As a seasoned researcher who has witnessed the ebb and flow of the crypto market over the years, I can’t help but feel a sense of deja vu when analyzing Cardano’s performance in Q2 2024. The decline in ADA‘s price, market cap, transaction fees, and other key metrics is a stark reminder of the volatility that characterizes this space.

Based on a recent analysis by Messari, the data intelligence firm, it was observed that Cardano and its associated token, ADA, underwent a substantial drop during the second quarter (Q2) of 2024. This decline appears to be a reflection of the broader slump that has impacted the overall cryptocurrency market. Important performance measures also displayed significant reductions across various metrics.

Price Plunge, Market Cap Dips To $14 Billion

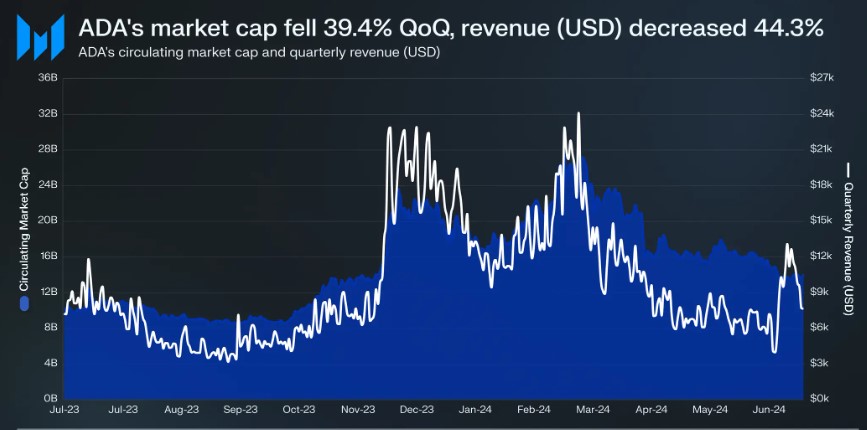

Based on the findings of the report, ADA‘s value dropped significantly by 39.7%, landing at $0.39. Additionally, its total market value decreased by 39.4% compared to the previous quarter, amounting to approximately $14 billion.

Messari noted that this decline was influenced by a slight increase in circulating supply, which accounted for the minor discrepancy in market cap figures. Consequently, ADA’s market cap ranking dropped from 9th to 10th place.

On the Cardano network, transaction fees that facilitate transaction processing and storage costs saw a decline as well. The USD-denominated revenue dropped by 44.3% compared to the previous quarter, amounting to $0.74 million. Meanwhile, the revenue measured in ADA decreased by 28.0%, reaching 1.60 million.

Over the past quarter, the average daily transactions on our platform dropped by about 27.5%, reaching around 51,400. Additionally, the number of daily active addresses declined by roughly 33.2%, settling at approximately 31,800.

Moreover, the typical transaction cost in US Dollars fell by approximately 23.1% (from $0.21 down to $0.16). In contrast, the average fee for transactions in ADA experienced only a minor decrease of 0.6%, maintaining its value at 0.34.

Treasury Balance Grows

Regardless of the obstacles faced, there was an 8.4% quarter-over-quarter increase in the number of transactions per active addresses, indicating a surge in frequent usage by more active participants on the platform.

As a crypto investor, I noticed a slight uptick in my Cardano (ADA) staking metrics, with more ADA being staked and a higher staking rate. However, the total value of my staked ADA in USD took a significant hit, decreasing by approximately 39.6% to $8.9 billion. This substantial drop is primarily attributed to the downward trend in the price of ADA.

The balance held in Cardano’s treasury, expressed in ADA, increased by approximately 5.8% compared to the previous quarter, reaching a total of 1.57 billion. However, the dollar value of this balance fell by around 36.7%, amounting to $604.7 million. At present, 20% of transaction fees are directed towards the treasury.

The number of activities on Decentralized Applications (DApps) built on the Cardano platform has experienced a decrease. Specifically, the average daily transactions for DApps dropped about 35.7% quarter-on-quarter to approximately 34,300, and the total volume traded on decentralized exchanges (DEXs) in US dollars fell by around 42.5% to roughly $4.2 million.

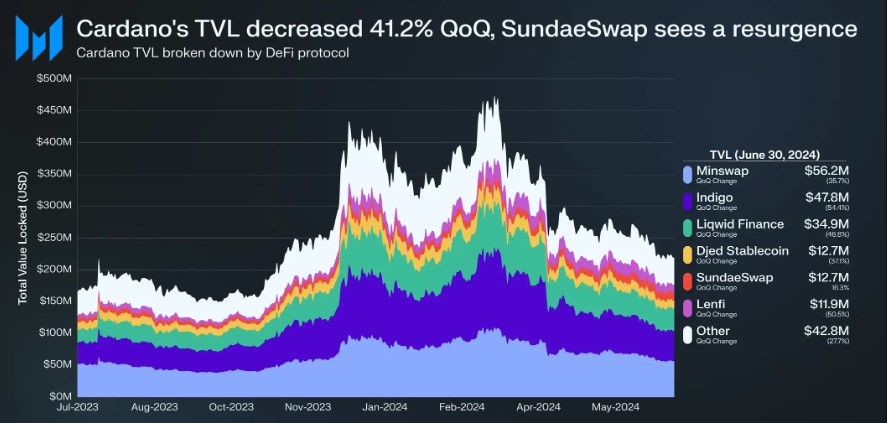

Cardano TVL Drop Amid Market Downturn

The total amount locked within Cardano decreased by approximately 41.2% from one quarter to the next, reaching $219 million. This decline occurred after a high of $506 million in March 2024, which was primarily influenced by the overall crypto market’s downturn rather than factors specific to Cardano itself.

As a researcher observing the Cardano ecosystem, I’ve noticed an intriguing development: The market capitalization of our platform’s stablecoins, which were introduced towards the end of 2022, has seen a decline for the first time since their introduction – a decrease of 12.4% quarter-over-quarter, leaving us with a total of approximately $19.6 million. Additionally, the average daily sales of non-fungible tokens (NFTs) have taken a significant dip, experiencing a quarter-over-quarter drop of 57.4%, resulting in around 730 transactions per day.

As a crypto investor, I’ve been navigating through some tough times, but the latest report sheds light on the continuous advancements within Cardano’s ecosystem. The arrival of new stablecoins like USDM and MyUSD has sparked a significant increase in their market caps, suggesting a transformation in the investment landscape.

Furthermore, forthcoming updates like the Chang Hard Fork are expected to enhance Cardano’s governance functions, bringing the network a step closer to its future aspirations of self-sustaining operations and collective decision-making.

At the time of writing, ADA was trading at $0.34, down 0.7% for the 24-hour period.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- All Elemental Progenitors in Warframe

2024-08-28 06:05