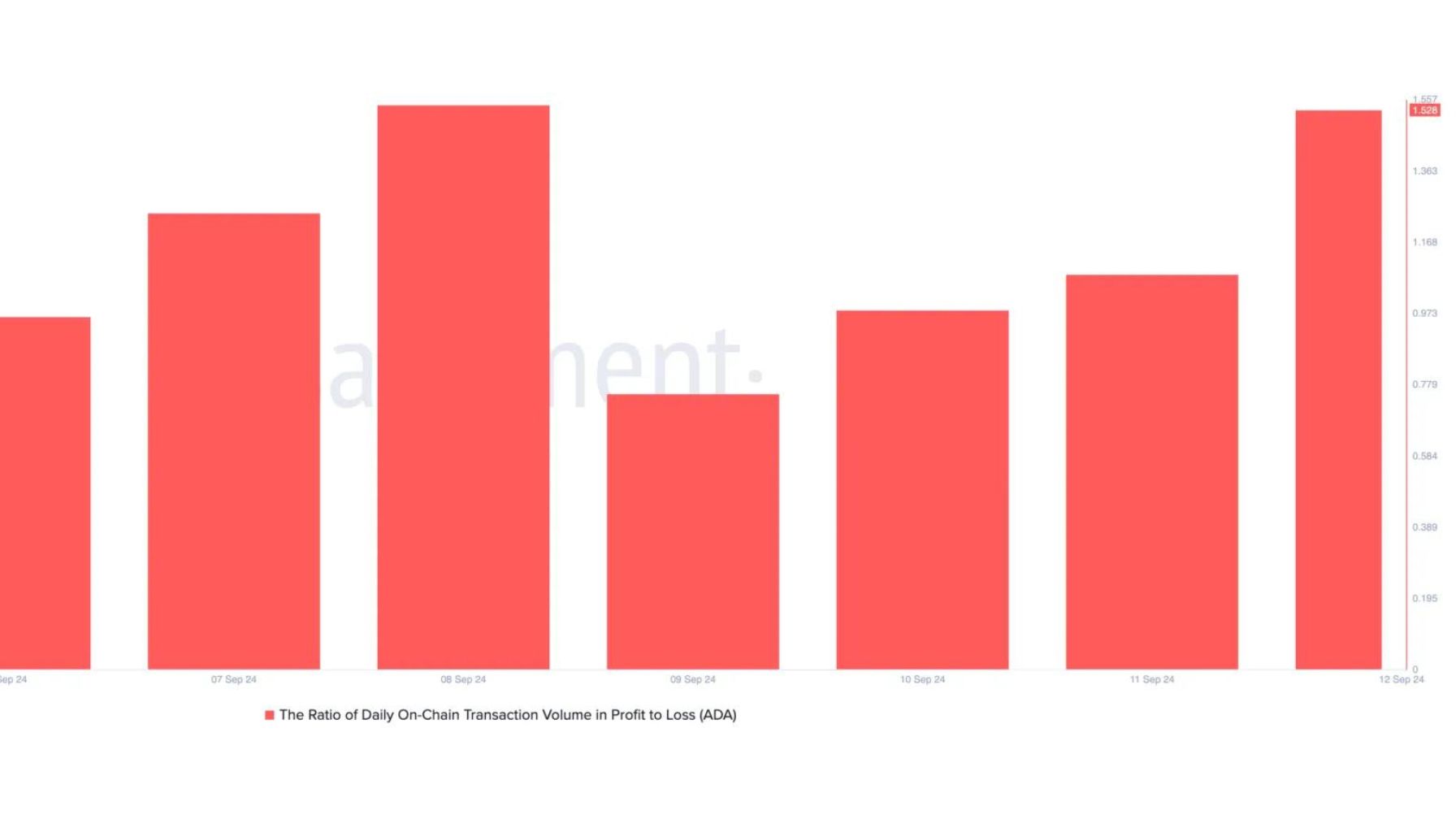

Cardano has experienced a 10% increase and breached a significant resistance point, potentially indicating higher future prices. However, the overall upward trend might be tempered as data from the blockchain shows long-term holders are starting to cash out their profits. The daily transaction data shows that more trades are currently profitable than loss-making, hinting at numerous investors cashing in on recent returns.

In a constantly changing market scenario, ADA consistently aims to keep its upward trajectory, fueled by favorable opinions and increasing hopes for future price increases. Yet, this profit-taking behavior suggests that certain investors are being cautious and taking profits, which might result in temporary fluctuations in the price.

Anticipating further gains in the upcoming period, investors are keeping a close eye on ADA‘s progress to determine if it can maintain its current momentum. The forthcoming days could provide insight into whether Cardano can stay above these price points and potentially reach new record-breaking heights.

Cardano Long-Term Holders Selling

Cardano is currently examining potential support points following a notable rise, as investors are adopting a more conservative approach when it comes to their immediate trading tactics.

Yesterday, the proportion of daily transactions on the ADA chain where profits were made over those resulting in losses was approximately 1.53. In simpler terms, this means that for every transaction where someone lost money, there were around 1.53 transactions where someone made a profit. This data suggests that many investors are benefiting from recent price increases, causing some long-term holders to sell their ADA coins at a profit.

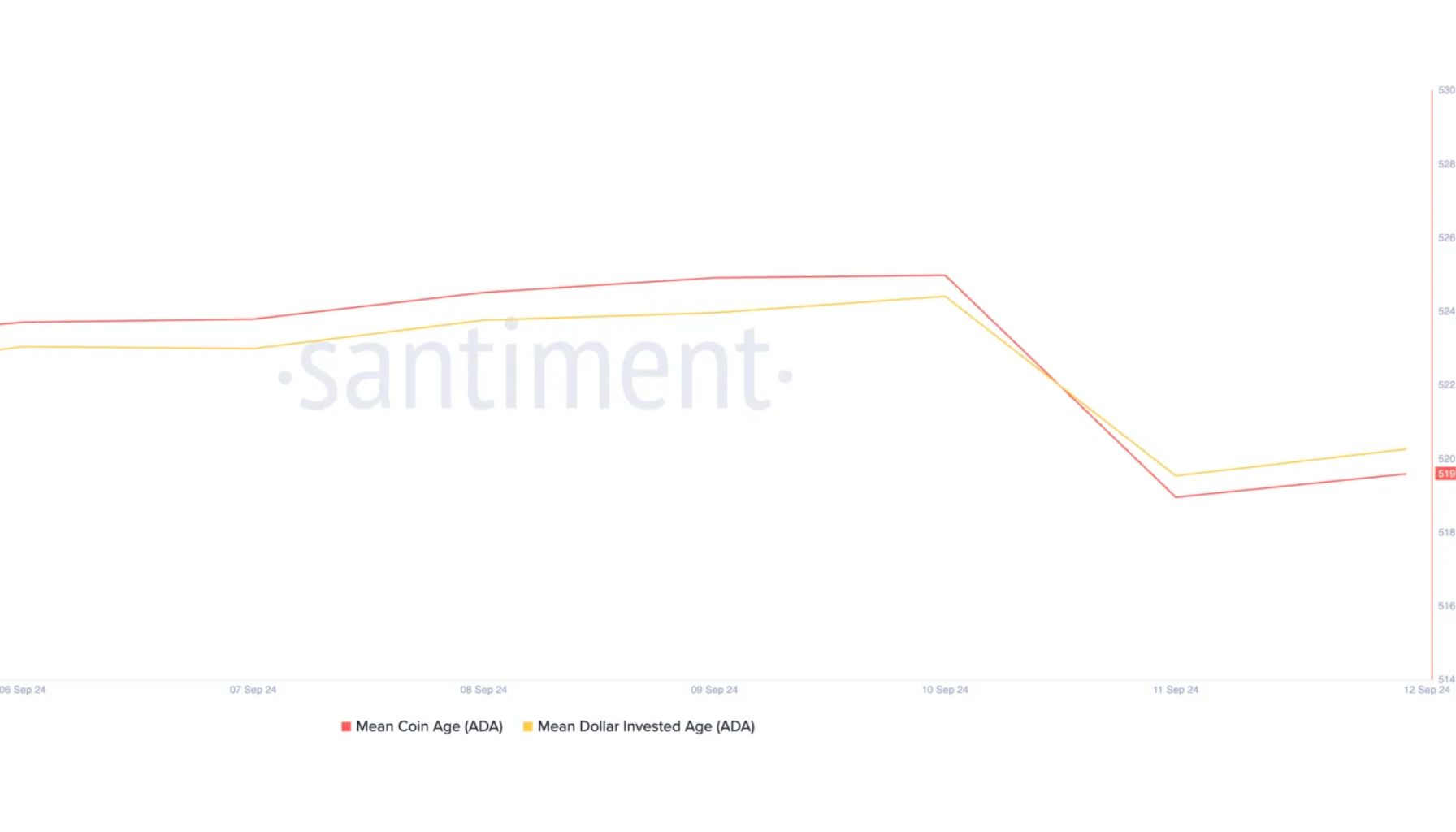

According to Santiment’s data, there seems to be a minor decrease in Cardano’s Average Coin Age and Average Dollar Invested Age on September 11. These measures indicate long-term holder behavior, representing the typical age of ADA coins and the sum invested over time. When these figures drop, it usually means that holders who bought ADA at lower prices are now cashing out, thereby reducing the average age of the coins they hold.

As a researcher, I’m observing that despite the ongoing selling pressure, I remain optimistic about Cardano (ADA) maintaining its bullish trend if market conditions persist favorably. The cryptocurrency could potentially reach higher price levels, but the cautious approach demonstrated by experienced investors suggests that any rally might encounter resistance imminently.

In the upcoming period, it’s essential for ADA to maintain its present elevated position to signal an ongoing upward trend. Should buyers reclaim dominance and the demand surge, Cardano might breach significant resistance barriers and strive for record-breaking heights.

ADA Price Action Details

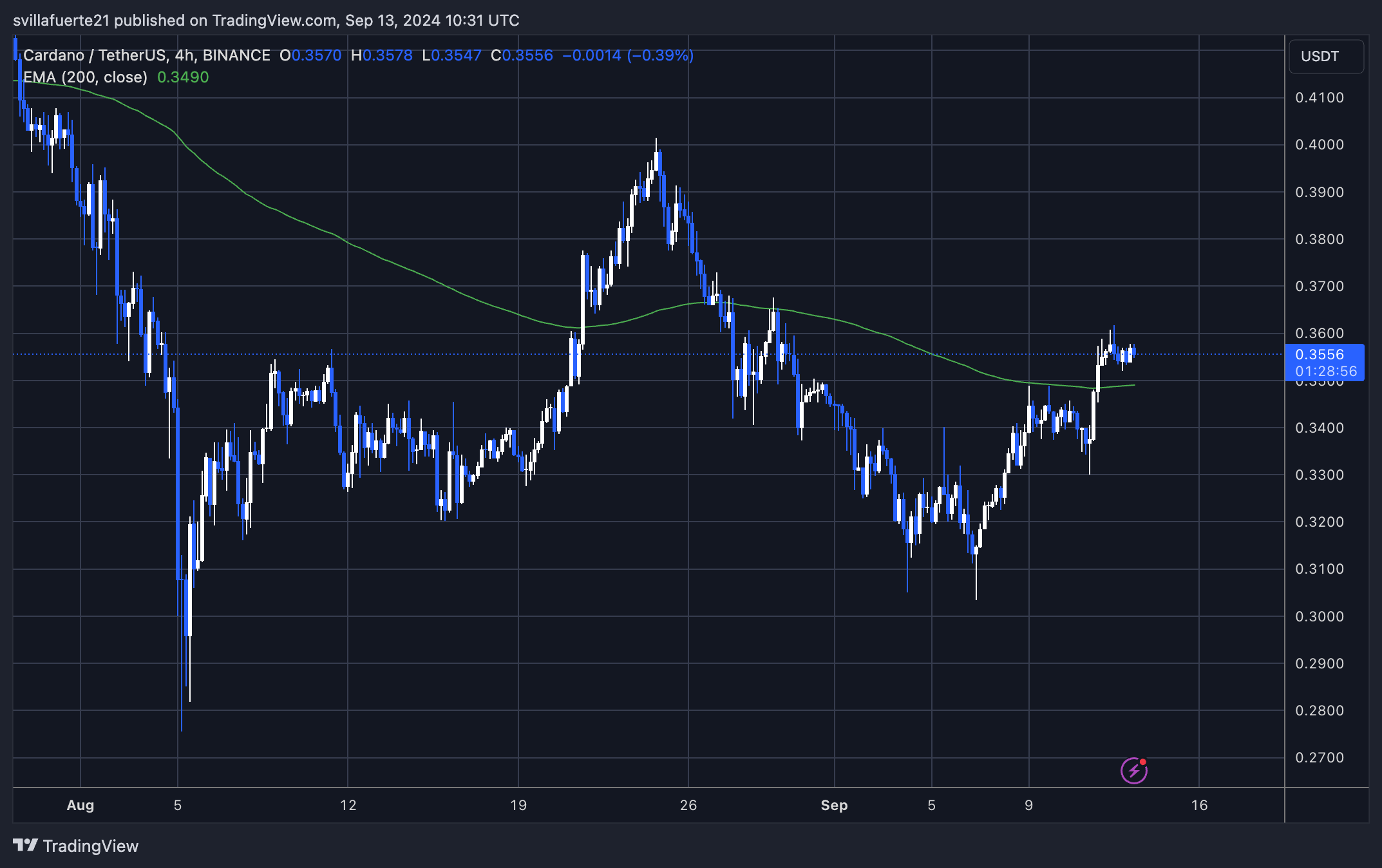

Currently, ADA is trading at approximately $0.3565. It recently encountered significant resistance at $0.36 but managed to close above the 4-hour 200 Exponential Moving Average (EMA), which currently stands at $0.3490.

In simpler terms, ADA has recently managed to overcome a level it previously considered strong resistance back in early August. Retaking this 4-hour 200 Exponential Moving Average (EMA) is essential for keeping the current upward trend intact.

If ADA successfully retests the Exponential Moving Average (EMA) and maintains it as a support, it would indicate a short-term bullish momentum. Should it break and sustain above this level, it implies that ADA might continue its upward trajectory. The projected future price ranges for ADA, according to investors and analysts, are between $0.38 and $0.40.

Should ADA fail to hold its current support level, there’s a chance it might slide down to areas of reduced buying interest, potentially reaching approximately $0.33. Such a move could indicate a weakening trend and might provoke additional selling, leading to further price declines.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-09-14 01:16